For SMEs, obtaining and securing the right source of finance can present a major challenge. Lack of available funding for SMEs has been brought into sharper focus post-credit crunch. Stabilising working capital and providing funding for export activities will help this sector overcome problems and re-oil the economic engine in these unprecedented times. Besides analysing supply chain financing for SMEs, we investigate Government initiated trade facilities to reboot international trade and look into future trends offered by digital technology. Why do we need SMEs to survive in global trade? Why is financing crucial for them?

SME’s global role

Out of the world’s 400 million Small and Medium Enterprises, 66% are involved in global trade according to WTO. They are connected to the world economy either through export or import transactions. SMEs play a key role in productivity which impacts GDP and job creation that contributes to the level of employment. Both factors are now critical for each country hit by the COVID 19 pandemic, therefore keeping SMEs active is essential to rebound economic growth. For SMEs, managing a good cash flow and a stable working capital are the enablers to survive in international trade. They need to secure sufficient funding to carry out operations during this difficult period. To tackle this, they are to investigate their existing supply chain and be on the look-out for favourable trade finance facilities initiated as stimulus programmes.

Check your supply chain; unlock cash

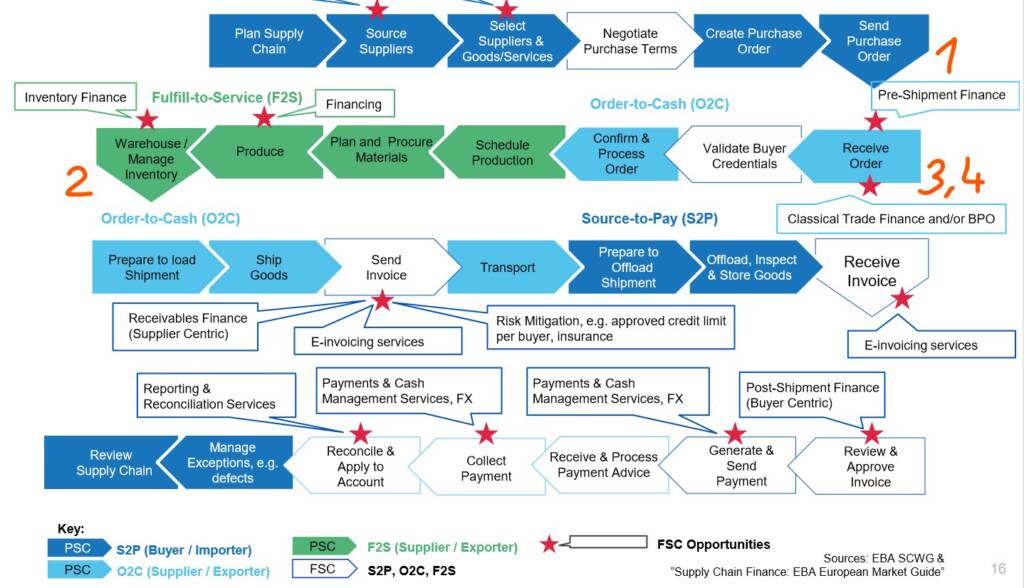

Supply Chain Finance still gives the best solution and approach to unlock potential to convert trade assets into cash. Managing cash for an SME is the first choice to tackle in the days of uncertainty. It is rarely the case that big cash-cushion is available to overcome many weeks of no cash-inflow. Bringing in cash would give a higher chance to start the new beginning with the right move into the markets. By investigating the process road map of a manufacturing company, the below 4 critical points stand out as evident opportunity for funding:

- Pre-shipment Finance. A strong collaboration with a banking and financing partner can help get the necessary financing for the whole manufacturing process or a commodity trade finance if you buy raw materials, commodities on a regular basis and hold a valid purchase order. The basis of the financing is a PO and this is called Purchase Order Finance.

- Inventory Finance. Based on the assessed stocks that are recorded in the books, financing is also available, usually short term. In case it is clearly known whom the SME is selling to, it would be beneficial for obtaining the funding against that specific asset type.

- Receivables Finance. This is the jewel of the crown, the most valuable to trade with in regard to funding. The invoices are not only playing the key role in indicating the level of survival, but the flexibility to exchange them for cash when needed. It can be Invoice discounting or Receivable purchase or factoring, the Bank name it. The rate of discount and pricing is dependent on the customer’s profile and rating. In an optimistic scenario, the customer’s risk can be mitigated by trade insurance.

- Trade Insurance. It is something out of our control and heavily reliant on the various Insurers giving and evaluating the necessary credit for those Buyers. We learnt that cutting the credit lines were the first panic move from the Insurance industry back in the Global Financial Crisis, therefore a formula can be brought in to be used more successfully that counterweight risk mitigation and add more value to receivables.

SME funding: Crisis Playbook with trade receivables

Funding and trust is crucial. Those will survive that are actively seeking ways to get the necessary funding and have trade receivables. Getting the insights into their business model will help the funder obtain more clarity and build trust. Documentation and clear workflows will also give them strength in the negotiations with their finance provider.

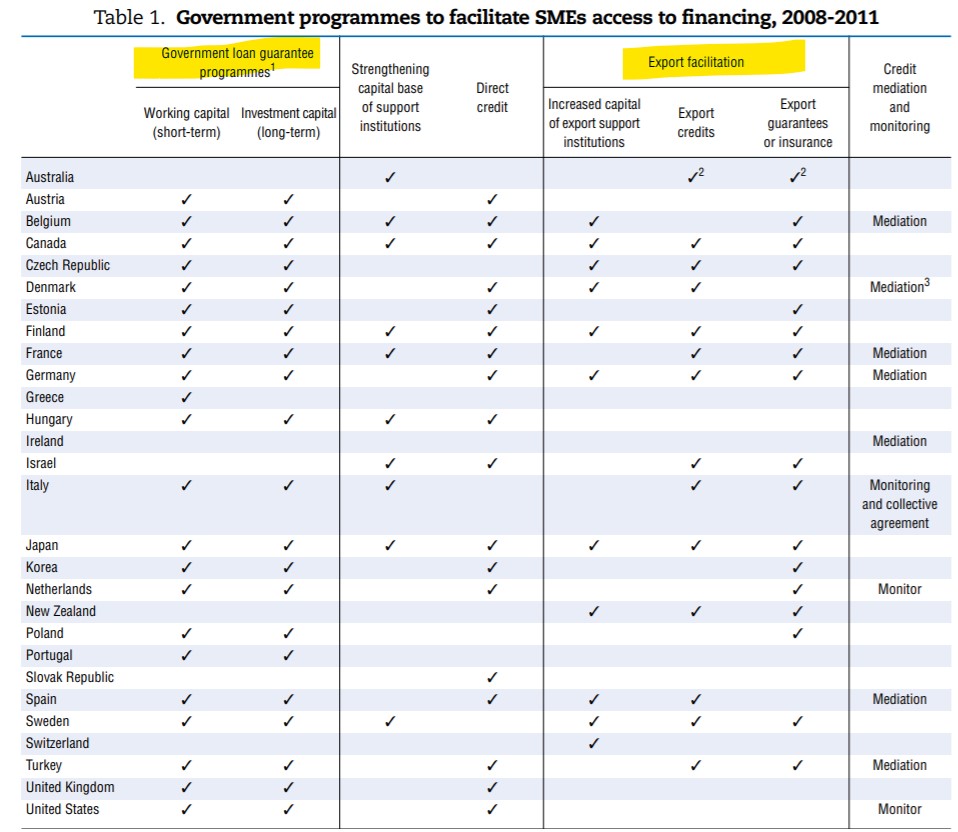

Government is your friend. Administration is determined to support export, and these are the programmes that anyone should join. These usually come in a form of Government-backed loans or guarantees to stabilize exporters’ trade accounts. Export Credit Agencies balance sheets are further strengthened to give access to large scale trade transactions. Government programmes for SMEs by countries during Financial Crisis outlined in the OECD study paper:

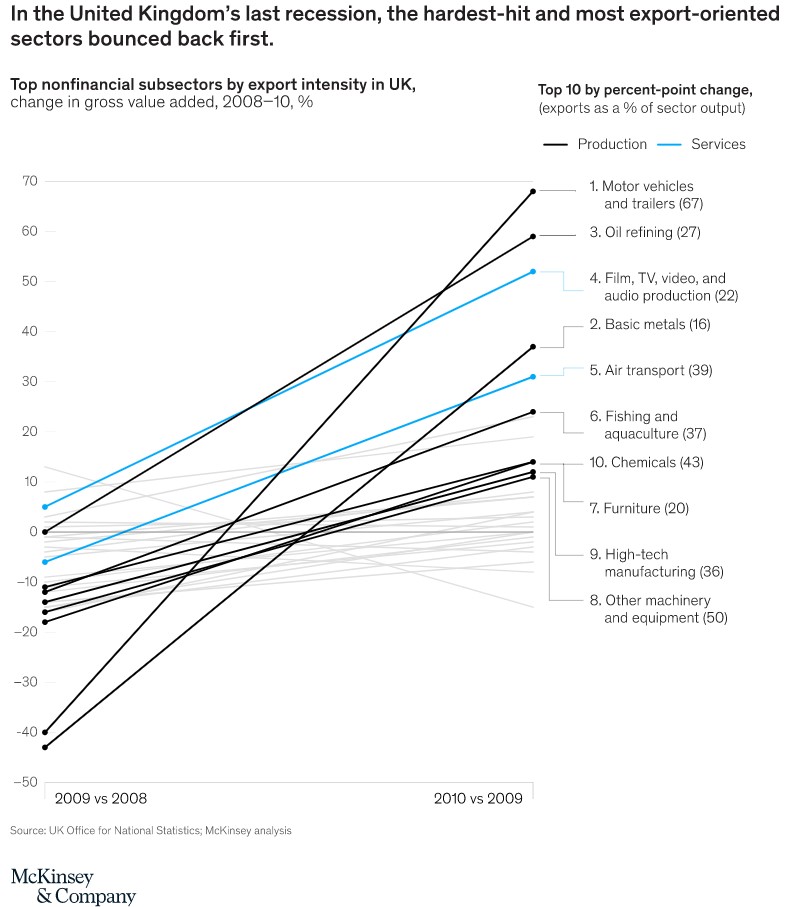

Export facilitation programmes and working capital injection stimulus are inevitable for all SMEs in international trade. Local Eximbanks (Exim) and Export Credit Agencies (ECA) are leveraging on strong balance sheets backed by the State. With export insurance, not only the Buyer is insured but the political risk is taken care of most of the time. Joining these programmes will help to reboot trade activities if we cannot get ahead with traditional financing that supply chain finance offers. Proven measures of State programmes differed by countries during the Financial Crisis, however, McKinsey study shows that for example UK exporters rebounded the quickest in 2009/10 and were among the fastest to cope with economic downturn thanks to the country programmes.

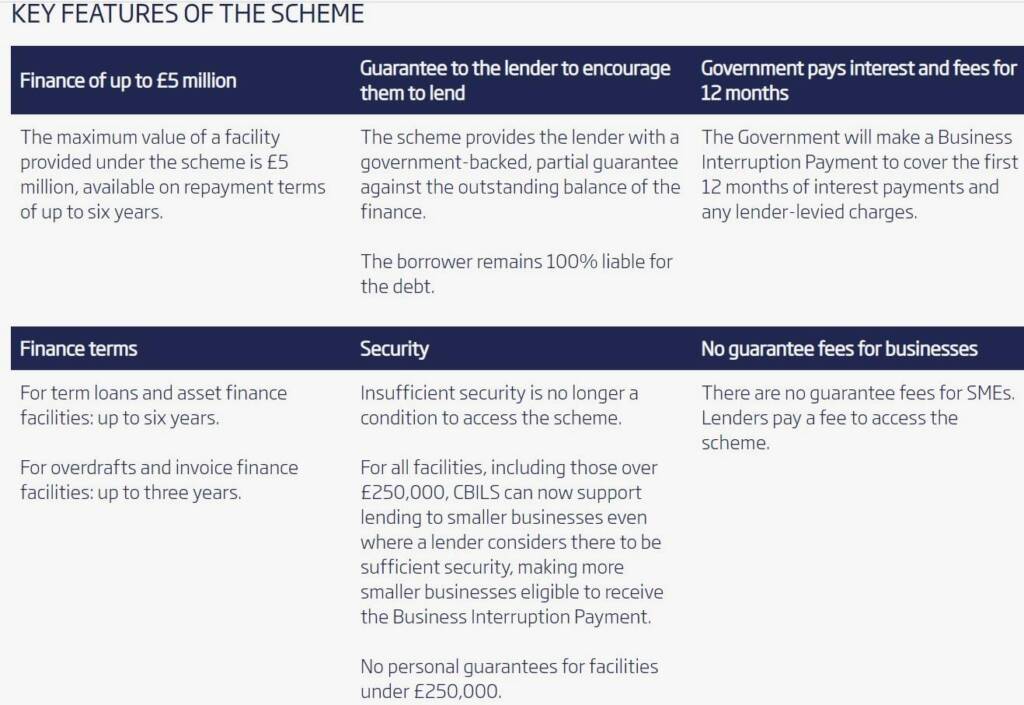

The updated Coronavirus Business Interruption Loan Scheme (CBILS) is open for financing for invoice and asset finance up to £5 million for UK businesses. Partial Government guarantees availability and 12 months interest and charges are borne by the State.

“Importantly, access to the scheme has been opened up to those smaller businesses that would have previously met the requirements for a commercial facility but would not have been eligible for CBILS. Insufficient security is no longer a condition to access the scheme.

More schemes involving trade finance are to follow: The World Bank Group announced a $160bn emergency scheme for financing for 100 developing countries. IFC and MIGA fast-tracked their support to businesses including trade finance and working capital. IFC’s quick response includes,

“$2 billion from the existing Global Trade Finance Program, which will cover the payment risks of financial institutions so they can provide trade financing to companies that import and export goods. IFC expects this will support small and medium-sized enterprises involved in global supply chains”.

Further trends and opportunities in supply chain finance

The old and reliable infrastructure of documentary credit is under pressure by digitalisation. Considered the most trusted and safest trade finance method –most favourable by Banks because of a clear structure to follow through of the cash-flow – calls for a change. During the lockdown, a major problem of the document signature has risen claiming for the shift to paperless.

Companies want digital. New horizons open up with the use of the Enterprise Blockchain platforms, coupled with the digital initiative in trade finance. More transactions are expected to come onboard in a wide range of sectors and across the countries as a consequence.

We.Trade blockchain platform, originally formed by a consortium of leading European banks (HSBC, KBC, Société Générale, Santander, UBS, Deutsche Bank, Unicredit, Nordea, Erste and others), went live a year ago and transactions are spreading. We have asked their banking partner CSOB in Europe on their experience of the first blockchain transaction completed with an SME in Czechia.

Zoltan Kormoczi (ZK): How did you find the deal suitable for a blockchain transaction?

Tomas Perger, we.trade manager in CSOB Bank (TP): Finding such a deal was pretty much easy for us. We had been approached by one of our clients [Spoluworks – an sme engaged in aviation, engineering] with their need to find a fully automated, digital and secured payment. It was several months before the Bank went live, however a deal came in during the COVID-19 pandemic outbreak. In that moment I realized that the blockchain platform is the best choice for our clients looking into the future.

ZK: Why the We.trade platform was the ultimate choice?

TP: The main focus of our client was on digital as this was best aligned with the company image the seller has undertaken. They wanted to skip any paper documents and opted for the ease of use with limited human involvement and reliability of payments.

So, we.trade was the only one possible digital solution in Czechia that enables direct electronic contract conclusions related to deliveries of goods and services including automatic payments.

ZK (Q): Could the client ask for a funding option in the transaction?

TP (A): Yes, a seller can ask for a funding option just by one click. The online request is part of Smart contract, it means easy and quick without the need to visit a branch. The transactions on the platform are fully secure and for the Bank visible only if any financial services are requested.

ZK (Q): What were the main benefits offering the we.trade blockchain platform to the client?

TP: Seller could securely provide the e-invoice for the counterpart and request the on-time payment without a hassle to deal with heavy documentation. The customer journey was totally digital with a fast, easy and secure way to navigate in the system to complete the process. Everything happened in real-time and the transaction was completed in seconds with great transparency.

*This is an extract from an interview with Tomás Perger involved in the completion of the first ever Czech Blockchain transaction.

No surprise as a giant technological company is expanding its presence in trade, which is on the verge of transitioning to digital. IBM became an investor in the we.trade platform to enhance global reach of technology into the trade finance world.

Conclusion

Using the various types of supply chain finances, SMEs have to convert trade receivables into cash. This will enable them for a growth strategy to rebound and expand to new markets post-COVID. The Governmental trade programmes, currently for exporters, are a good way to mitigate buyer risk and country political risk in this new environment. Finally, SMEs need to re-think their innovation strategy including digitalisation as the pandemic has accelerated the shift to digital technology in trade, especially to Blockchain-based solutions, which gives a high transparency, swift transaction execution and secure data handling without paper documents.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with their company, Trade Finance Global or London Institute of Banking and Finance’s view.

Type a message