As is becoming standard nowadays, there were political distractions in the United States throughout September. However, this time the only real attention on Donald Trump was by association. His pick for the Supreme Court, Brett Kavanaugh, was forced to testify in front of a Senate judiciary committee to refute allegations that he had sexually assaulted a university professor, Christine Blasey Ford, at a party some years ago.

The Senate panel still confirmed his candidacy by 11 votes to 10 and despite a brief FBI investigation in the last week, it looks as though he will indeed be confirmed. Many people have expressed dismay at his conduct during his testimony, to the extent that Kavanaugh felt it necessary to write an op-ed in the Wall Street Journal. If he is confirmed, it will rank as a victory for Trump, along with his agreeing a deal between the US and Mexico and Canada – imaginatively called the US-Mexico-Canada Trade Agreement.

This, as well as some decent economic data from the US has kept the dollar well supported throughout the month. The Canadian dollar also made some gains following news of the deal.

Fed hike rates once more

The Federal Reserve did as expected and increased interest rates by 25 basis points to put them at 2.25%. It is the eighth time the Fed has hiked rates in the past three years. In the accompanying press conference, policymakers suggested that the economic outlook remained positive and they were prepared to keep hiking rates, with investors expecting the next increase to come in December 2018, with more to come throughout 2019.

This has led to a few wobbles in the bond market and Asian shares are falling, as countries that borrowed heavily in dollars when rates were at rock-bottom levels, will be stung by higher interest rates.

Labour and Tory conferences

In the UK, we have had the Labour and Conservative party conferences. Neither party seems able to find, or voice, a unified position on Brexit. Strange, how Brexiters constantly refer to delivering what the people voted for at the same time as arguing over what they voted for.

Labour’s conference delivered a strong socialist agenda and they agreed a motion to keep the option open for a second referendum on the deal, although they could not agree whether it would include a vote to remain in the European Union. The Conservatives went next and Theresa May danced onto the stage just hours after Conservative MP James Duddridge submitted a letter to Sir Graham Brady, the chairman of the backbench 1922 committee, demanding a vote of no confidence in the prime minister.

May went on to say that her Chequers plan was the only way forward, despite the fact that the EU has already rejected it and her party is divided on the merits of the proposal. On the plus side, there have been more positive noises emanating from the EU, although the Irish border issue is still no closer to a resolution.

Higher inflation could lead to a rate hike

UK economic data has been mixed throughout the last month. Purchasing managers’ indices from manufacturing and construction were a little lower than expected, although services PMI was marginally higher than economists had expected. GDP for the second quarter of 2018 was also better than expected, as was average earnings data.

Inflation jumped to 2.7% which surprised everyone and is most likely because of the sharp fall in the value of the pound since April. This will certainly worry the Monetary Policy Committee and they might feel obliged to increase rates sooner rather than later, especially if inflation stays at elevated levels in the next few months.

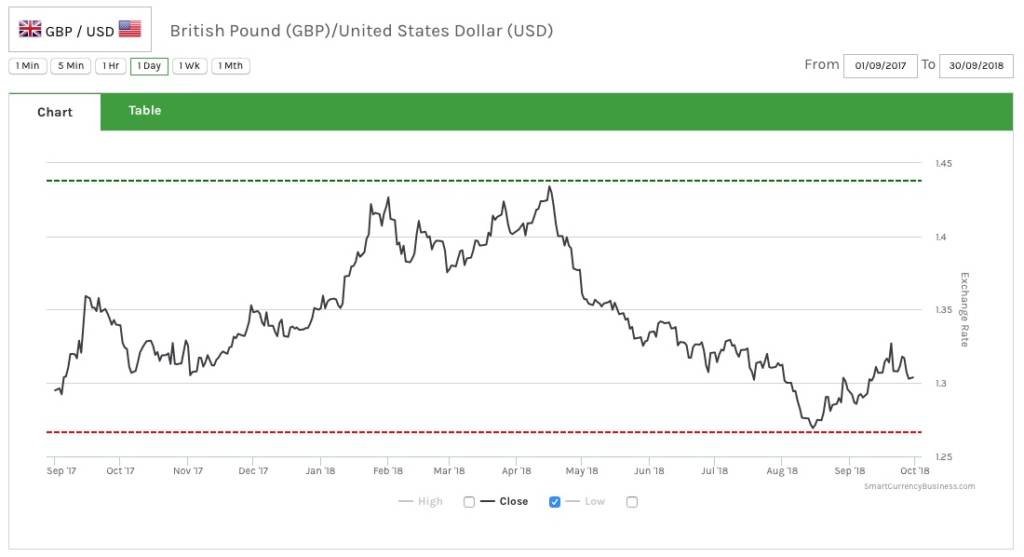

Sterling traded a similar range to August and, as it stands, it continues to hover around the $1.30 and €1.13 mark.

GBP/EUR – September 2018 Chart

GBP/USD – September 2018 Chart