It is widely known that oil Prices in Saudi Arabia have risen significantly. Being the world’s top oil exporter, Saudi Arabia has influenced the oil market since the 20th century, generating 50 per cent of its GDP and accounting for 70 per cent of its export earnings. Factors that have reduced the supply of oil globally have been the main reason for this price hike. This has significant implications for the countries that are dependent on oil. Maintaining the price of oil remains a challenge for Saudi Arabia and the rest of the world.

What are the reasons for the rise in oil prices in Saudi Arabia?

Supply and demand: Oil is a globally traded commodity. Its prices are determined partly by the current balance between supply and demand and partly by hopes and fears about future shifts in that balance. When demand exceeds supply, price rises and vice versa. Over the past few months supply has been reduced globally due to the long-running production cuts by OPEC and Russia. Oil prices are thus moving higher as supply fails to keep pace with rising demand, a trend which has affected principal producers and exporters. Prices have risen in Saudi Arabia with the demand excesses. This is also called demand-pull inflation and occurs when there is too much money in the economy chasing too few goods.

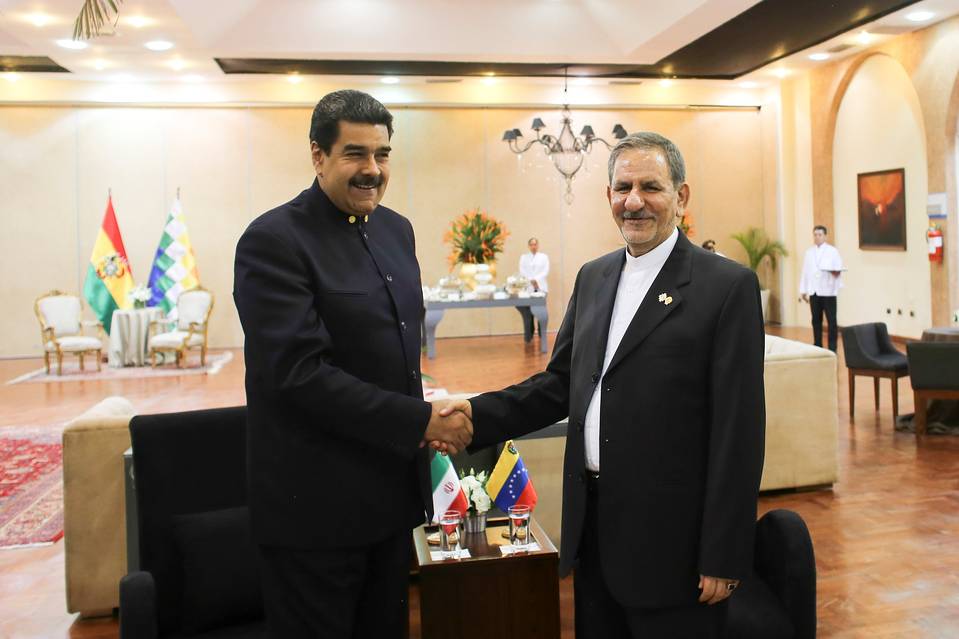

US sanctions: Iran and Venezuela are two countries that have been heavily sanctioned by the USA. Iran exports around two million barrels of oil a day equivalent to about 2 per cent of global supply. Venezuela has nearly halved output, to less than 1.4 million barrels a day, because of international sanctions. As both Iran and Venezuela are significant global exporters of oil, international sanctions have reduced the supply of oil and thus increased the price exported by Saudi Arabia. As geopolitical and geo-economic risks continue to build up, the oil supply outlook looks even more uncertain.

Politics and turmoil: Fighting among various armed factions in Libya has meant that the North African country has not been able to supply around 850000 barrels a day, most of its output. This has put enormous pressure on Saudi Arabia to bridge the gap caused by Venezuela, Iran and Libya. Oil markets have also become increasingly politicized. The president of the United States, Donald Trump has been unusually vocal in trying to push oil and gasoline prices down by asking King Salman of Saudi Arabia to increase production. Prices could rise to $100 a barrel unless the market kept away from politics. Nowhere has the political impact of plummeting oil prices been more acute than in Venezuela. The country’s output has halved since the early 2000s to 1.5 million barrels per day, hit by a lack of investment in the oil industry.

What effect does a higher oil price in Saudi Arabia have on the global economy?

For most oil-producing countries, higher oil prices may weaken the resolve to curb military spending, heightening the risk of conflicts and insecurity.

Higher oil prices will hurt countries that remain heavily dependent on crude oil imports. Those will see their current- account and fiscal positions worsen, their currencies weaken and inflation soar. The Asia-region will be affected the most, as the region’s oil demand accounts for 35% of the world’s total consumption.

Higher oil prices constitute a ‘major risk’ to India’s economy. India- which imports almost 80% of its oil – has warned about its high degree of sensitivity to oil prices.

For Saudi Arabia with a higher oil price, the fiscal deficit will likely be reduced beyond the government’s own target and register 3.8% of GDP, versus 6.7% of GDP.

Venezuela’s economy will likely deteriorate further if oil prices rise. Despite holding the largest proven oil reserves in the world, state intervention and weak governance has undermined the sector and severely reduced Venezuela’s oil production.

Iran’s economic and social crisis will also worsen as sanctions enter into force, eroding the benefits from higher oil prices. Besides an expected sharp fall in oil exports, the determination of the US administration to implement the renewed secondary sanctions strictly and aggressively will aggravate socio-economic conditions in Iran.

Turkey will be most at risk as higher oil prices exacerbate an unfolding currency crisis. Turkey’s dependence on oil imports is one of the highest in the world and a major drag on the country’s large twin deficits. Higher oil prices will add further pressures on an already battered local currency, stoking further inflation.

As the world’s largest importer of oil, China accounts for almost 10% of global oil consumption. Low oil prices in 2014-17 have helped to boost consumer spending, lower the cost of doing business and support growth. Higher energy prices could reverse these trends, hit Chinese manufacturers and dampen private consumption.

What is the future for the price of oil in Saudi Arabia and across the world?

On July 5th, 2019, OPEC’s crude oil production dropped to below 30 million barrels per day in June, down by 170,000 barrels per day from May. The lowest monthly output since April 2014, as higher Saudi oil supply was insufficient to compensate for declines in the cartel members subject to U.S. sanctions, Iran and Venezuela.

The Strait of Hormuz is a strait between the Persian Gulf and the Gulf of Oman which sees around one-third of all seaborne global oil supply. There have been recent attacks on oil shipping which has prompted a major military response from the United States. Worst case scenario the strait would shut down, even if temporarily, sending cataclysmic shock waves through global oil markets.

The future of the price of oil is uncertain raising concerns about a potential U.S – Iran conflict. A prolonged hike in oil prices would create demand destruction, the point at which consumers turn to alternative energy sources, as well as unsettling oil markets in ways not seen in decades.