We spoke to Sarah Walker, who is the UK Lead of Alternative Finance at KPMG about her thoughts on the alternative finance sector and where it is headed, following NESTA’s Pushing Boundaries report in collaboration with the University of Cambridge and KPMG.

What is KPMG doing in terms of driving alternative finance and helping SMEs access finance?

“Over the past 3 years as alternative finance has grown, we have built a team within KPMG looking at alternative finance through the regulatory, consultancy and tax lens.

“Over the past 3 years as alternative finance has grown, we have built a team within KPMG looking at alternative finance through the regulatory, consultancy and tax lens.

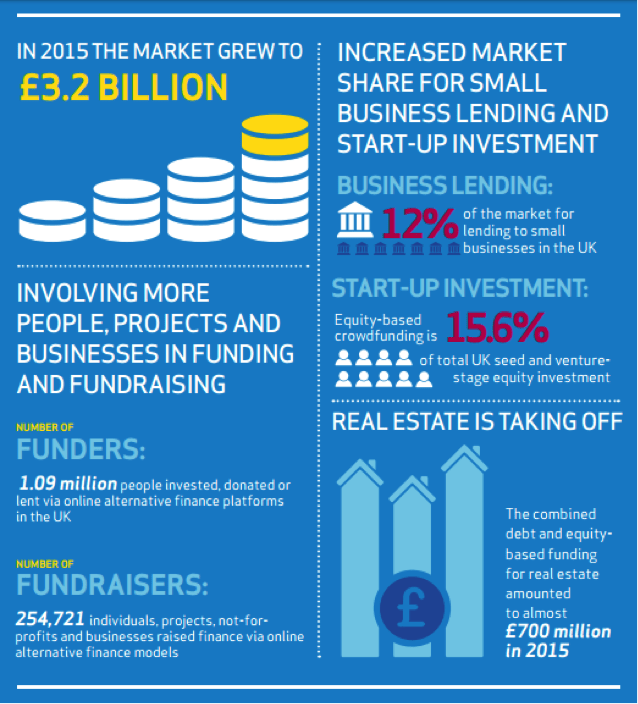

In this relatively new sector, there are new products that are coming out, and we recently worked with NESTA and the University of Cambridge to produce a series of global reports on the state of alternative finance. The study reaches stakeholders and key figures within the alternative finance and small and medium enterprise (SME) finance space.

We have a symbiotic relationship with MarketInvoice, for example, and are enabling customers of KPMG’s Small Business Accounting Service to access MarketInvoice finance direct through their accounting software. The partnership will also include a programme of business education incorporating regional events, webinars, e-books and online ‘accountancy clinics’ for small business owners.”

Why are SMEs using alternative financiers over banks?

“SMEs don’t have access to finance through traditional methods such as bank funding, and alternative financiers are often good at able to serve SMEs with the most appropriate products. There are probably two reasons why alternative financiers can help SMEs access funding; the speed to which they serve businesses (MarketInvoice can fund unpaid invoices in just 24 hours), and the ability to serve the SME market.

Banks are in a spiderweb of complexity when it comes to innovating and acting quickly to serve SMEs, and would need to look through a different lens in order to step change innovation and agility to overcome internal barriers and operational structure within their organisation.

Banks may also have their hands tied with bigger fish such as larger corporates, whereby alternative financiers may be built to serve the market at an enterprise and SME level. Generally speaking, a bank would have to lend to several SMEs in order to get the same returns as working with bigger clients, and the alternative finance players may be better placed to serve these smaller clients.

Nonetheless, alternative financiers are generally strict with their lending criteria from a risk perspective and when undertaking due diligence on potential clients to lend to.”

Can this be addressed by banks? Absolutely. As Warren Mead, Head of Alternative Finance and FinTech at KPMG said;

“The emergence of marketplace funding is a sobering challenge for incumbent banks who are already facing higher regulatory hurdles and new high street and digital challengers. So can they fight back? Absolutely. Banks know that they too have important and inherent advantages. They have an established distribution network, scale, access to a huge customer database (valuable both from a marketing and credit data perspective), recognised brands and strong customer recognition. Not to mention huge financial resources. On each of the five Cs – customers, credit, culture, costs and capital – incumbent banks can respond to the P2P challenge.”

What alternative finance sector is growing the fastest?

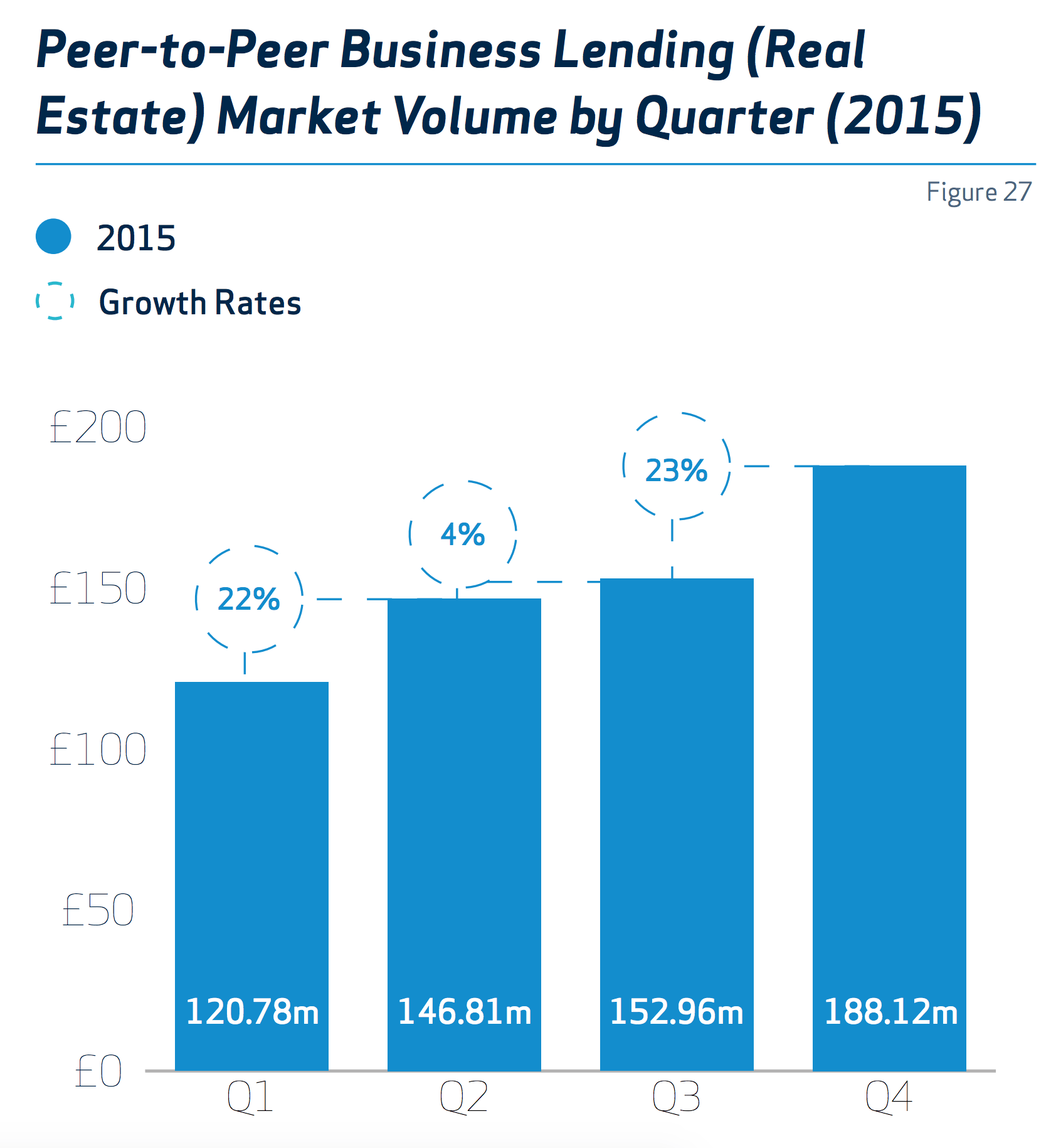

“Real estate, by far. There are a number of new platforms in the market which allow retail investors to access a market there might have once been inaccessible. Offering retail investors the ability to access and lend in the development finance and commercial property space could be an interesting opportunity for customers. If you think about putting your money in a bank account you might only get 0-2% interest per annum if you’re lucky. Whereas in real estate lending, you might get considerably more.”

The flexibility of platforms allows retail investors to also diversify their portfolio and specialise where they invest; for example, Property Partner allows individuals to identify locations and individual properties that are likely to yield attractive returns.

Where does the UK stand in terms of regulation?

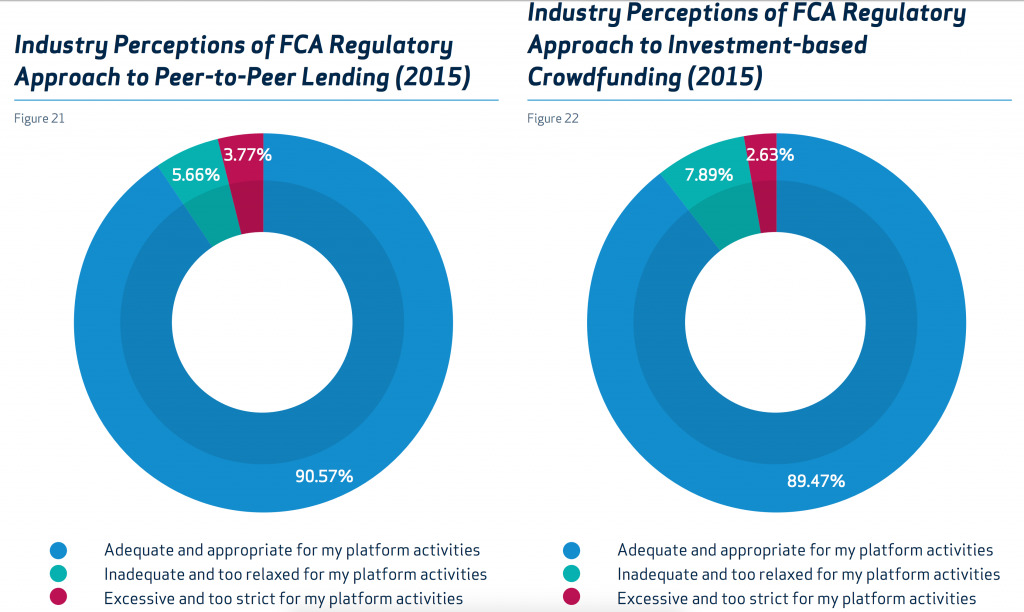

“The UK is leading the way in terms of regulation, being at the front foot of responding to the market (demand by consumers who want to invest or get funded, as well as providers and marketplaces to service the needs). There has been a government backing towards alternative finance in the UK, and the UK regulator has been helpful in responding.

For example, crowdfunding requires regulation in order to do business in the UK, and some alternative funders are going about seeking the seal of approval from the Financial Conduct Authority (FCA).

Other markets globally are looking towards the UK as an example and leader in terms of regulation within the alternative finance space. It’s also clear that customer acquisition channels such as social media might be addressed by regulators, which traditionally is not used by incumbents to drive product awareness.

From a regulatory perspective, one clear message is ensuring the customers understand the products they are investing in and the risks associated, as we could well see some bad investments in the future, and the industry will need to react to this accordingly.”

What are the main trends you see in the alternative finance space in the next two years?

“We certainly anticipate continued growth in alternative finance, especially in the real estate market. As this growth continues, we’d expect more slices of the pie to be eaten into, in terms of different product offerings. For example, the crowdfunding space is now quite diversified from where it was at 3 years ago, as we highlighted in the NESTA report.

Secondly, another big player might securitise their assets or create a fund, such as Funding Circle’s fund listing on the LSE.

Finally, the market seems unsustainable currently, given the sheer number of platforms operating in similar spaces, so we may see consolidation or acquisition of smaller players by banks or the larger alternative funders soon.”