Estimated reading time: 11 minutes

The documentary credit is one of the most popular payment methods available to buyers and sellers in international and domestic trade, it provides comfort and security to both buyer and seller by guaranteeing payment to the seller and ensuring the presentation of the documents required by the buyer and already stipulated in the credit.

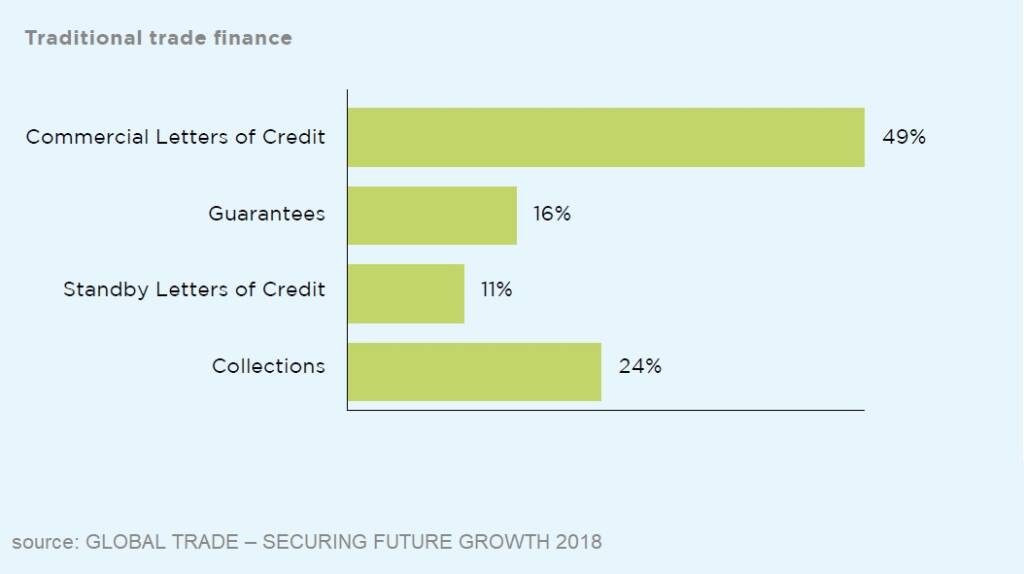

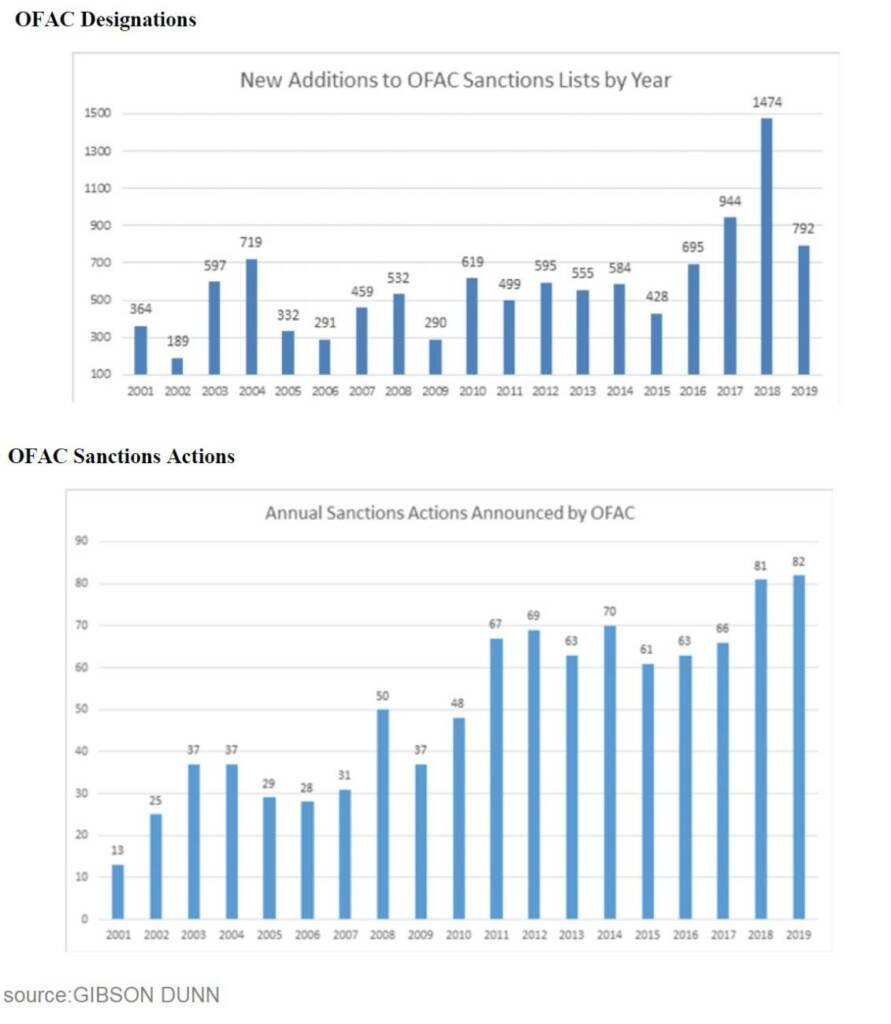

As a result of the growing number of sanctions imposed by one country or (a group of countries) on another, which lead to the appearance of sanction clauses in the trade transactions particularly documentary credits. These clauses are intended to warn counter-parties that they may prevent banks from meeting their obligations. The below charts illustrate the increasing use of U.S. sanctions.

Documentary Credits

A documentary credit is an irrevocable undertaking issued by a bank named (issuing bank) that undertakes to make payment to a seller named (the beneficiary), provided that a complying presentation is made. ‘UCP 600’ The rules governing documentary credits define ‘credit’ as follows:

‘Credit means any arrangement, however, named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.’

In conclusion, the documentary credit is definite, irrevocable and binding undertaking on the issuing bank from the moment it is issued, when a complying presentation is made the issuing bank is obliged to honour.

Economic sanctions

They are a way of restricting the financial or commercial activities of persons, organisations or nations in the field of trade that violates the law or restrictions and are used as a foreign policy instead of military force. In other words, it acts as punishments or penalties and fines and can be divided into commercial and trade-based restrictions. Sanctions may be imposed by the United Nations, the European Union, governments or individual countries.

Sanction clauses

They are statements that a bank upon processing the documentary credit and any presentation hereunder will comply with applicable sanctions rules, their purpose to avoid dealing with any sanctioned party, for example, specific countries, vessels, ports or goods. Whilst the insertion of a sanction clause may give a measure of protection for banks in specified circumstances with relevant sanctions legislation, it does not remove the bank’s undertaking.

Documentary Credits vs. Sanction clauses

UCP 600 does not have an express reference that deals with sanctions i.e. that banks do not need to honour their obligations under a documentary credit if it would breach sanctions, the use of sanction clauses will raise ambiguity, doubt and uncertainty and bring into question the independent nature of the documentary credit and its irrevocability, they are considered as non-documentary conditions for the purpose of UCP 600 sub-article 14 (h) as they are stated without requiring a document to indicate compliance with them, moreover, any form of refusal or non-payment based on sanction not considered as a formal refusal notice as required by article 16 from UCP 600. On the other hand, international sanctions have a significant effect on the payment obligation under documentary credits as they are a force of law, which will override the UCP 600 rules, irrespective of their inclusion or not under documentary credits the participating banks will always comply with applicable law.

The perspective of counterparties

The advising bank may reject and refuse to advise the documentary credit as some countries have legislation that prohibits the mention of ‘boycott’ or ‘sanctions’ clauses in the transaction. The confirming or nominated bank willing to act on its nomination may seek for removal of these clauses under the documentary credit before it adds its confirmation or acts on its nomination. From the beneficiary’s perspective, these clauses will cause doubt and uncertainty to receive payment even if a complying presentation is made.

Examples of sanctions clauses

Based on the language used, the effects of sanctions clauses could range from legal reasons to the internal policy of the bank and its discretion to refuse payment. Below are examples of some of the different forms of the clauses being used in trade transactions and proposed by institutional and educational organisations like the ICC and IIBLP.

Clauses relating to sanctions laws or regulations applicable to the bank, a similar clause proposed by IIBLP (the following is a sample clause proposed by the ICC):

‘notwithstanding anything to the contrary in the applicable ICC Rules or in this undertaking,] We disclaim liability for delay, non-return of documents, non-payment, or other action or inaction compelled by restrictive measures, counter-measures or sanctions laws or regulations mandatorily applicable to us or to [our correspondent banks in] the relevant transaction.’

Clauses relating to the internal policy of the bank to include the international sanction lists:

‘the issuing bank will not affect a transfer (if applicable) or make any payment under this credit to any person who is listed on united nations, European union or united states of America sanctions list, nor to any person with whom the issuing bank is prohibited from engaging in transactions under applicable united states federal or state anti-boycott, anti-terrorism or anti-money laundering laws or us sanctions laws.’

Clauses relating to the discretion of the bank to refuse payment (this is the most extreme and it should be avoided):

‘our bank processes transactions in accordance with local and international laws and regulations, and reserves the right to comply with foreign sanctions as well. Consequently, documents issued by or showing any involvement of parties sanctioned by any competent authority or contained any information thereon might not be processed by our bank at our sole discretion and without any liability on our part.’

ICC stance on the use of sanction clauses

As a consequence of the growing number of sanction clauses inserted in the international trade transactions including documentary and standby letters of credit, demand guarantees, counter-guarantees and documentary collections, particularly in the form of non-specific clauses that creates uncertainty The ICC Banking Commission issued its first guidance paper on the use of sanction clauses for trade-related products document No. 470/1129 rev in 2010 and this document was updated to No. 470/1238 in 2014 and recently, in May 2020, the addendum to document No. 470/1238 was issued as a result of the resurgence in the use of these clauses in documentary credits and in demand guarantees.

The purpose of the Guidance Papers

- To highlight certain issues arising from the use of sanction clauses not only for the documentary credits but for standby letters of credit, demand guarantees, counter-guarantees and documentary collections.

- Recommend banks to refrain from issuing trade finance-related instruments that include sanction clauses that purport to impose restrictions beyond, or conflict with, the applicable statutory or regulatory requirements.

- Avoid bringing into question the irrevocable, independent nature of the credit, demand guarantee or counter-guarantee, the certainty of payment or the intent to honour obligations.

- Failure to do so could eventually damage the integrity and reputation of letters of credit and demand guarantees which may have a negative effect on international trade.

- The ICC recommends in the addendum although that sanction clauses should not be used generally. Nevertheless, if a bank, after consultation with its customer and counterparty in the trade finance transaction, considers that a sanction clause is to be used, the clause should be drafted in clear terms, restrictively, to limit the reference only to mandatory law applicable to the bank.

- The addendum includes guidance when drafting a sanction clause.

- For the first time in the addendum, the ICC proposes a sample clause, at the same time it emphasises that the referenced clause is a sample only and not to be used without seeking advice from legal and compliance advisors.

ICC Official opinions on sanction clauses under the documentary credit

ICC Opinions is one of the ICC services they aim to encourage uniformity of practice in a field where individual document checkers often differ in the way that they approach documents that they have to review. They can serve as guideposts to courts in interpreting ICC Rules. They can prevent the development of disputes that would otherwise lead to court action. We summarise below two of the opinions on the use of sanctions clauses in documentary credits.

Opinion TA752rev3 states:

It is not appropriate for the confirming bank to include a sanction clause. It is for the beneficiary to question the confirming bank as to the scope of a sanction clause appearing in confirmation advice, where the beneficiary deems appropriate, to seek legal advice as to where such a clause is enforceable. A confirming bank may decline to honour or negotiate under its undertaking where economic sanctions that are applicable to by law or regulation specifically prohibit it from doing so.

Opinion R906 / TA884rev states:

The issuing bank has an obligation to honour a complying presentation. Banks involved in international trade should ensure that any of its policies do not work against nor contravene articles of UCP 600, nor issue documentary credits that breach internal policies. If this is the case, then any differing requirements that result from such breach should be clearly stated in the terms and conditions of each credit. An issuing bank should act with the provisions of UCP 600 article 16 otherwise, it will be precluded from claiming that the documents do not constitute a complying presentation. Furthermore, a notification that a bank is prevented from honouring its obligations based on sanction regulations should not be construed nor structured as a formal refusal notice.

Steps to consider by the beneficiaries

The beneficiary should understand that sanctions clauses might cause delays as well as, create additional and unnecessary risk. The following steps should be considered by the beneficiary to lessen the uncertainty of payment:

- Make sure when drafting the sales contract with the buyer (applicant) not including any reference to sanction clauses, as well as upon receipt of the documentary credit.

- If you are obligated to accept such a clause as it is one of the bank’s internal policies, make sure that the clause drafted in clear terms, restrictively, to limit the reference only to mandatory law applicable to the bank, as depending on the structure the clause could have a big impact on your payment security.

- If the clause added by the confirming bank, you should question the confirming bank as to the scope of a sanction clause appearing in its advice, also, seek legal advice as to where such a clause is enforceable.

Conclusion

Sanctions are a force of law, which will override the rules, it may restrict a bank’s ability to perform its role in documentary credit, some banks choose to control their legal risks by using sanction clauses, however, these clauses should not be used routinely and only be considered in specific transactions. On the other hand, the beneficiary should carefully check the terms and conditions of the documentary credit and make sure if it contains a sanction clause to be in clear form and not to contain any reference to (bank policy and procedure) and if necessary, to seek advice from legal and compliance advisors.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with Trade Finance Global or, LIBF’s view.