A plummeting currency and isolation from the financial world means that Russians are turning to crypto to preserve their wealth and get around sanctions.

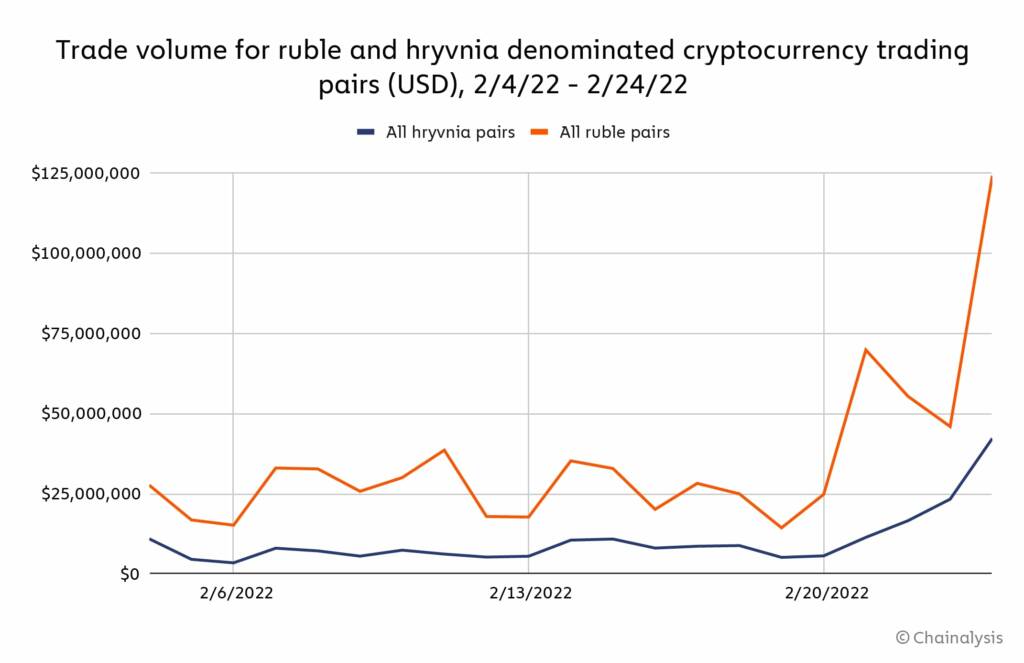

Over the last two weeks, crypto analytics firm Chainalysis has found that trade volumes using the Russian rouble on crypto exchanges have increased significantly.

From February 19-24, rouble trade volume increased by 8.6x.

Likewise, during the same period, trade volume on crypto exchanges using the Ukranian hryvnia increased 8.2x.

Also, during the same period, the rouble fell 9% against the US dollar, sinking from 77.435 to 84.950.

As of March 2, the rouble is at 106.5 to the dollar – having lost over 40% of its value since mid-February.

Who’s behind the keys?

The increase in rouble trade volume on crypto exchanges could be from Russian actors who are being targeted by sanctions, or from regular Russian citizens.

SWIFT sanctions imposed by Western governments, for example, make it harder for Russian companies who use Russian banks to complete cross-border transactions.

Russian businesses may attempt to use crypto to evade these sanctions. They could also be using crypto to send or receive payments for goods and services, or simply to transfer their wealth out of roubles and into crypto.

Bitcoin to the rescue?

A renewed focus on the crypto economy could be a lifeline for Russia as it buckles under the weight of financial sanctions.

This would not be the first time that a nation under financial duress has turned to crypto in its hour of need.

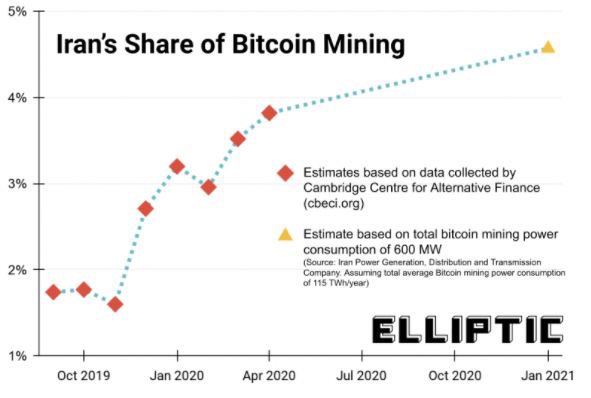

After the US tightened its sanctions regime against Iran in 2013, the Iranian government slowly turned to bitcoin mining as a means of converting its oil reserves into cash.

In 2019, according to crypto watchdog Elliptic, Iran officially recognised crypto asset mining, and later established a licensing regime that required miners to identify themselves, pay a higher tariff for electricity, and sell their mined bitcoins to Iran’s central bank.

By 2020, according to Elliptic, almost 4% of all bitcoin mining took place in Iran – a figure that was expected to rise to 4.5% in 2021.

In effect, this allowed the Iranian government to continue to import goods without having legal access to US dollars via its oil exports.

Crypto exchange and legal hurdles

But all of this is easier said than done, especially when the world’s governments, businesses, and regulators are tightening the noose around the Russian economy on a daily basis.

It will be interesting to see which crypto exchanges join the sanctions crowd, and which try to take a more neutral stance.

Binance, for example, the world’s largest crypto exchange by volume, has refused to impose sanctions, and continues to allow Russian customers to trade on the exchange.

This flies in the face of demands from the likes of Ukrainian Vice Prime Minister Mykhailo Fedorov, who has called for a blanket ban on Russian users on all crypto exchanges.

I'm asking all major crypto exchanges to block addresses of Russian users.

— Mykhailo Fedorov (@FedorovMykhailo) February 27, 2022

It's crucial to freeze not only the addresses linked to Russian and Belarusian politicians, but also to sabotage ordinary users.

In the UK, lawmakers have called for targeted sanctions on Russian oligarchs linked to Putin. In crypto terms, this could include the use of ‘transparent blockchain’ companies that can help identify crypto wallet holders and addresses that are being used to evade sanctions.

Russia’s crypto crossroads

This all comes at an interesting time for Russia – a country that, just before the conflict in Ukraine, was close to imposing heavy regulations on the crypto industry.

In January 2022, for example, Russia’s central bank proposed a ban on crypto mining and trading.

Putin has noted the strategic advantage of Russian energy in crypto mining, however, with Russia currently the world’s third largest bitcoin mining nation, according to Coindesk.

More recently, the Russian treasury has proposed more relaxed measures that would make it easier for regulators to track transactions, similar to foreign currency exchanges.

However, these measures would have to go through parliament, so have not been implemented as of yet.