FCI, the global representative body of nearly 400 members for the Open Account Factoring and Receivables Finance Industry together with Demica, the leading independent provider of Working Capital and Finance Solutions, recently signed a legal agreement which allows FCI members to access to the ‘FCI reverse’ Platform. Leveraging Demica’s best in class technology and FCI’s global network of inter-factor relationships this will enable FCI members to onboard buyers and suppliers in a transparent and seamless manner anywhere in the world. This is the first ever SCF agreement signed between a global trading network and a major technology partner.

FCI is a global association of factoring and receivables finance companies around the world. Focussing primarily on traditional receivables finance and invoice discounting, factoring, however in the last five years FCI launched a project to look in to the benefits, of offering their members a system and operating platform enabling an ability to offer cross border supply on boarding in a reverse factoring payable finance manner.

What is FCI Reverse?

FCI reverse is a new platform powered by Demica, one of the leading providers of technological solutions. As an independent provider of working capital solutions, they were able to look at both sides of the balance sheet with funding partners. A challenge of banks when on boarding suppliers is dealing with those in multiple jurisdictions.

FCI Reverse will allow FCI members to expand their service offering both for domestic and international business through FCI’s unique global network of nearly 400 members in 90 countries. Pilot members have been identified and testing of the platform will now commence. FCIreverse will be made available to all members at the end of the pilot stage, estimated to be completed by year- end.

The platform allows all of the actors to be put together in the same place – the buyers, funders and suppliers, and alongside a supplier on boarding tool which is embedded in the platform, which allows many banks around the world to use the platform in forms of a white label platform.

There are two types of FCIreverse:

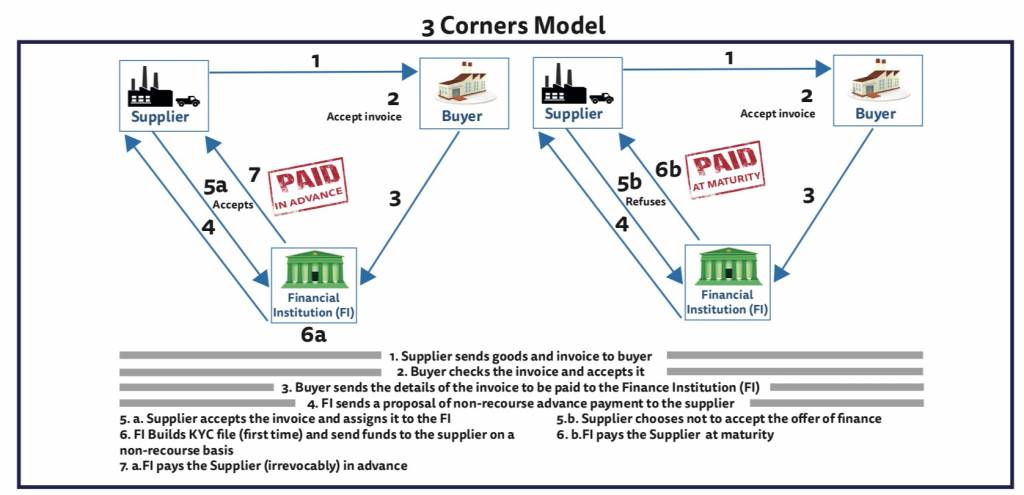

3 corner model (Buyer, Financial Institution, Supplier) – this may be used for both Domestic and International business

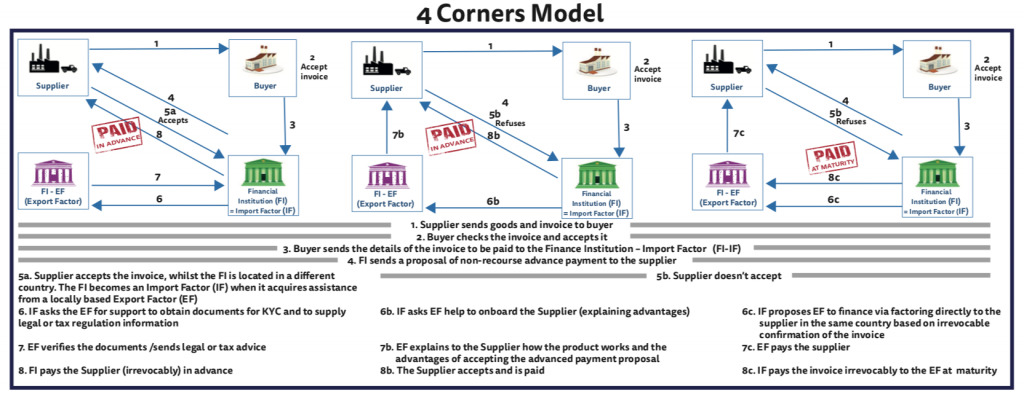

4 corner model – this may be used in International business where it’s beneficial for a correspondent factor in the supplier’s country to become involved

Interview with Peter Mulroy from FCI:

Peter Mulroy, Director Secretary General of FCI spoke in an interview to members about FCIreverse:

FCI celebrates its 50th anniversary by launching a second business line that opens the world to FCIreverse. Details of FCIreverse and SCF in general will be presented during FCI’s 50th annual meeting in Amsterdam, 10-15th June 2018.

Supply Chain Finance (SCF) is defined as the use of trade and receivables financing and mitigating the associated risks to help find efficiencies and make working capital work and flow around a business. SCF is often used in open account trade and can have multiple SCF suppliers. By having full visibility of the trade flows by jurisdiction, product and finance provider, it allows such financing arrangements which can be enabled by a technology platform such as FCI reverse.