Estimated reading time: 5 minutes

Due to long mining periods and overblown expectations, industries in the midstream lithium supply chain shoulder the most pressure and are the most fragile in the supply chain.

Imbalanced lithium market

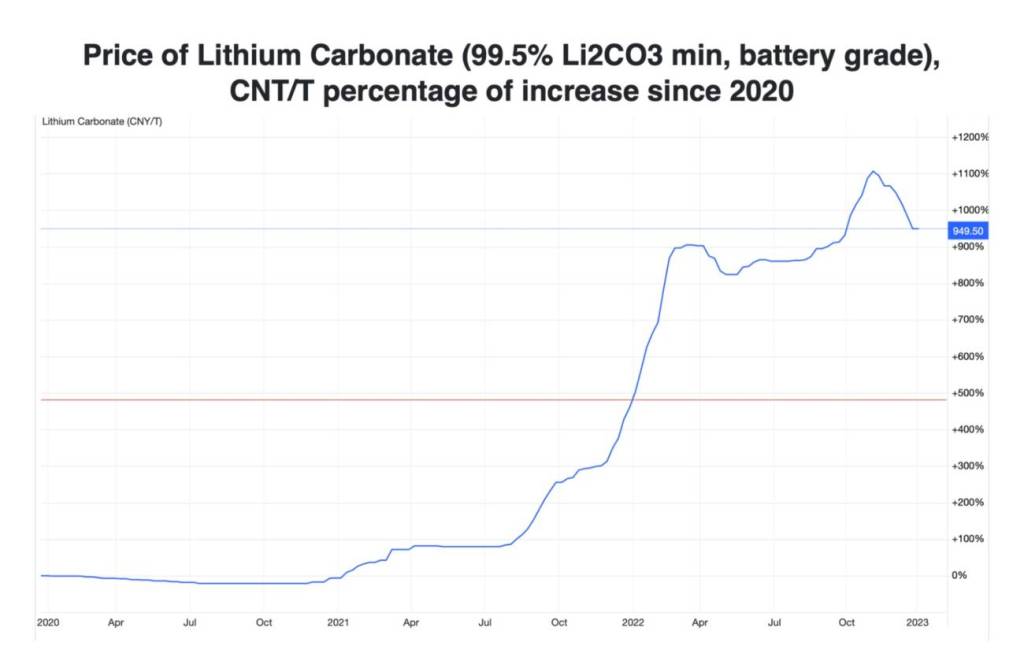

As the largest consumer of lithium, China has experienced a surge in battery-grade lithium carbonate prices since 2020. By the end of 2021, the price substantially increased by nearly 500%. The price continued to grow rapidly till the end of 2022. The incredible growth rate is attributed to an extreme imbalance between global demand and supply.

Data source: Lithium carbonate prices data, Trading-Economics

Based on the current situation, the demand from electric vehicle (EV) producers is expected to increase for at least ten years. Meanwhile, the diminishing stocks of global lithium producers have yet to recover from the COVID-19 lockdowns.

The increasing stress on the lithium supply chain has raised panic about a potential supply crunch.

Rich natural lithium resources do not mean sufficient supply

Unlike oil, the natural reserve of lithium natural reserve is rich.

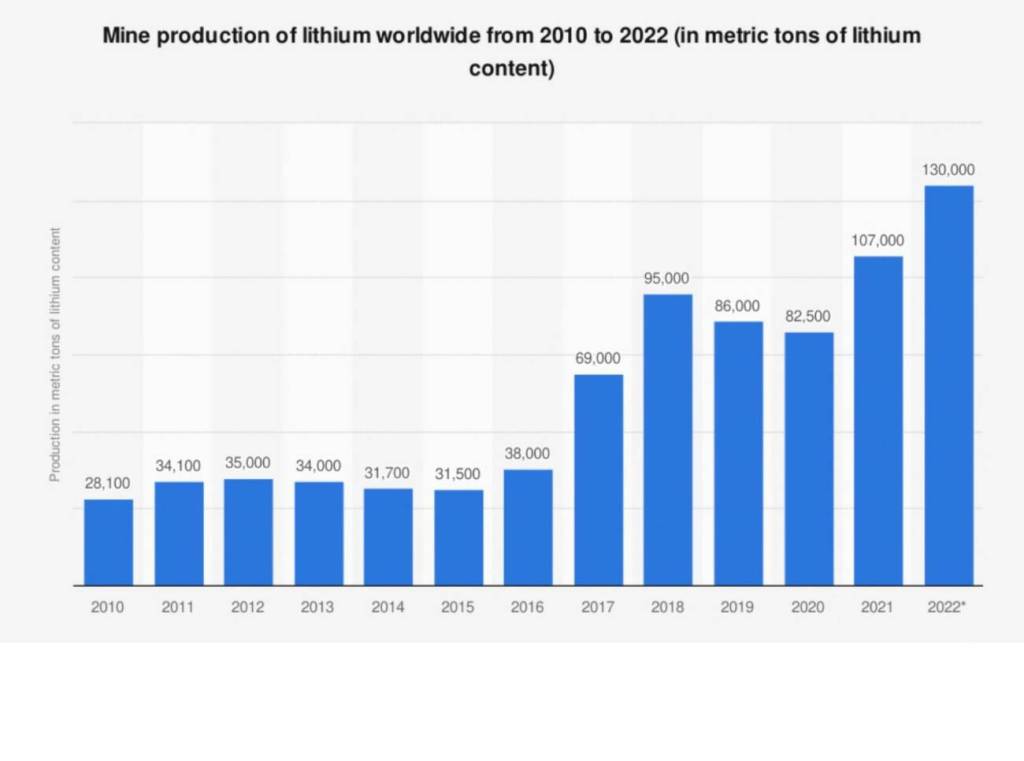

According to a US Geological Survey, there are an estimated 14 million tonnes of lithium on earth, approximately 100 times the worldwide production volume in 2022.

This means there is no acute problem with the shortage of lithium resources. The industry’s concern is how quickly and efficiently these raw resources can be exploited and developed into the required materials.

Image source: US Geological Survey, ©Statista2023

From discovery to financing to production

There is a lengthy delay between finding a lithium deposit and producing usable lithium since mineral resources cannot simply jump from discovery to production.

Generally, the process follows three main stages:

- Discovery Stage: The discovery and investigation of lithium mines and experts will determine the feasibility of exploitation. (This is the most time-consuming stage.)

- Orphan Stage: The discovered mineral deposit sits untapped while mining firms seek investors and capital inflow to start construction and operations.

- Production Stage: With capital raised and investors on board, mining companies can begin operations.

To illustrate the time frame in question, Australia Hard Rock Mines, the largest global lithium supplier, takes an average of 6 to 8 years to complete the entire process.

Currently, most global mine producers are still in the first stage, with production not expected to occur until well into 2024.

Rich natural lithium resources provide the illusion that sufficient lithium stock exists in the market and encourage confidence in lithium-related industries’ future expectations. Meanwhile, the promise of EVs further stimulates the pursuit and demand for lithium.

These factors push the price of lithium even higher before many of the minerals had even been exploited – with whispers that a financial lithium bubble may be on the horizon.

Economic impact of rising lithium prices

The lithium supply chain mainly consists of mining companies upstream that sell the mineral to EV and laptop manufacturers downstream through intermediary lithium development companies.

These development companies transform the raw lithium into materials (such as batteries) that are useful for the downstream manufacturers. Their production period is relatively short compared with mining companies, but they are beginning to face profitability challenges in light of the rising lithium prices.

This is because the contracts between midstream and downstream companies usually last for several months while the price of raw lithium bought from upstream organisations is floating.

Rising lithium prices, therefore, mean that the costs these intermediaries face increase while their sales remain locked in at lower prices. On top of this, their negotiating power is generally far weaker than that of their larger downstream counterparts, leading to increasingly squeezed gross profit over time.

Lower gross profit will cause fewer investors and cash inflow for such companies and many newly-founded companies in the lithium midstream have faced financial difficulties over the past few years.

For many mature intermediary firms, however, it is not price so much as unstable supply that is the primary concern.

To secure their raw material supply, many midstream companies attempt to vertically integrate by purchasing stakes in mining companies rather than remaining as mere customers. However, these actions attribute significant additional frictional costs in the market.

In the case of Canada’s Millennial Lithium Corp Acquisitions, the deal was broken twice, the buyer changed 3 times, the process was extended for more than 6 months, and more than $30 million in termination fees were paid. This proved to be a time-consuming and costly process that added no tangible value to the global lithium industry.

With start-ups struggling to survive in the midstream industry and mature firms paying a considerable amount of frictional costs in lithium reserve competition, barriers to the midstream market are rapidly increasing, and the relationship between the upstream and midstream industries is becoming more fragile.

Midstream industries: The fragile mainstay of the lithium supply chain

A robust relationship between upstream and midstream industries is the key to preventing a catastrophic lithium supply crunch.

In an imbalanced lithium market, companies that are just starting up will struggle to survive, and mature companies will struggle to use their capital effectively.

Overblown expectations, increasing midstream market barriers, and considerable frictional costs are the key factors that will aggravate the chain’s vulnerability.

Moving forward, it will prove vital to control lithium price bubbles, encourage midstream enterprise development, and reduce frictional loss. Only then can we mitigate against the lithium industry’s growing midstream dilemma.