Geneva, 2nd December 2019. Today, at the WTO’s ‘Global Trade and Blockchain Forum’, ICC, TFG and WTO released a white paper combining over 200 responses from banks, corporates, fintechs and associations in the trade sector, as well as over 20 consortia, on the broader impact that distributed ledger technology (DLT) is having on the trade industry.

This is a jointly produced white paper between Deepesh Patel, Editorial Director, Trade Finance Global (TFG), and Emmanuelle Ganne, Senior Analyst at the World Trade Organization (WTO). This white paper is endorsed by the International Chamber of Commerce (ICC).

“The numerous blockchain networks and DLT platforms will help realize the potential of digital transformation to drive greater economic inclusion. The International Chamber of Commerce (ICC) together with its partners, as neutral conveners of all trade stakeholders across the world, aims at connecting and coordinating these disparate groups in order to accelerate efforts to digitalize trade” said David Bischof, Deputy Director, Finance for Development, International Chamber of Commerce.

“Having a constant need to know all developments and involved parties, this report is an indispensable tool for the entire ecosystem to keep track and align actions.” Bischof added.

Reality Check

We’re living through exciting times. While international trade in goods has seen little innovation since the invention of the container in the 50s, the tedious, labour- and paper-intensive processes required to ship around the world could well become a story of the past thanks to the advent of new technologies, particularly distributed ledger technology (DLT) – colloquially termed “blockchain”.

Rarely has a technology spurred so much hype and hope amongst the trade and trade finance community. Not without reason: The possibilities that blockchain unlocks to track transactions and exchange assets in real-time, in a trusted and highly secure environment using peer-to-peer validation and networks makes it an appealing tool to remove many of the inefficiencies that hinder one of the oldest forms of traditional finance today.

Over the past few years a myriad of projects have been launched to enhance processes related to trade finance, to digitalize trade documentation, and to reduce inefficiencies in transportation and logistics. Some take the form of multi-player consortia and networks, others are building a fabric layer to interconnect these different projects, and others are built to digitize particular aspects of the trade and supply chain.

These international trade actors are changing fast, but how many of these initiatives have moved beyond a proof-of-concept? What are the challenges that these new actors now face as we go past the trough of disillusionment and exploratory phase of DLT in trade?

Building on the WTO publication “Can Blockchain Revolutionize International Trade?” authored by Emmanuelle Ganne and TFG’s white paper “Blockchain and Trade Finance”, this study provides an overview of the main projects underway in trade, with a focus on trade finance, shipping, and the digitalization of trade documents, and assesses their stages of maturity. Based on a survey of more than 200 actors in the field, it analyses the key challenges that companies involved in blockchain projects are facing and discusses actions that may need to be taken to allow the technology to truly transform international trade. After years of hype around blockchain, the time has come for a reality check.

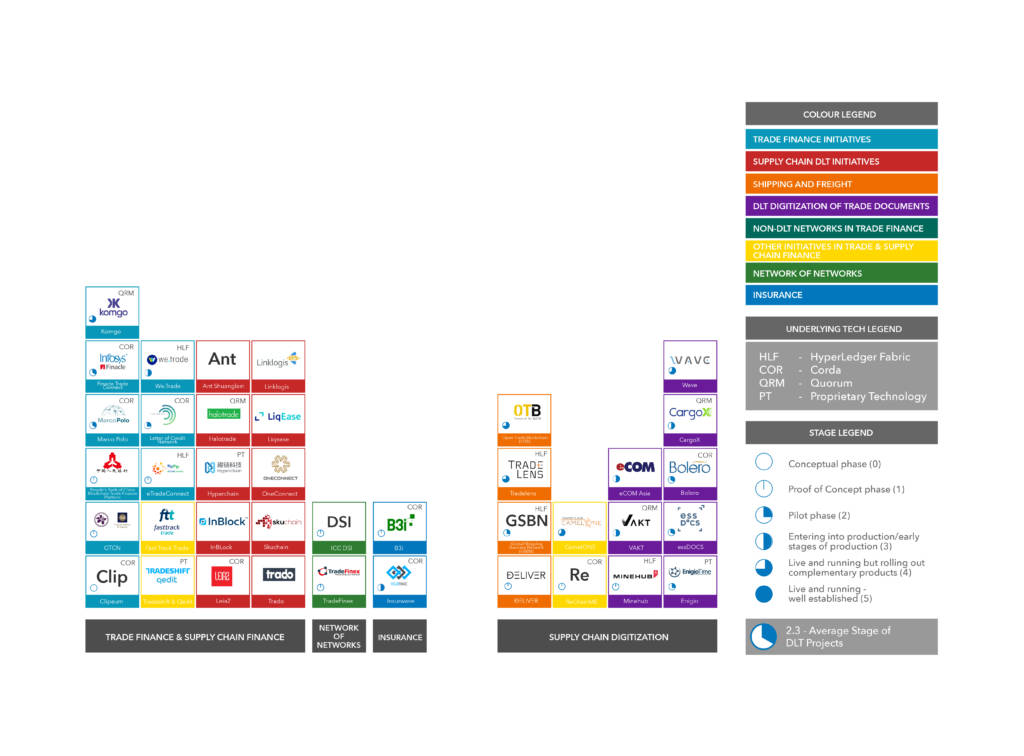

Periodic Table of DLT Projects

The paper begins by introducing a visual depiction of the DLT in trade landscape, the periodic table of DLT projects. Following this the paper takes a dive into each of the initiatives being pursued, providing some background as to what each is seeking to accomplish and the tools, participants, and structures that will help them get there.

Following this was an examination of the various products that are being rethought and digitized. Next, the paper looked at the participation of banks in the various projects and consortia.

Evolution not Revolution

Lastly, ICC, TFG and WTO examined the results of both their qualitative and quantitative industry surveys, looking at the assorted insights that these have provided about what the future of the industry holds.

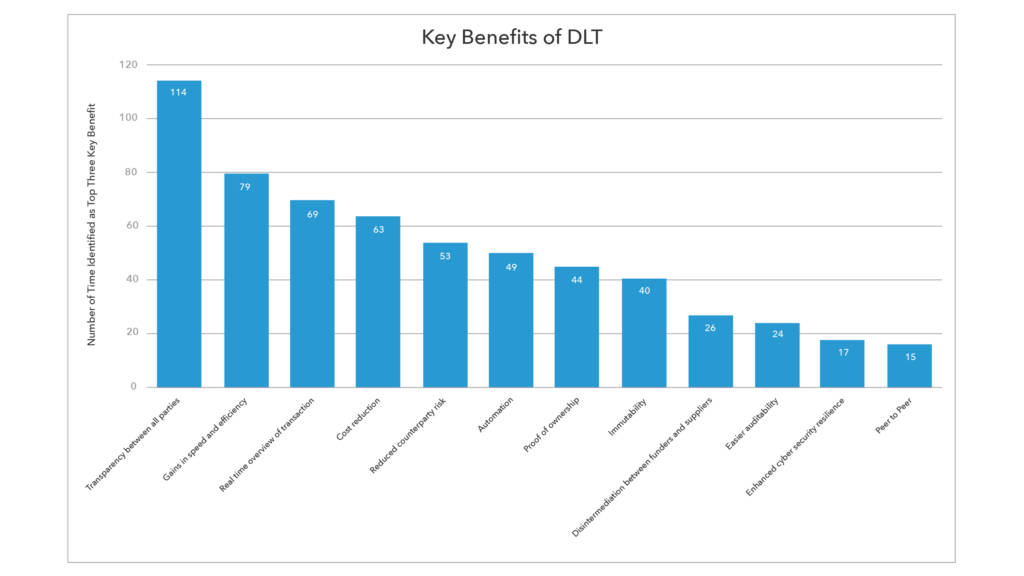

Over 200 responses from banks, corporates, fintech companies, and industry associations were received to our general survey on DLT in trade and trade finance, and over 20 consortia, banks and companies involved in the various projects covered in the present study provided detailed inputs.

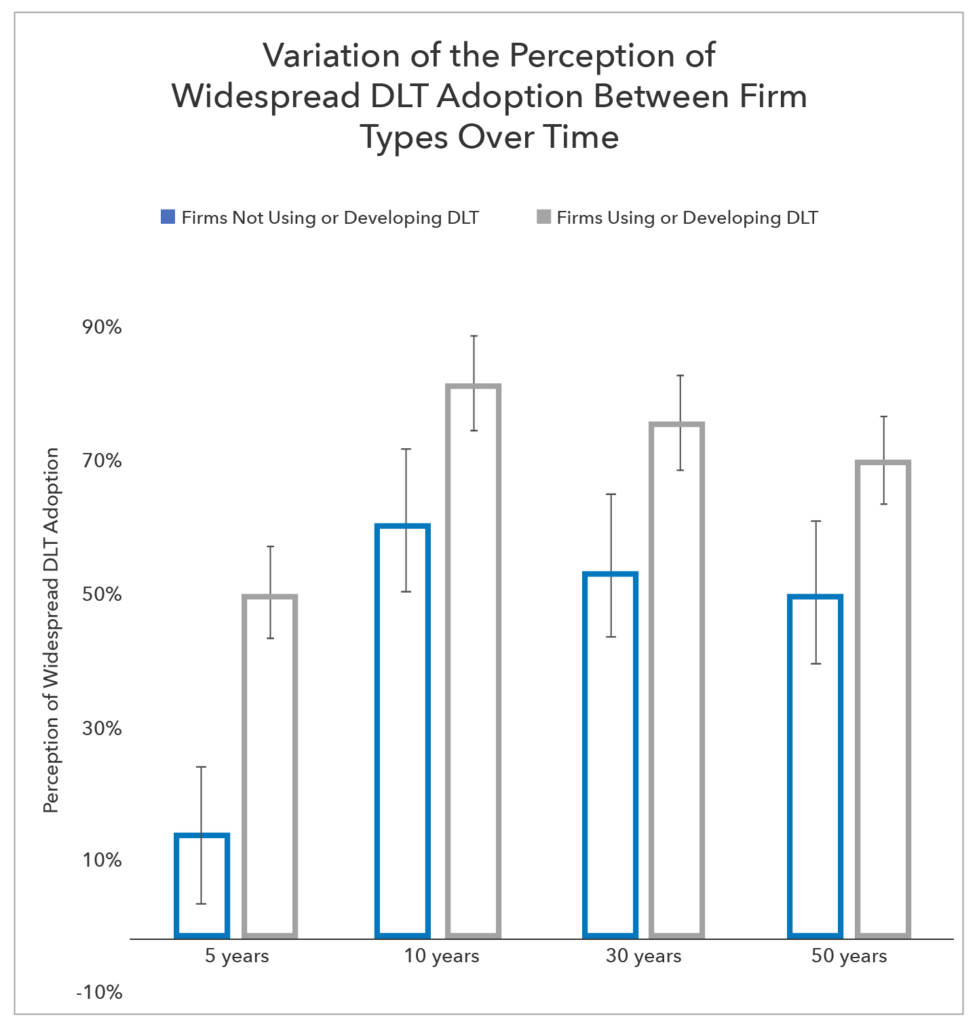

Perceptions of widespread DLT adoption between different types of firms, as well as the key challenges by firm type (Source: ICC, TFG and WTO Blockchain for Trade Survey, October 2019. Responses from corporates, banks, consultancies and vendors, n = 202, lines indicate standard deviation)

An Exciting Time

A new wave of industry change is coming for the world of international trade. DLT and non-DLT projects alike are springing up to leverage new and exciting technologies to help bring trade into the digital era. Projects, initiatives, and consortia from all aspects of the industry from financing, to shipping, to insurance are generating innovative approaches to the challenges at hand. These projects are disrupting many of the old ways of operating by bringing new ones to the table.