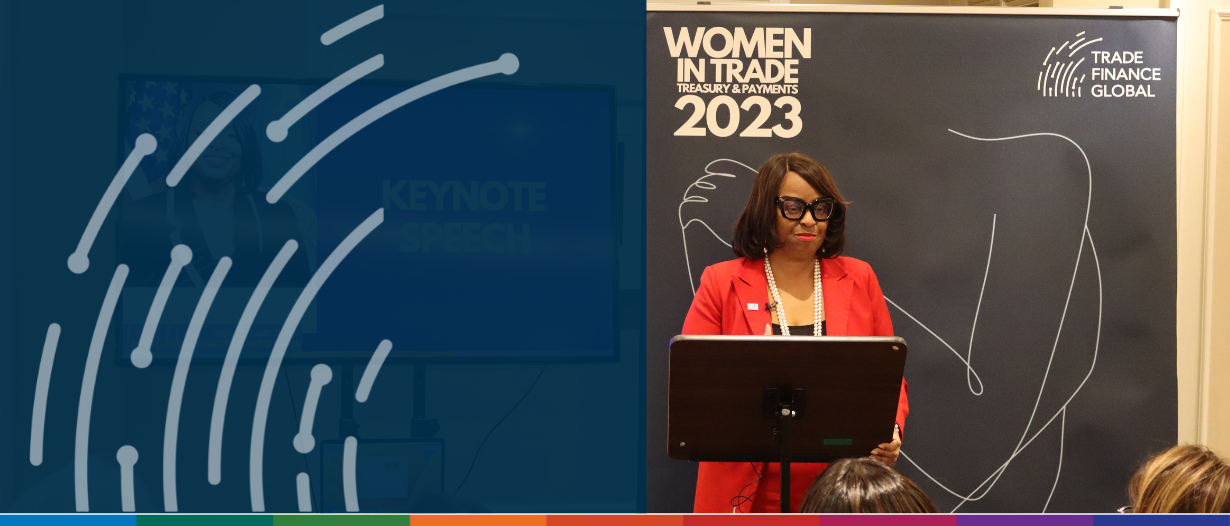

To kick off Trade Finance Global’s Women in Trade, Treasury & Payments roundtable event and dinner, President and Chair of US EXIM Bank, Reta Jo Lewis gave a keynote address to the audience.

Multilateral organisations have the power to create strong and long-lasting partnerships to empower women and alter social and economic norms.

Chair Lewis’ experience at US EXIM Bank has provided her with a global perspective on the empowerment of women and the positive impact of investing in women-owned businesses.

“Good afternoon, everyone. It is a privilege to be with you and especially on this day as we celebrate Women’s History Month across the United States and International Women’s Day, which will be celebrated around the world.

My name is Reta Jo Lewis, and I am the second woman and first Black person to serve as the President and Chair of the Export-Import Bank of the United States (EXIM) –America’s Official Export Credit Agency.

Our convening today means a great deal to me because gender equity concerns us all and remains a priority for both developed and developing nations.

And as multilateral organisations take strides towards improving on the economic welfare of societies, leaders must do their part to recognise that advancing gender equity must be a top priority as we work to achieve the sustainable development goals set by the United Nations.

In the Biden-Harris Administration, women’s empowerment is recognised as an essential component of achieving gender equity. This is because gender equity is not just a matter of fairness but also a marker of both economic and social progress.

Multilateral organisations also have the ability to establish norms and, most importantly, use their financing and programming to create incentives for nations to adhere or inch closer to these norms.

For instance, the United Nations Development Program has implemented various programs to promote gender equity and women’s empowerment, such as increasing women’s political participation, reducing gender-based violence, and promoting equal access to education and employment.

International organisations can also support capacity-building initiatives that enable women to participate fully in the economy. These initiatives include training programmes, access to finance, and promoting entrepreneurship.

I believe that by empowering women and women-owned businesses, we can contribute to economic growth, reduce poverty, and promote sustainable development.

EXIM Bank recognises its responsibility to promote gender equity in trade finance.

At EXIM, we are able to invest with our values, and international organisations play a similar role in setting the tone for where our attention should be paid and where we invest effort and funding.

In the U.S., there are approximately 13 million women-owned businesses, and they are growing at more than double the rate of all other businesses.

More than nine million Americans are employed by women-owned businesses, which are generating an estimated $1.9 trillion in revenue.

Even though female entrepreneurship is growing exponentially in the U.S. and globally, one of the largest obstacles for women-owned firms is a lack of access to capital and/or funding.

EXIM has a statutory mandate to provide financing when private-sector lenders are unable or unwilling. We step in to fill in that gap for American businesses by offering financing programs.

I am a firm believer that EXIM cannot achieve our mission to fully support U.S. businesses without expanding financing opportunities for women to grow their businesses with exports.

To close the equity gap between women-owned and male-owned businesses, we must address financing constraints. Small business trends have found that only 25% of women seek financing for their businesses.

That is why one of the first things I did at EXIM was to establish the Council on Advancing Women in Business, a subcommittee to our Advisory Council that works to provide recommendations on ways EXIM can reach more women in business and better consider equity goals set in the agency’s strategy.

Supporting women, and women-owned businesses, must be seen as necessary to our economic prosperity.”