Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 47

Host: Deepesh Patel (DP), Editor, Trade Finance Global

Featuring: Arnaud Doly (AD) CEO & Founder at Nabu

Handling documents used in letters of credit, for instance, is a laborious and time-consuming task, where examiners can spend hours checking a single set of documents. To address these problems, several industry players and start-ups have been working for years to design solutions that could be used across trade finance. Technology has to be reliable enough in order to be most effective and to make a really useful contribution.

Superhumans: the rise of AI supporting trade finance professionals

Among the oldest areas of financial services, trade finance always held a central position within international trade, with 80 to 90% of transactions being financed by some form of credit, guarantee or insurance.

While evolving in an increasingly stringent regulatory environment, the sector is one of the most manual and paper-based of the whole industry, resulting in expensive and error-prone operations with a slow processing time. Handling documents used in letters of credit, for instance, is a laborious and time-consuming task, where examiners can spend hours checking a single set of documents. Out of the 4,2 million documentary credits issued annually, approximately 70% of these documents have been rejected by banks at the first presentation because of discrepancies.

In order to remain competitive, banks must accelerate processing times without incurring higher prices or operational costs while staying accurate, although the amount of data to be checked is growing.

To address these problems, several industry players and start-ups have been working for years to design solutions that could be used across trade finance. In such an information security and regulation driven sector, where a single typing error may lead to document rejection, technology has to be reliable enough in order to be most effective and to make a really useful contribution.

PODCAST: WEF – The Fourth Industrial Revolution: Inclusive digital trade is the future (S1 E44)

What does the future hold?

Emerging technologies such as blockchain and artificial intelligence will transform the way transactions are conducted. The former, a technology under the spotlight since the bitcoin boom, seems to be a perfect fit for data transmission in trade finance. As numerous parties involved in a transaction need access to the same information, it’s almost worthless nowadays to send the relevant paperwork around the world by post or even fax. Blockchain can bring different trade stakeholders on a single decentralized network, allowing them to process all the documentation digitally. Not only would this remove courier delays or loss of papers during transit, issues that have seen an increase in occurrence given the current Covid-19 crisis, but it could save days in a trade finance operation.

If this technology has the potential to revolutionize the industry, it is only at the beginning of its development. Banks and fintechs won’t be able to unlock blockchain’s benefits if they act alone, it is the entire sector that needs to rise up as a community and form a partnership to adopt and follow standard rules and guidance governing electronic documents, and start conducting their transactions digitally.

Artificial intelligence, on the other side, can have added advantage over and above what blockchain promises to offer. It can be used both with physical or electronic documents through OCR, and digital data. Many professionals don’t see full digitalisation of trade finance happening in the short or medium term, and physical documents will still be actively used, even if they are doomed to disappear. Taking this into consideration, it is essential to tackle actual problems and improve processes as much as possible with solutions that can be implemented now.

Most international banks are already using OCR in order to digitise documents, but they are yet to realise its full potential. It is typically used to transfer paper-based content into back-end fields, thus reducing manual and time-consuming actions. As it allows banks to focus on their core business, the technology does nothing to assist when it comes to the examination of documents against international rules and credit terms. AI powered OCR coupled with deep learning, natural language processing and state-of-the-art data analysis algorithms can effectively address this problem. This would allow trade finance to digitalise one of the most inefficient tasks without the need of having a fully digital transaction.

As their names are well known, their real functionalities and applications are much less understood, and they are sometimes considered to be competitors. The whole industry needs not only to be interested in technology, but to understand its ins and outs, and to be more open in collaborating with fintechs in order to deeply modernise these dusty processes.

The artificial intelligence momentum

If artificial intelligence has been around for some time, it is only recently that the capacities of different AI development fields such as computer vision, deep learning and natural language processing are becoming powerful enough to be seriously used in operations that need such a high level of meticulousness as trade finance.

Highly heterogeneous documents layouts and the fact that many data fields may be free text make it challenging to automate compliance examination. With the advent of electronic documents and digital data on blockchain platforms in the next coming years, data will be structured and therefore much easier to process. But as long as physical documents are widely used, state-of-the-art technology is needed for production use.

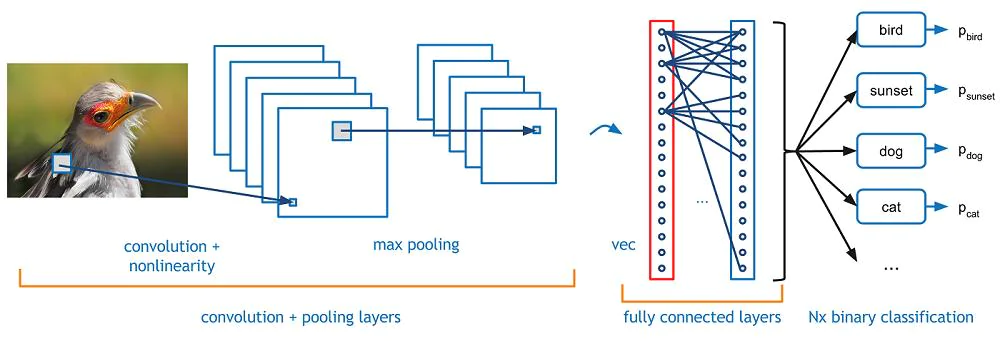

One of the fundamental capacities of humans is to analyse their environment. In the majority of cases, this involves recognising the elements in our field of vision: finding other people, identifying cars, animals… The latest developments in deep learning allow mind-blowing applications. The use of OCR with neural networks to localise text in an image along with understanding what the text is can go a long way. CNN, RNN or LSTM are examples of artificial neural networks architectures that can be useful for AI-powered OCR.

Until the emergence of convolutional neural networks in 2012 with Alex Krizhevsky, it was a difficult task for a computer. Fortunately, the approach of these networks inspired by our eyes (more specifically the fact that some neurons in our visual area only react to vertical borders and others to horizontal/diagonal ones) has opened up many applications, whether in medical imaging, autonomous vehicles, facial recognition, and even text analysis.

A CNN is organized in two parts: the extraction of information and the analysis of that information. It will refine an image through convolution and pooling, before predicting its content. The same can be used in trade finance by training models to identify each type of document (commercial invoice, transport document, insurance policy…). Then, the algorithms should extract the data fields contained in the document through information extraction such as Named Entity Extraction for example. After applying NLP to the extracted data in order to understand its meaning, such as fields 46A or 47A of a SWIFT MT 700, data analysis algorithms can them check the data against any business rule. The analysis results can then be displayed to the user to make a decision based on them.

Neural networks are getting smarter over time, meaning that it keeps enhancing its knowledge and capabilities. Such a tool at the service of anyone involved in document checking would be a game changer, as it could transform a regular professional manually checking a set of documents in hours into a superhuman casually handling it in minutes.

Unlocking the future of trade finance?

Trade finance has been struggling to find new talents since years. With a commonly accepted training period of around 10 years for a junior document checker to become senior, it is easy to understand why. The median number of years people stay at the same position or work for the same employer getting lower every year doesn’t help either. Attracting and developing the next generation of trade finance practitioners is a challenge that has been the subject of industry discussion for a decade or longer. Over 50% of banks responding at the International Chamber of Commerce’s Global Survey 2020 finding it more challenging to attract trade finance talents in 2019 than in 2018.

Augmented intelligence, the action of using artificial intelligence to enhance human workers through decision support for example, is the best answer to the ever-growing volume and complexity of regulation and data to be processed.

Working together to achieve a real digital transformation

At the moment, blockchain and artificial intelligence can help and complete the work that humans do to provide better services. Tomorrow, these technologies could, together, work on their own, drastically improving efficiency and allowing companies to focus on their core business. Working 24×7, a technologically run trade finance would make transactions more efficient, secure and transparent. Blockchain and AI could also could play a key role in helping to reduce the unmet demand for trade finance in countries who are currently outside the traditional financing system by easing processes and working in place of a virtually non-existent qualified workforce.

The role of fintechs and industry players is now to conceive innovative and industry-accepted solutions, in order to finally take trade finance into the 21st century.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with their company, Trade Finance Global or London Institute of Banking and Finance’s view.