Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn

Rumour has it that the elves start making toys for next Christmas almost immediately after Santa returns from his magical trip around the world each December.

With an estimated 2 billion children in the world, the elves need to produce around 5.5 million toys every single day of the year just to have enough for every child to find one under their tree on Christmas morning.

At the International Trade Forfaiting Association’s (ITFA) 2024 Christmas party, Trade Finance Global (TFG) spoke with Sean Edwards, Chairman of ITFA, and Dhiresh Dave, Chief Legal Officer and Managing Director – Legal, Compliance and Governance at Falcon Group, to discuss a financing tool that might come in handy for Saint Nicholas: inventory finance.

Filling the inventory finance gap

For businesses, that same bursting warehouse as Santa’s at the North Pole represents not only a logistical puzzle but also a financial one. How can these goods be funded without locking up precious capital?

That’s where inventory finance comes into play.

Inventory finance is a financial tool that helps businesses fund goods in the production or storage stages, bridging the gap between supplier payments and sales receipts. It enables companies to manage inventory without tying up working capital, ensuring operations run smoothly and supply chains remain resilient.

Dave said, “There’s a whole range. From the simplest end being the typical loans or repos to the other end of the spectrum, which is bespoke solutions where someone like Falcon would slip into a supply chain and own goods where you need them for when you need them.”

The result is a way for businesses to adapt to the inventory requirements of a post-COVID world.

The post-COVID wake-up call: warehouse disruption, just in case, holding extra inventory

During the pandemic, factories ground to a halt, shipping delays stretched endlessly, and businesses learned hard lessons about vulnerability. Suddenly, just-in-time supply chains didn’t feel so smart anymore, and the idea of buffer inventory went from being a luxury to a necessity almost overnight. Companies needed to keep their operations running, no matter the disruptions.

Dave said, “The interest in inventory really piqued post-COVID, as people were interested in developing a stronger supply chain, and so resilience was initially the driver. How can we stop this from happening again?”

But keeping extra stock can be expensive. It ties up capital and strains resources, which is why so many businesses have turned to inventory finance. With it, they found a way to hold the necessary buffers without breaking the bank.

Edwards said, “The underlying problem that we’re trying to solve here is the ownership of inventory and the operational issues about managing that and dealing with that inventory.”

This shift has also created new opportunities. Bulk buying from suppliers at a discount became a feasible option with the right financing in place. Consider that a typical motor vehicle can contain up to 25,000 component parts; bringing this material together creates an intricate and sprawling supply chain. Similar industries to automotive, like tech, have embraced this approach.

Why banks can’t handle inventory alone

Banks are great at handling numbers on paper, but when it comes to dealing with physical goods, they’re out of their depth.

Edwards said, “I remember years ago, we had to take possession of a warehouse full of cocoa beans. That was not a happy experience. Banks are not very good at doing that. All of that practical management is usually dealt with by an intermediary, and in many cases, banks can’t do it anyway for legal reasons.”

This is where non-bank entities step in. These players have the specialised expertise to manage inventory and supply chain logistics. Acting as intermediaries, they bridge the financial and operational worlds, letting companies focus on their goals without worrying about the details of inventory. These types of non-bank entities can add value for clients by providing support on both the financial and physical dimensions.

Dave said, “When you’re stepping into a client supply chain, the risk to them of you not performing is that the entire manufacturing chain goes down. If you don’t perform properly, they don’t get the parts they need to sell their own product. The upside is phenomenal, but the downside is great as well.”

Non-banks are often better suited to balance these risks, providing reliability and expertise where it’s most needed.

The future of inventory finance

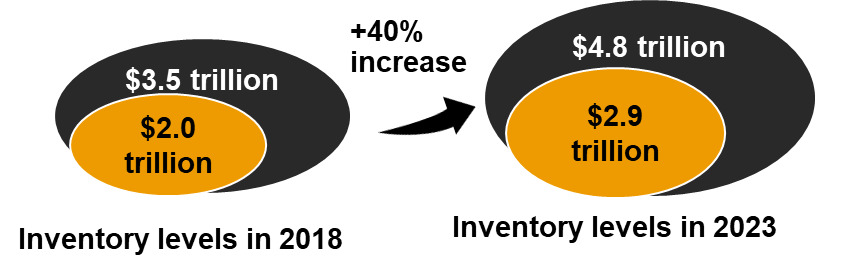

Inventory finance is a solution for today’s problems and tomorrow’s challenges, but it may still have a lot of room to grow. The market has grown 40% between 2018 and 2023, and is estimated to grow at a CAGR of 10.5% from 2024 to 2033, from $205.7 billion to $558.7 billion.

Dave said, “[The inventory finance market] is still very much in its infancy, given that the interest in it has been driven by supply chain disruption. In current times, the only thing that is certain is uncertainty when it comes to global trade, and a solution to ensure that you have the inventory where you need it and when you need it is something that corporates cannot afford not to have in their toolkit.”

The next step is scaling these solutions. For that, banks and non-banks will need to find common ground. Banks prefer structures that feel familiar, while non-banks push the boundaries with innovative approaches. As these partnerships evolve, inventory finance will likely become more refined and accessible to a broader range of industries.

Awareness is also key. Many organisations still don’t realise the benefits inventory finance can bring. Success stories and growing adoption will help spread the word. Competition among providers will encourage new ideas, making these solutions even more effective over time.

—

By addressing the inventory gap, companies can face challenges head-on, keeping their operations steady and their goals within reach. In the aftermath of the pandemic, flexibility and adaptability have become cornerstones of success. and inventory finance delivers both.

With banks and non-banks working together to refine these solutions, the future for businesses ready to embrace this powerful tool looks as bright as a glowing red nose on a foggy Christmas Eve.