Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn

The last two years have been like no other for the global economy. With a forced global shutdown followed by unprecedented fiscal stimulus, it’s no surprise that volatility has been the name of the game since the outbreak of COVID-19.

But just as we say goodbye to one crisis, another has reared its head in the form of Russian aggression in Ukraine.

Last year, we were on a royal road to recovery, with global trade hitting a record high of $28.5 trillion for the year, according to UNCTAD.

But will these gains turn out to be short-lived, as the global economy swaps one crisis for another?

John Miller is the chief economic analyst at Trade Data Monitor (TDM), a Geneva-based company that assembles trade data from over 100 countries.

Miller has worked in trade for over 30 years – including as a trade reporter for the Wall Street Journal – and at TDM, his clients include multinationals, trading companies, governments, and lobby groups.

Megatrends: Commodities supercycle

One of the clearest trends that Miller has seen over the last two years – and which TDM was tracking long before it became ‘news’ – is the supercycle we’ve seen in commodities.

Combined with rising inflation, this has led to huge price increases across the commodities industry, some of which show fews signs of reversing any time soon.

“You’re seeing a macro knock-on effect from all the government spending to shore up the economies where consumers have been buying a lot, importing a lot, and that’s caused a scramble for resources,” said Miller.

“Last year, for example, Brazil’s iron ore exports were up 4% in volume and 69% in price, so that just means people are paying more for the iron ore.”

Iron ore prices have surged to a RECORD HIGH. And that's a great excuse to tell you about how the market has changed over the last 75 years.

— Javier Blas (@JavierBlas) April 28, 2021

Iron ore is the main raw material to make steel (and that's why steel prices are surging too). And it's a cash cow for big miners ????1/15 pic.twitter.com/4bKdIVZbXn

Another tailwind behind the supercycle is the rise of Asian markets as commodities consumers, driven by a rapidly emerging middle class in countries such as India and China.

In the 2021-22 fiscal year, India’s crude oil imports are expected to more than double to over $100 billion, with oil trading at almost $130 a barrel at the time of writing.

“India’s fuel imports were up massively last year, and even coal, surprisingly, is back,” said Miller.

“Coal is a swing supplier for power countries – including Germany and China – and so when coal trade was up last year, it was a trend that nobody expected.

“The scramble for resources is forcing up prices, and now you’re seeing it in consumer inflation. We saw that in trade data all of last year.”

Resilience in global trade

Another theme that Miller has kept a close eye on at TDM is resilience in global trade, following a range of shipping and supply chain challenges caused by COVID-19.

“The good news is that while COVID was a big challenge to supply chains, the global trading system bent, but it didn’t break,” said Miller.

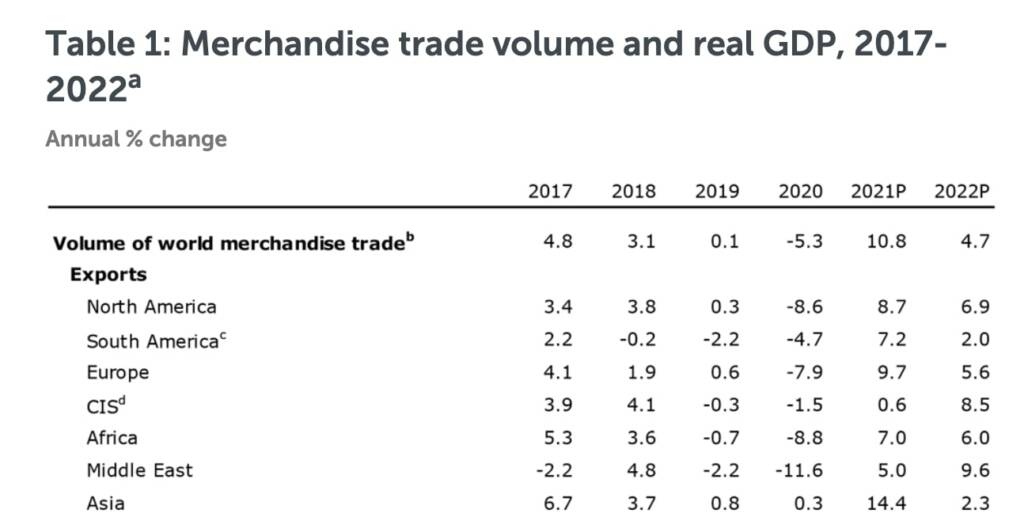

Even after a strong 2021, according to the World Trade Organization (WTO), global trade is expected to rise by 4.7% in 2022.

Granted that’s not as much as the 11% increase we saw last year, but that number, says Miller, couldn’t really have been achieved without the very low baseline of 2020.

Among other COVID-19 growth trends that Miller expects to stick is the rise of working from home, which he believes will continue to support high-tech, exporting nations in Asia.

“The work from home trend has meant that high-tech trade is probably going to double. So overall, if global trade is up around 5% in 2022, high-tech trade will be up more than 10%,” he said.

“That’s people just getting used to working at home and buying routers, buying computers, all the gear they need.”

Likewise, another major force that Miller believes will drive trade growth in 2022 is US energy exports, which he sees making a comeback.

“We’re seeing again this big increase in energy trade, and the US is becoming a key energy supplier,” he said. “All of its fracking gas is coming online and being shipped all over the world.”

Inflation nation

Despite global supply chains having proven resilient enough to withstand COVID-19, Miller believes that inflation may turn out to be an even bigger – and more intractable problem – for global trade.

Looking back on the various fiscal interventions that were designed to soften the blow of COVID-19 – including the US government’s $1,000 checks for all – Miller sees these as coming back to haunt consumers in the form of inflation for the foreseeable future.

“On this issue I don’t really have good news, as we’ve seen price increases in essential trade items for the past 18 months,” he said.

“Last year, the US trade deficit was also the highest it’s ever been in history, which has had all kinds of effects on currencies and on inflation.”

In 2021, the US trade deficit increased by 27%, bringing it to an all-time high of $859 billion – surpassing its previous high of 2006.

#EconWatch: The #US trade deficit rose to an all-time high of $859 billion last year, a 27% surge. Remember, the trade deficit is made in the USA. It’s the result of the US savings deficiency, which is largely the result of the fiscal deficit. pic.twitter.com/JNVDYd8M7S

— Steve Hanke (@steve_hanke) February 10, 2022

“Inflation is just everywhere. I mean, last year, Chinese natural gas imports were up 18% by volume and 170% by price – so that just means they’re paying more.

“They’re outbidding others for the same amount of natural gas, and this is what’s at the root of inflation.”

At TDM, Miller and his colleagues don’t offer predictions, but he did stress that he believes inflation is here to stay, and that there is no magic bullet to fix it from a policy perspective.

“I do think that’s something that your listeners should worry about,” he added.

To find out more about TDM and Miller’s thoughts on the global macro picture for trade, please listen to the full podcast episode.