Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn

The world of factoring has undergone a major boom in the last year.

TFG spoke to one of the world’s largest factoring associations to find out how trade receivables can help solve the liquidity crunch caused by supply chain disruption.

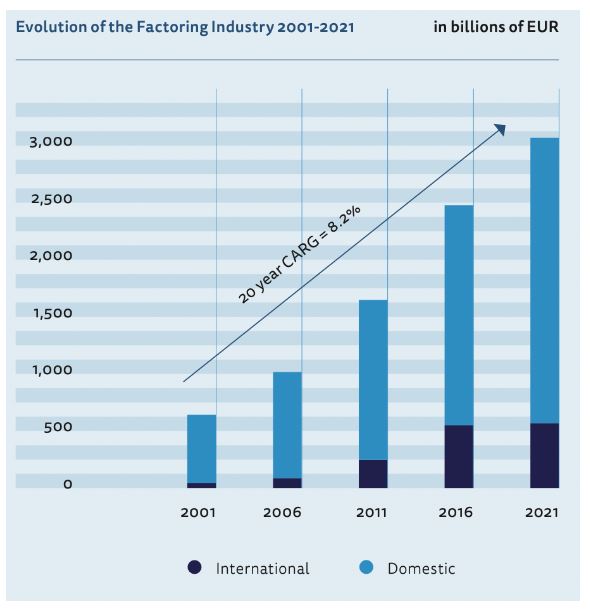

In recent years, the factoring market has grown from around $600 billion to a $3.4 trillion business in 2021.

With the rise of fintech solutions to broaden market access, together with the advent of trade receivables as an asset class, there is much potential to bring more liquidity into the trade and export market at a time when it is most needed.

TFG spoke to factoring expert Peter Mulroy, secretary general of FCI, a non-profit trade association headquartered in the Netherlands with around 400 members in 94 countries.

FCI’s focus is on everything relating to traditional factoring including reverse factoring, supply chain finance, and cross-border receivables financing.

The organisation just released their Annual Review of 2021, which is renowned within the industry for highlighting important trends within the international factoring business.

These include performance indicators from previous fiscal years that provide those in the factoring, supply chain, and receivables finance industries with a true picture of the overall nature and direction of the industry.

Annual review: key findings

One of the key takeaways from the June 2022 FCI report is that the industry is very resilient.

It bounced back from a decline of around 6.5% (a 200 billion drop in trade volume) during 2020 to an increase of 13.5% in 2021 (a 350 billion increase).

“That growth is coming from a variety of drivers,” Mulroy said.

“One of them is a huge increase in SME clients, which comprise the backbone of many developing trade economies.”

SME growth has been particularly pronounced in the food, textiles, and consumer products manufacturing sector.

“Manufacturing distribution counts for around two-thirds of the clients that use receivable finance around the world,” Mulroy added.

Of that, manufacturers of consumer electronics account for nearly half.

This is good news for the industry as a whole, suggesting that supply chain problems should be short-lived and that access to trade finance is broadening to those groups usually left out of the system.

Dark times ahead

The FCI report also revealed some potential struggles ahead for the industry.

“Of course, in a period of downturn, recession, and fear, we typically see a rise in non-recourse debt,” Mulroy says.

“That certainly happened, there was a significant rise ‒ the biggest increase I ever witnessed in the last 25 years in non-recourse loans.

“We also saw a 98% rise in reverse factoring in 2021.”

Non-recourse factoring is where the financial institution providing the receivable finance service is taking on 100% of the risk of the debtor, i.e. of the client’s customers (who are buying on credit).

This means that if that debtor defaults or files bankruptcy, then the client, i.e. the business that has factored their accounts and received funding in the form of a loan on a future invoice payment, has no recourse to recovering that debt.

According to Mulroy, this type of factoring “allows the seller, namely the clients, to sleep at night.”

Reuse factoring is similar in the sense that it’s also treated as a non-recourse event.

However, in this instance, the buyer obligates themselves to pay the invoice at the due date without any conditions.

This basically gives financial institutions the confidence that they can fund these invoices ‒ they know for certain that they’re going to get paid and the only risk is if the buyer goes bust.

On these reverse programs, lenders are typically only providing the service to strong investment-rated companies.

That’s the key difference.

Looking ahead: future trends

Successful factoring largely comes down to accurate assessments of payment risk, which, in the current macroeconomic and geopolitical climate, is something many lenders are carefully trying to manage.

This is especially true in the second half of 2022 when expected risk and credit risk are predicted to rise in the wake of a further withdrawal of state support.

“I’m hearing from the members globally that they’re still experiencing very strong growth in the first half of 2022 – increases in mostly double digits – as high as 30% in some markets,” Mulroy says.

“It really bodes well for at least the factoring industry.

“Historically, the factoring industry does extremely well during and after times of crisis because there is a demand for products that eliminate or reduce risk.

“Nonrecourse factoring does just that, providing and eliminating the size of the risk on the seller’s balance sheet.”

According to the FCI report, when it comes to the balance sheet of the average seller, around 40% of their assets are currently receivables – this is their largest concentration of risk – something which is not helped by an increase in inflation and interest rates.

Mulroy admits that this enhanced commercial risk while having a positive effect on factoring volumes, does erode overall confidence.

This will potentially suck liquidity out of the market and lead to a significant decline in consumer confidence in the short term.

However, the rest of 2022 is no longer poised to be as demanding as some were predicting:

“A lot of what the insurance companies were predicting in 2021 did not come to pass,” Mulroy says.

“We haven’t seen ‘zombie companies’ and ‘leverage entities’ affected by a reduction in state support and stimulus programs, but I think with everything else happening, 2022 is going to be a challenging year.”

In the short term, the narrative seems predominately positive but begins to be shrouded in a veil of uncertainty for the medium term.

“Factoring is a countercyclical sector,” Mulroy says.

“We do very well during times of crisis as long as we manage risk properly.”

A lot will depend on geopolitical factors and what happens with regard to supply chain disruptions.

These disruptions continue to put pressure on distributors to increase inventory levels, and in turn, lead buyers to request longer terms on those receivables, which means higher receivable valuations and more financial liability for corporate buyers.

“This is going to test the credit culture crisis next year but the great thing about our industry is that there is such a close pulse to the buyers, to the retailers, and to the wholesalers,” Mulroy says.

“We’ll continue to keep that close pulse and I can only imagine we’ll get through this quite well – fear tends to drive people to our industry.”

This podcast episode was recorded after FCI’s 54th Annual Meeting in Washington, DC.