Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

State of the Global Supply Chain Finance Market – UK and China

Season 1, Episode 5

Host: Mark Abrams, Head of Trade, Trade Finance Global

Featuring: Simon Kleine, Director, East & Partners Europe, Dr Rebecca Harding, CEO, Coriolis Technologies

Mark Abrams: I’m Mark Abrams, Head of Trade at Trade Finance Global.

The trade and supply chain finance sector

Within the current macroeconomic and geopolitical climate, there are significant opportunities to enhance Anglo-Chinese relations. Brexit and the China-US trade war have fundamentally changed the chessboard. The US$1.5 trillion trade finance gap needs to be addressed, taking into account the effects of digitalisation and innovations around structuring finance for international trade.

With that in mind, Trade Finance Global, in partnership with East & Partners, the ICC United Kingdom, and Coriolis Technologies, put together a whitepaper on the state of the global supply chain finance market, focusing on the UK and China trade corridors.

Mark Abrams: We’re delighted to be joined by our contributors to the whitepaper; Simon Kleine, Europe Business Lead for East & Partners, a specialist business banking insights and analytics consulting firm, as well as Dr Rebecca Harding, international economist and CEO of Coriolis Technologies, a business providing data as a service to the trade finance sector.

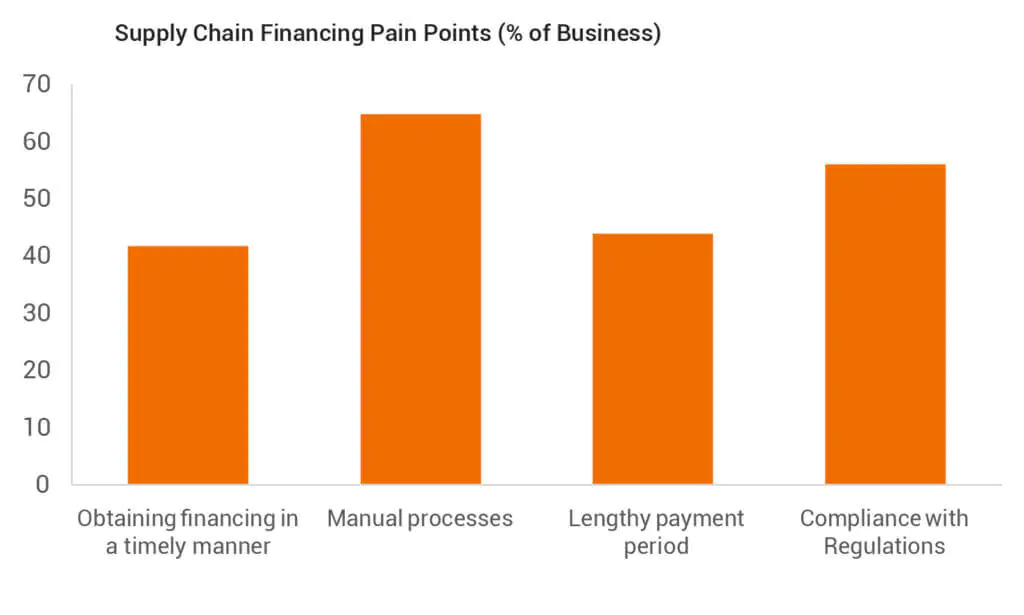

We have mapped some of the pain points and areas that require development in trade and supply chain

Rebecca, Simon, thanks for joining us here today. In 30 seconds or so, please give us a quick background of yourselves and your companies?

Simon Kleine: I work for East & Partners. We’re a specialist Business Banking insights analytics firm, and what we do is conduct research or, more precisely, ‘Voice of the Customer’ research with businesses. So, your FTSE 250, your fortune 500 companies, in their use of business banking services and products. And that gives us a very clear insight in terms of what customers want, what their pain points are, and what their demands for the future are.

Rebecca Harding: I’m a trade economist and have been for a long time. After realising that the data wasn’t good enough to make business decisions, I set up Coriolis technologies to become the data provider to the trade finance sector. So, we cover trade, trade finance and company data, with a view to providing an end-to-end risk resolution.

State of the Global Supply Chain Market

MA: Let’s jump straight into the whitepaper. Simon let’s talk about cross-border supply chain finance. Asian markets dominate when it comes to cross-border sales orders, with the UK closely following. Why is this so, and what are the big trends in terms of financing of this trade for corporates?

SK: Okay, the situation with Asia is that it’s dominated by its makeup and within that, it’s the predominance of China, and the demand from countries in Asia – particularly South East Asia – who are very dependent on their imports. So with Hong Kong and Singapore for example, 90% of their supply chains come through imports, which in itself has created a kind of unique demand in terms of supply chain funding in that region, where we’ve seen some of the most innovative and dynamic use of supply chain financing

UK Supply Chain Finance Market – What are corporates worried about?

MA: Taking a closer look into the UK and European market, working capital finance is hugely important for supply chains. Is there a struggle for corporates and their suppliers having access to supply chain finance, and what is the role of technology and fintech in all of this?

SK: Yes, as mentioned just now, in Europe we see a much more traditional landscape. And within that the availability of working capital finance is clearly there. That’s primarily due to its availability, along with traditional /trade-finance/trade finance.

Within that though, there is an increasing move to more off-balance sheet supply chain financing. I think one of the areas for that is where suppliers are looking to increase their supply chain lines. Having said that, when you’re looking at large corporates, even where they do put supply chain funding in place, their financial providers in most cases i.e. banks, tend to only finance those suppliers coming from the top end of town. So small business tends to lose out. But when we

MA: The ICC Banking Commission Annual Meeting is being held in Beijing this week. So let’s talk about the China UK trade partnership. It’s clear that we’re no longer in the golden era of trade but Rebecca, you mentioned the importance of this partnership. What does the data tell us?

RH: I think it’s very clear that trade is still a major driver of economic growth. And it’s terribly important to the UK in the situation that it is in at the moment. It needs to trade within and without the EU and China is a very big trading partner for the UK. However, China exports around US$58 billion to the UK every year. So it’s a very big market now. I think between the two countries both of those trade flows have been growing – so China has been importing more progressively. The UK, particularly in its key sectors, like aerospace and cars and pharmaceuticals, has been exporting more to China. So at a time when trade is under the cosh in some way, because of increasing bilateralism and the breakdown of some of the trade relations that we’re seeing around the world, these are two countries that are committed to multi-lateralism and maintaining the rules-based international order. It’s therefore very important that these relationships are sustained.

I think it’s very clear that trade is still a major driver of economic growth.

Rebecca Harding, CEO, Coriolis Technologies

China – A Supply Chain Finance Overview

MA: The story for supply chain finance from Chinese corporates is very different from the West. What are we seeing in the market in relation to how Chinese businesses are being provided supply chain finance, and why do you think this is so?

SK: It’s very much essentially coloured by the fact of the dominance of the Chinese banks. 75% of the financing is coming from Chinese banks and 16% from offshore banks. But that’s very much been the key factor. That said, we’re starting to see changes in that and, in the coming year, we’re expecting to see the dominance of Chinese banks reduced by about 11% overall.

When we look at domestic Chinese banks, it’s going to be far more – they’re going to see a decline of about a third of their share, and offshore banks are certainly going to see an increase in excess of 10%. I think it comes down to more globalisation taking place; the Chinese are becoming much more outward looking, in terms of how they work as global players.

MA: You mentioned in the whitepaper that the UK’s fintech sector offers huge opportunities for innovation in trade finance. Trade between the UK and China presents significant opportunities for both markets when you look at the facts. With an estimated US$77 billion dollars as a trade finance market for goods and services flowing in this trade corridor, most of which is currently done on open account terms, several opportunities exist around trade financing, technology and partnerships. How can technology and partnerships help accelerate the UK China trade corridor and help bridge the US$1.5 trillion trade finance gap?

RH: I think it’s fair to say that this is one of the most exciting areas of trade at the moment. We don’t how big digital trade is and we don’t really know how big service sector trade is because they’re just not measured properly. So this is this is a huge area for exploration, which makes it exciting. At the moment, the service sector is growing at a normalised rate of 7%, while the service sector of trade between China and the UK is growing at an annualised rate of 7%, which means that actually there is a huge amount of momentum behind what is developing.

So how can that then link to helping small businesses? Well, if you look at the way in which small businesses trade and look at the way in which small businesses wants to take risk on to their balance sheets in the way in which they just want to finance their activities, it’s on a very short-term basis. And working within supply chains is a very good way of doing that, because they get some security. Having supply chain finance on one platform is an easy way of doing it. That’s one of the technological solutions that some of the bigger banks are beginning to address, but then I think this is exciting from a Chinese perspective, because some of the distribution companies are beginning to compete in this sector as well.

You’ve got logistics companies and supply chain companies beginning to say, well, we can provide short-term receivables finance on the basis of knowing that something is going from A to B, and it takes out the middleman in some senses. So that is an area where bigger banks are really having to work with the fintech sector.

Brexit – An Opportunity?

MA: Let’s talk about Brexit. I mentioned that there are significant opportunities for UK companies, particularly with respect to China’s Belt and Road Initiative, as well as the UK’s departure from the EU. Simon, what are China’s business leaders talking about with regards to opportunities and challenges around Brexit?

SK: We interviewed 91 of China’s top 100 corporates last September and asked about their current use of supply chain financing, and how they were organising their supply chains. And dare I say it, we asked the Brexit question!

What was really interesting was that three quarters of the China corporates we talked to said that they saw it as an opportunity to look at supply chain opportunities coming out of the UK. I think it plays back to the point Rebecca made just now about increasing imports coming from the UK to China. It’s something they’re proactively looking at. What’s even more surprising is that, in terms of how the financing is changing in China, is that of those three quarters, just over 70% of those said they would look at a domestic finance provider from the UK for that supply chain. So, the Chinese are becoming more global in that way. And for them, I think there’s been a high level of kind of bullish optimism towards Brexit. Companies are preparing for it in many ways. They’re looking opportunities beyond the EU. Yes, there’s a huge risk in that, there’s risk of FX volatility. But I think on both sides, people are seeing the opportunities as much as they are the threats.

MA: Finally, what are the big issues facing Chinese corporates? What are you seeing Simon?

SK: What came up for us in what we’ve done on Chinese corporates in the last year is, when we look at external factors, in terms of their supply chain financing, probably the biggest external factor for them is compliance. More than half of the Chinese top 100 corporates saw that as a key issue for them.

Compliance – KYC, KYT, AML

MA: Rebecca, does that match with your thinking?

RH: Well, I think compliance has become a huge issue globally.

And that’s not recently – that’s been growing over the last over the last 10 years since the financial crisis. I mean, compliance has been the one thing that’s been holding back the sector as a whole and trade finance generally. And there are technological solutions to that. I think the problem that everyone faces now is that the compliance issue is becoming politicised. So we’re beginning to see the emergence of compliance criteria, which are associated, for example, with US foreign policy. So Iran, China and Russia are beginning to get more difficult, more challenging, and that obviously affects small businesses, but it also affects new entrants into the market like the Chinese, so it’s going to become a tighter, more complex issue in the coming year.

MA: We’ve been looking at Chinese data, and it looks like there’s a slowdown overall, but how does that actually impact what’s going on in the economy? And what are your thoughts, especially around the Belt and Road? Can you give some insights?

RH: Sure. I think the interesting thing about China is that we’ve become very used to it being an export-led growth business model. We have become very used to China being an exporter and importing vast amounts of raw materials. But actually, what China is trying to do is achieve middle-income status. And that means it’s becoming more reliant on consumer demand and less reliant on demand for an emerging economy; things like commodities, and shunting supply chains out across the region, and through belt and road initiative, right into Europe, as we’ve seen recently with Italy signing up to the Belt and Road as well. So, in terms of what China is doing, it’s actually exporting its economic model across the region.

And that means there’s a huge potential for a debt crisis, because it’s spending a lot of money doing all of that. But on the other hand, if we all engage with it, it offers the world a huge amount of opportunity in areas that are actually relatively underdeveloped at the moment. So that’s one thing. And the other thing that’s really interesting is that the impact of the trade wars has actually been felt in the region as well. There’s been this kind of uncertainty around what’s going to happen as a result of the US-China trade…let’s call it dispute, at the moment. But what’s happened in any case, is that we’re beginning to see some of the higher values supply chains moving to places like Vietnam and Malaysia, we’re seeing bigger exports of things like electronics from those countries. So actually, we are seeing some signs of an emerging demand in China but actually from around China too. These are interesting times.

MA: Interesting times indeed. Well that brings us to the end of today’s podcast.

It seems that while there are many challenges in the current global environment for trade, there is certainly a case for opportunities around innovation and technology within trade, especially between the UK and China.

Thank you very much for your insights, Rebecca and Simon, and for joining us today. We look forward to hearing Rebecca speak at Beijing’s ICC Annual Meeting this week!

Want to find out more?