Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 21

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: Wayne Evans, Advisor International Strategy, The City UK

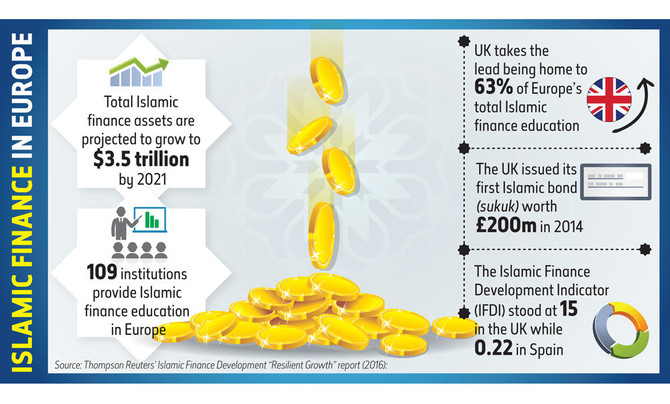

TFG heard from the Advisor on International Strategy of The City UK, ahead of the annual Islamic Finance Week conference. Islamic finance is a specialist area that presents exciting growth opportunities for UK-based financial and related professional services. The industry’s increasing importance for Islamic and other investors around the world is evidenced by its steady growth in recent years. Potential future growth prospects are robust, supported by global demographic trends.

Deepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global.

Islamic Finance is a specialist area that presents exciting growth opportunities for UK based financial and related professional services. The industry’s increasing importance for Islamic and other investors all around the world is evident by steady growth in recent years. Potential future growth prospects and robustly supported by global demographic trends, Sharia Islamic law, Sharia-compliant banking assets make up 6% of the world’s banking assets, but globally, approximately one in four people are Muslim. So the scope for growth in this sector is obvious. Today we’re at Islamic finance week, London. And we’re here with Wayne Evans from the City UK talking about Islamic finance. So Wayne thank you for joining us today at Islamic Finance Week London in no more than 30 seconds. Can you introduce yourself and tell us what you do at the City UK.

Wayne Evans: Thank you Deepesh. And thank you very much for asking me to speak to you today. The City UK is the leading membership body for the UK financial unrelated professional services industry that we have a very broad membership, including all the major banks, law firms, accounting firms, consultancies, and also people like the London Stock Exchange, and Lloyds of London. I was one of the founding directors but step back a bit recently. I’m now a Senior Advisor on International issues and lead on Islamic Finance.

DP: Thank you and we’ve really enjoyed your panel session that Islamic Finance Week London this week, which Trade Finance Global are delighted to support as media partners. So when what are the key proponents of Islamic Finance? And how does Sharia and products such as Sukuk and Takaful fit into this?

WE: Thank you Deepesh. And thank you very much for asking me to speak to you today. TheCityUK is the UK’s leading membership body for the financial and related professional services industry. I was one of the founding directors but have stepped back a bit. I am now a senior adviser on international issues and lead to Islamic Finance.

Islamic Finance vs. Conventional Finance

DP: Thank you, and we really enjoyed your panel session at Islamic Finance Week London this week, which Trade Finance Global are delighted to support as Media Partners. So, what are the key proponents of Islamic Finance and how does Shariah, and products such as Sukuk and Takaful fit into this?

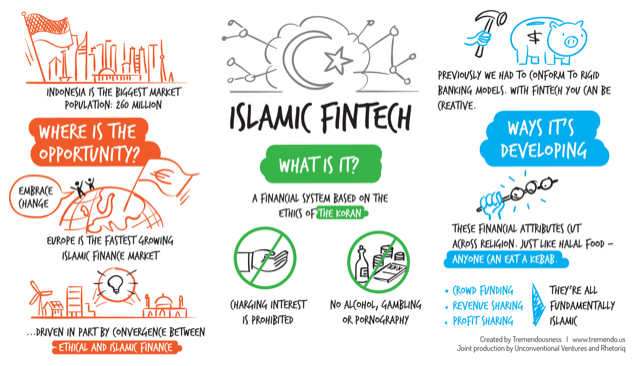

WE: The easiest answer and the one that most people think of is Islamic Finance forbids trade in certain products for example, alcohol, pork products, and gambling etc. plus of course that the earning of interest is forbidden.

But Islamic Finance goes much deeper than that. It is an ethical and responsible financial system that governs financial transactions and products. Increasingly it is being used to support the growing Halal economy. Central to Islamic finance is the fact that money itself has no intrinsic value. As a matter of faith, a Muslim cannot lend money to, or receive money from someone and expect to benefit – interest (known as Riba) is not allowed.

To make money from money is forbidden – wealth can only be generated through legitimate trade and investment in assets.

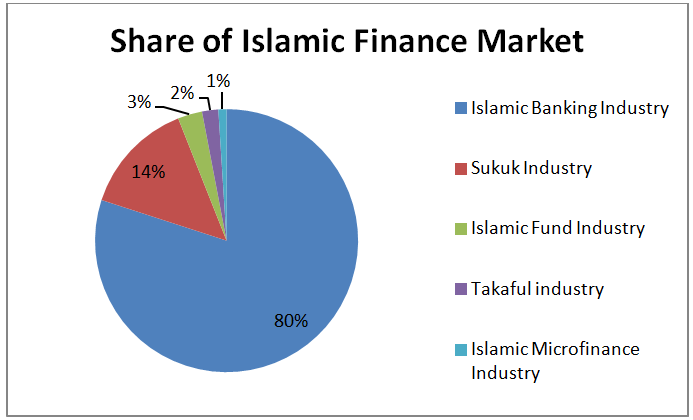

Broadly speaking Sukuk and Takaful are Islamic products which respectively in the conventional finance sector would be described as bonds and insurance.

However, they are different from their conventional equivalents. Sukuk is used to describe a financial certificate, equivalent to a conventional debt issuance such as a bond. But unlike conventional debt issuance, Sukuk holders are the legal and/or beneficial owners of the underlying assets, Takaful, is an Islamic alternative to conventional insurance. It provides mutual protection of assets and property. Takaful is very similar to the concept of mutual insurance where the members are the insurers as well as the insured.

Global Trends and Islamic Finance in the UK market

DP: So according to your recent report, Global Trends and Islamic Finance in the UK market, the global market for Shariah assets total some 2.4 trillion US dollars and 2017 seeing single-digit year on year growth. What is driving this growth and where are the global opportunities?

WE: You mentioned in your introduction, that approximately one in four of the global population are Muslims. This is a young and growing population. As this population grows and becomes more prosperous; Muslims wish to buy products that accord with their faith.

These might be financial products – loans, mortgages, investments, pensions etc. or physical products such as food, cosmetics, medicines and interestingly the growth of Islamic tourism. This is the basis for the growth of the halal economy.

Also, there is a shift in international investment priorities. We have been fortunate in that in the past there has been much investment from the GCC and other Islamic countries into the UK, these flows continue but there is a growing interest in using Islamic Finance products rather than conventional for investment.

Easy wins for global opportunities remain the GCC and Malaysia. Saudi Arabia’s ambitious 2030 plan is to reduce Saudi Arabia’s dependence on oil and diversify its economy. Much of the funding required for this plan will come from the use of Sukuk. Malaysia is the leading Islamic finance centre in South East Asia. Subscribers to pension plans in Malaysia have the option to use Sharia compliant pension schemes. These pension funds have to look for solid, long term investments that are also compliant.

At TheCityUK we are currently engaged with Uzbekistan and Kazakhstan, helping them develop their Islamic Finance infrastructure. We have close partnerships with Turkey and Malaysia. Indonesia, Pakistan and Iran have huge potential. There are developing markets across Africa from Casablanca to Cape Town. And I personally believe that one day India and China will have to address the needs of the Muslim populations.

The UK Islamic Finance Market

DP: The UK is one of the leading centres for Islamic Finance outside of the GCC. We have five fully Shariah-compliant banks and can see the use of Islamic finance through a number of large infrastructure projects both in London and major cities in the UK. Can you give us an overview of the UK Islamic finance market?

WE: We have a robust Islamic Finance market in the UK that has spun out of London’s role as the leading global financial sector. The UK offers one of the most attractive regulatory and tax systems for Islamic Finance anywhere in the world. Apart from the banks, you mention the depth and breadth of London’s capital markets provide access to a wide pool of investors and secondary market liquidity. Major global institutions such as the LSE and Lloyds of London have taken a keen interest in Islamic Finance. TheCityUK estimates that of the 200 international law firms based in the UK over 25 of these have teams working on Islamic Finance. All the leading accounting, consulting and professional services firms have Islamic Finance Departments.

We also have five professional services institutes and the UK offers 80 Islamic Finance courses making the UK one of the leading global providers of Islamic Finance, education, training and qualifications.

How are funds mobilised into contracts which are permissible by Sharia?

DP: The LSE is a key global venue for the issuance of Sukuk. As of the start of this year, over $53bn had been raised through 72 bond issuances. We also have 3 Sharia-compliant ETFs quoted on the LSE. How are funds mobilised into contracts which are permissible by Sharia? Is it just through Sukuk bonds?

WE: The LSE offers a broad range of Islamic finance products, reflecting their commitment to London being the largest western hub for Islamic Finance.

Within Capital Markets, global Sukuk issuances are a prominent asset class and make up a significant proportion of the Islamic Finance Industry. In terms of listing developments, the UK Listing Authority has a worldwide reputation as a fair, effective and efficient regulator. A London listing guarantees investor diversification for Sukuk issuers.

Important players in the Islamic Finance industry, like the Islamic Development Bank and the Islamic Corporation for the Development of the Private Sector continue to list on the LSE’s markets, highlighting their position as a leading platform for landmark Sukuk transactions.

In addition, the London Stock Exchange’s International Securities Market, offer key derogations that enable a convenient Sukuk listing process.

The LSE has recently acquired the Sukuk benchmark index, which is one of the most widely used Sukuk indices amongst investors.

The Sukuk Index measures the performance of global Islamic fixed income securities – The index includes US Dollar-denominated, investment-grade Sukuk that are Sharia-compliant and issued in the global markets. Quite a few Sukuk included in the Index are listed on London Stock Exchange’s Fixed Income markets e.g. Islamic Development Bank.

Sukuk issuances have been successful, and oftentimes oversubscribed, but liquidity in the secondary market still remains low due to supply constraints. As secondary market trading increases with more supply, a dedicated Sukuk based ETF could be the next step for the market.

Green Sukuk and Islamic Finance Fintechs

DP: Let’s talk about Green Sukuk, which represents the intersection of green finance and Islamic finance. What is this, and how is it being used to fund environmentally-friendly projects? What are the similarities between green finance and Islamic finance?

WE: In the last few years, environmental awareness amongst Muslim authorities and Islamic organisations has been rising. They increasingly recognise and articulate an Islamic environmental ethic and actively seek to mitigate environmental problems such as climate change, pollution, degradation or natural disasters. If you accept the premise that Islamic finance is a more ethical financial system then green products are a natural fit. Islam, like Christianity and Judaism, proclaims the importance of humanity’s stewardship over nature. Indonesia and Malaysia have been key issuers of Green Sukuk.

In the last few years, environmental awareness amongst Muslim authorities and Islamic organisations has been rising.

Wayne Evans, TheCityUK

Green Sukuk are simply Shariah-compliant investment vehicles that fund environmentally friendly projects. The projects themselves wind farms, solar parks, biogas etc are no different from conventionally funded projects. But as with all green projects, there is a question on how green they actually are. There is no point in destroying a natural habitat simply to produce more palm oil.

DP: Thank you. Now let’s move on to FinTech in Islamic finance. We see a lot of hype in the UK around some of the newer Islamic FinTech firms, such as Wahed Invest and HelloGold. TFG are delighted to be media partners of the European FinTech huddle this week, by Islamic Finance News. The UK is also well positioned in the market as a FinTech hub, tell me more about some of the recent global developments, and opportunities for Islamic FinTechs here in the UK.

WE: The UK is well-positioned for Islamic Finance Fintech, one survey, I think by IFN, placed the UK second after Malaysia when ranked by the number of active companies.

In 2017 the UK Regulator authorised Yielders our first Sharia complaint, crowdfunding, investment company and since then we have seen a number of new companies coming to the market.

Personally, I do not really see the need to make a distinction between Islamic and conventional fintech. Fintech is fintech.

However, from a Fintech perspective, the opportunity in Islamic Finance continues to grow. The real potential is that Fintech will enable Islamic finance to attract more customers, increase efficiency, reduce costs and offer a wider range of products, helping the sector become more competitive against conventional finance.

Financial inclusion in the Organisation of Islamic Cooperation (OIC) member states lags global norms. Expanding sharia-compliant financial services through fintech will improve financial inclusion.

High transaction costs make it uneconomical for Islamic banks to offer fully-fledged bank accounts to low-income groups, which make up a large part of the population in most developing countries.

High mobile phone penetration across the Muslim world will enable fintech to attract new customers through digital channels, allowing for money transfers, micro-credit and bill and goods payments – vastly lower than a normal bank account. Successful deployment of blockchain-based Fintech solutions by Islamic banks would greatly expand the number of SMEs that could be financed.

Opportunities in the Islamic Finance Sector

DP: Taking a forward-looking view now on the rest of 2019 and beyond, what are two or three opportunities you see within the UK for the Islamic finance sector, and it would be remiss of me to not bring up Brexit into the mix?

First, I hope we will see a growth in the UK Islamic Finance retail sector. Muslims in the UK are underserved not just in banking but in other sectors such as pensions, insurance and student loans..

Second, by the end of 2019 we will hopefully see the Bank of England’s liquidity provision in place and have details of the second Sovereign Sukuk. These will help to boost the UK Islamic Finance Sector – related to this the UK, like the rest of the world has a need for funding for infrastructure projects. This funding could come from Sukuk or other Sharia compliant commodity trade finance products. I also see the use of Takaful to support major projects being more commonplace.

On Brexit Government policy will be to open up the UK to new markets to look for new trade partners. Our expertise in Islamic Finance and our openness to Islamic investment will be an asset as we seek to grow trade with our partners in the Islamic world.