As we celebrate our 20th podcast of Trade Finance Talks, we’re doing something very special. It’s TFG’s first-ever Podcast Takeover, and we welcomed Michael Bickers, Editorial Director of BCR Publishing, who Trade Finance Global have partnered with for the BCR Supply Chain Finance Summit APAC on the 15th and 16th of October in Singapore. Michael speaks to Jolyon Ellwood-Russell, Partner, Financial Markets at Simmons & Simmons, based in Hong Kong. The topic is around Supply Chain Finance (SCF) programmes in Asia, how they’re changing, and what corporate treasurers, transaction banking teams and service providers could be thinking about when it comes to SCF.

Season 1, Episode 20

Host: Deepesh Patel, Editor, Trade Finance Global

Michael Bickers, Editorial Director, BCR Publishing

Featuring: Jolyon Elwood-Russell, Partner, Simmons & Simmons

Subscribe to Trade Finance Talks

Trade Finance Talks RSS FeedDeepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global. Today we’re celebrating our 20th Trade Finance Talks podcast, and we’re doing something very special. It’s our first ever Podcast Takeover, and I’m delighted to have Michael Bickers, Editorial Director of BCR Publishing, who Trade Finance Global has partnered with for the BCR Supply Chain Finance Summit APAC on the 15th and 16th of October in Singapore. Michael, thank you for coming!

Michael Bickers: I’m delighted to be here.

DP: Michael, I’m handing the microphone over to you now, so I will leave it with you to introduce our topic for today. Over to you!

Transaction Banking and Supply Chain Finance: Silent Powerhouses of Revenue

MB: Thank you Deepesh. Well, today’s topic is going to be around Supply Chain Finance programmes in Asia, how they’re changing and what corporate treasurers, transaction banking teams, and service providers could be thinking about when it comes to Supply Chain Finance. Thanks to technology, transaction banking is going through a revolution across Asia, particularly within the Supply Chain Finance space. We have talked about digitisation within receivables finance a lot in BCR and TRF news pieces and, as the world moves away from traditional instruments like the Letter of Credit and towards Open Account trade, banks are increasingly funding suppliers of large corporates via dedicated Supply Chain Finance programmes. So, I’m delighted to welcome our guest today, who is Jolyo

n Elwood-Russell, a partner of financial markets at Simmons & Simmons law firm, based in Hong Kong.

Jolyon is a finance lawyer with a wide variety of experience in banking and finance transactions, and, in particular, is a specialist in trade, receivables and commodity finance. He’s also going to be a keynote speaker at our forthcoming BCR Supply Chain Finance conference in October on the 15th and 16th of the month. So hopefully, Jolyon is there in Hong Kong. Jolyon, are you receiving me?

Find out more here

Jolyon Elwood-Russell: Absolutely, and delighted to be here, thank you very much.

MB: Welcome. OK Jolyon to start, can you tell us a bit about yourself and what you do at Simmons & Simmons?

JER: Sure. Well, first of all, I’m a partner at the law firm Simmons & Simmons. We specialise in finance and dealing with financial institutions and other finance-related entities, or even just companies that are trying to deal with their own finance.

My particular specialism, as you said, was in trade and receivables and supply chain finance. As you mentioned, I’m based in Asia, so my predominant focus is on the Asian market. I cover anything from helping companies raise money to chasing them when they don’t pay, or occasionally investigating; sometimes trade-based money laundering issues when they arise in the supply chain and also advising banks (and some of the new alternative debt providers) on how to establish supply chain programmes. The best fits for either their customer client base or for corporates to help them think about what is a good supply chain solution.

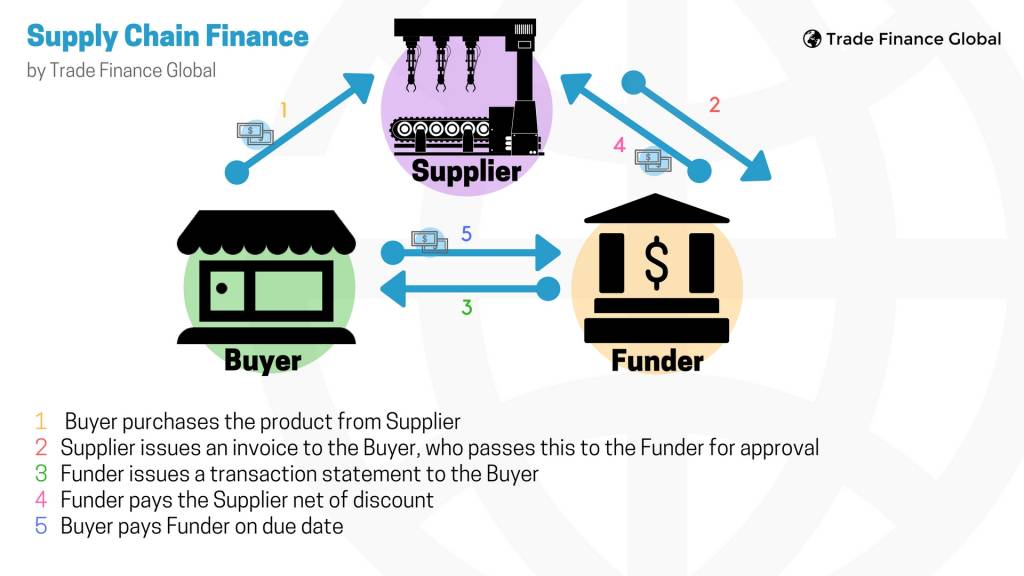

MB: OK, so for the benefit of our listeners, let’s be clear about what you mean by supply chain finance, because there are and have been various definitions and interpretations of that term. So, for the purposes of this podcast, we’re going to say supply chain finance is what is also known as supplier finance or approved payables finance, or reverse factoring, which I think is the way it’s commonly used by banks, in terms of their supply chain finance operations. So we’re focusing on just one link in the long supply chain, between the supplier and the purchaser.

The Definition of Supply Chain Finance

JER: Yes, well, I think the fact that you’ve just described what supply chain finance can mean in three or four different ways, probably shows the degree of confusion in what we’re dealing with, and what we’re talking about. So, to try and break it down a little bit and try and simplify it, all companies have supply chains; you always have buyers, and you always have sellers.

So if you have a buyer in the UK, say a strong buyer like Tesco, they often dictate their own terms. They might require suppliers to give them trade credit, or not be obliged to pay their invoices in a set period, so they’ll be some for 90 days or even 120 days. Then if you think that Tesco sources from around the world – and often its sellers are based in Asia – they’re making umbrellas for example, or the latest trends…in this part of the world it is difficult to get capital. So they are forced to give credit to the buyer, so you’ve got this sort of big mismatch between what the buyer is asking for and what the seller can match or be able to give.

So, what supply chain finance tries to do is bridge this gap or this problem to try and create a win-win situation for the buyer, where they continue to get their 90 days credit. So at the same time as offering to pay the seller early, they can make sure they deliver to the buyer exactly what was agreed without running into working capital problems, for example. So it aims to try and optimise the flow of money through the supply chain and between buyers and sellers. So banks and the financier will come in and look at that trade flow; they want to understand a customer’s portfolio, and they’ll pay those suppliers early because the banks or financiers will be looking at suppliers who wouldn’t normally be their customers. For instance, I was talking about Tesco, whose big banks will not have access to lots of different suppliers here in Asia. They wouldn’t even think about financing any of these small or medium enterprises, but supply chain finance can offer that by looking at the customer base of the big buyer for example, and then offering them finance. So the buyer’s happy because they’ve got their credit and they know the seller will perform. The seller’s happy because they’re being paid early, and the financier made a fee and maintains that relationship with his buyer whilst relying on the credit of the buyer at the same time as being able to finance a new supplier, for example, in a different part of the world.

Is Supply Chain Finance a Win-Win Situation?

MB: So just to sum that up, the buyer gets to pay later, has longer payment terms; the supplier gets paid earlier, but has to pay some finance charges to the bank (but the advantage to the supplier is that he’s paying finance charges based on the credit rating of the large buyer, so he gets finance cheaper); and the bank wins some business. So is it genuinely a win-win situation? Does nobody lose out? Does it really benefit all three parties?

JER: Absolutely. I’m a great believer in it. We’re looking at the buyer’s profile and its obligations – it’s going to pay those suppliers anyway. It’s just using its banking relationship to do that. There’s no real danger for the financier because the buyer’s going to pay for it anyway. If the purchaser has accepted the invoice and the goods – there’s not going to be much risk of any dispute in relation to the quality because they’ve accepted it. So that’s why we call it a win-win situation.

MB: So I’m going to drill down a bit more and focus on Asia, Jolyon. But just a quick question on that tripartite relationship: the supplier is a little bit reliant on the buyer approving the payment, so if there’s any delay and approval of payment, then that’s going to affect the supplier’s ability to draw down finance. Is that an issue which comes up?

JER: Perhaps. Since the beginning of time, people sometimes don’t want to pay on time – that’s inevitable. But I think – and I will talk about this a bit later – is what we’re seeing, certainly here in Asia, is the development and visibility through various technology platforms. They’re really facilitating the ability to give approval and for everyone to see the whole flow.

The Digitalisation of the Supply Chain Finance Industry

MB: Is the process automated to an extent?

JER: Yes, absolutely and it’s getting even more automated. Some of these banks have incredible technology platforms that the treasurer can use to click a button and the money just flows through. At the same time, you’ve got new players coming in who are using various bits of technology, with their own FinTech and blockchain solutions, which help the whole ‘smart contract’. So when goods are delivered at a certain point and they are approved, it triggers a chain reaction so that the suppliers get paid early.

Want to find out more?

Trade Finance Global have partnered with East & Partners and the ICC United Kingdom to bring you a free whitepaper on the UK China trade corridor and opportunities for Supply Chain Finance in 2019. Including the latest trade data from Coriolis and customer research from corporates around Europe and China, you can read the full whitepaper for free here

APAC Region and developments in Supply Chain Finance

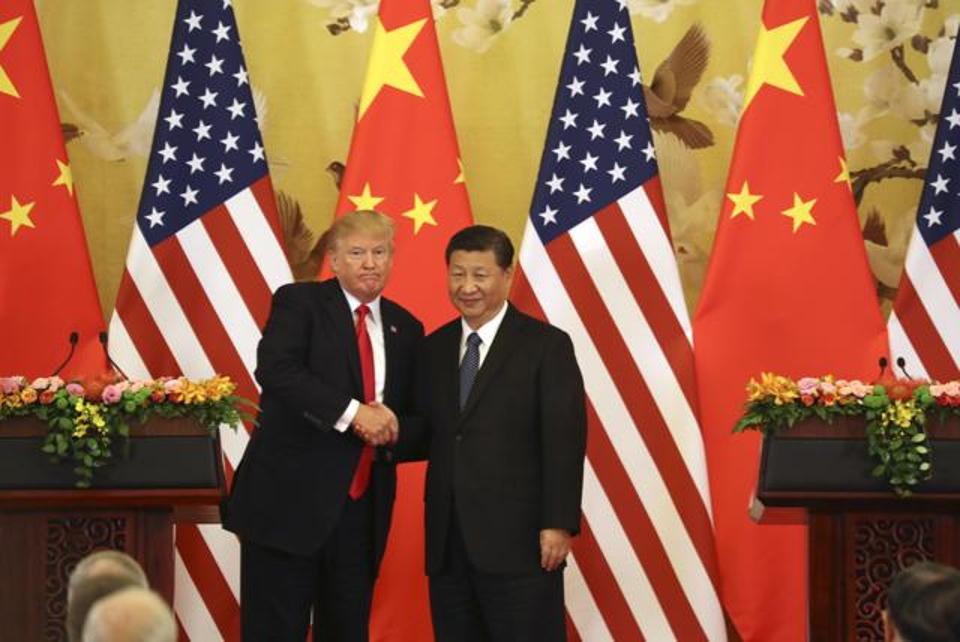

MB: Let’s let’s look at the APAC region a bit more closely. Globally, we’ve seen monetary policy easing and low-interest rates, with fairly strong growth in many parts of Asia – though some of this has been offset to an extent with the slowdown in China’s growth. We’ve also seen the world order change significantly with the US-China trade war, and various other geopolitical uncertainties hitting the headlines pretty much every day. So how do you see the APAC region in terms of its development in supply chain finance, especially bearing in mind the wider political scene at the moment?

JER: Of course, macro factors will inevitably have a long-term effect, but I always like to see things from a glass half full perspective; I like to think Asia is a very dynamic jurisdiction and tends to adapt very quickly. It still has a long way to go, but then life has always been difficult in Asia. But from a pure supply chain finance focus, I guess there are bound to be difficulties along the supply chain. Capital controls in China mean that for buyers in China, it’s difficult to get paid because you’ve got various capital controls and restrictions, which means life is not as straightforward.

So, all of these factors do impact supply chains, but in things like trapped cash and paying on time, none of these issues is really new. Tariffs, for example, wherever you are in the world, are not new. For people who work in trade finance, they are used to dealing between different jurisdictions, so none of the issues is new, they are just heightened at present. In the last few years, in Europe and the US, that has been a very homogenous jurisdiction, whereas Asia is a collection of many different countries with different approaches. But, again, I think it’s dynamic and Asia will definitely deal with it.

MB: So Jolyon, what do you see as the role of the financial institutions and banks in this market? Are they putting a lot of effort and energy into developing supply chain finance in the region?

JER: Yes, mixing those two questions up about the macro effect and how banks are reacting, I think, interestingly, for supply chain finance, it is becoming an increasingly important product in any bank or financial institutions’ armoury, because the traditional credit markets are either shut or too volatile and it’s not as easy to get financing. So being able to rely, as you said earlier on, on the credit of the buyer, means that as a way to raise capital, it’s still very healthy. If you look at the world and the large supply chain programmes, we’re still buying lots of technology, we’re still buying our mobile phones, our HPs, our computers and currently, a lot of these big manufacturers are the ones who are driving these big supply chain programmes.

The Cross-Selling Business between Corporates and Financial Institutions

MB: Okay, just to stop it there for a second Jolyon, I’m going to cut in with a question about the reason the banks are in this space, because in the West, as you probably know, in Europe, the margins are very fine in supply chain finance structures for banks, so they’re making quite a small profit out of these structures. A lot of banks are in this space in order to secure and develop their relationships with these large companies and corporations, so there’s an element of cross-selling being part of their overall picture for delivering these structures to corporates. Is there any similarity in Asia in the way that is managed and delivered?

JER: Certainly, to an extent. That’s absolutely right, in terms of wanting to try and develop the continuing cross-sell and the relationship of the buyer. But also, I think certainly in Asia, with trade wars, the factories and suppliers are very nimble and can move very quickly. So banks want to maintain their relationship with the buyers, because they know the supply routes that have been in place for the last 15 to 20 years are going to move on account of the macro situations. If they want to continue having a good relationship with a big buyer, those banks realise that, as a product, it’s a good way to maintain their relationships, especially in terms of a world where the number of suppliers can change very quickly.

SCF in FinTechs and Alternative Financiers

MB: Okay, and in terms of actually winning that kind of business Jolyon, what is the situation with competition from alternative financiers and maybe FinTechs? Perhaps even competition from other banks, is this a threat to regional banks?

JER: I don’t know if it’s a threat to regional banks because I think we work more with some of the alternative debt providers at the moment and that is a really exciting space. They are definitely coexisting; the alternative debt providers and debt funds are doing their own supply chain programmes, and looking at some of the risks of the banks. Certainly, in Asia, a lot of the regional banks have always been real estate or LTV-backed, as opposed to cash flows and trade flows. So they don’t tend to move away from that sort of model very quickly, whereas a lot of the alternative financiers and supply chain providers are more nimble; they can look at and understand the supply chain and say ‘we’re willing to take that risk on and supply those particular borrowers’.

MB: In terms of what the alternative financiers can do with the financing supply chain – compared to what the banks are doing – is it their ability to finance the long tail of suppliers, whereas the banks might be focused more on the larger SMEs in the supply chain?

JER: To an extent, I think that’s possibly right. The banks are very good, they’ve got a balance sheet, they know how to buy receivables, they can assess all of the risks, they are good at payment processing and they have always been the traditional home or supply chain finance. However, they are constrained certainly – they’ve received a lot of criticism in Europe, whereas alternative debt providers can be more nimble. They are more focused and less institutionalised; they can focus on the entire supply chain of a particular corporate.

MB: They’re not restricted by Basel regulations – perhaps that is a big advantage, right?

JER: Exactly.

MB: And the banks don’t want high-risk, small SME receivable debts on their boundaries?

JER: That’s right, yes.

Regulation and the Government

MB: OK. So let’s move on to regulation and governments. Do you think there is sufficient support from governments in helping the development of supply chain finance in the region? I know, from my own experience, that China has been very supportive of the development of supply chain finance, but I’m not sure what the situation is beyond China, in the APAC region. What’s your view on that?

JER: Again, in the same way that banks have traditionally lent with some element of real estate attached to it, or some sort of corporate lend or LTV ratio, there is less understanding by governments of supply chain financing. What governments are very good at here is actually looking at, or trying to protect against, some of the problems in trade-based money laundering in relation to double invoicing. That’s the main priority in terms of trade, supply chain finance and trade finances – governments trying to come up with solutions and provide better deterrents around fraud.

SCF in Asia Pacific

MB: But that’s a short-term priority really, in terms of looking at money laundering. But if you look at the longer term and the bigger picture, particularly with SME finance, I think most economies recognise SMEs as being extremely important to the economy of countries. But despite that, people still don’t seem to be giving them enough support, in my view, and I’ve particularly seen this in Europe – they don’t seem to recognise the importance of receivables financing and supply chain finance. Would you say that’s the case in the APAC region?

JER: Yes, I think that’s right, in terms of governments. But again, it’s not so impacted on the governments, that’s not a real priority. Having said that, I think that if there is enthusiasm for some of the new programmes – you mentioned China in terms of the technology platforms that allow us some of the receivables purchasing arrangements, which is trying to get greater liquidity into receivables. That’s getting a lot of interest by both governments and FinTechs – and when you think there’s so much support with companies like Alibaba and Tencent (and we’ve got all of these huge logistics providers and producers that have so many contracts with suppliers), then it’s those ones rather than governments. In China, there’s a lot of government influence that is trying to drive and come up with new platforms and financing methods which are very similar to supply chain finance, and that is really being taken note of in Asia. I think that when Alibaba and Tencent come up with these new platforms then people do take note. I think that is what we really are starting to see here, how these technologies act as drivers.

Sustainability and Supply Chain Finance

MB: Right, OK. Let’s move forward a bit now and look at the short-term future. I’m going to put you on the spot Jolyon – if you were talking to a bank or corporate treasurer, what sort of advice, let’s say, what three pieces of advice would you give to a bank or a corporate treasurer, in terms of what they should be watching out for in supply chain finance?

JER: Well this is something I do every day. One key thing – and certainly out here in Asia – is actually sustainability, and people are saying, well, what’s that got to do with supply chain finance? But this is actually the thing that I get really excited about, because despite the macro changes in the world, in terms of trade wars and downturns, there is more and more focus by customers to understand where the financing of their goods come from. Sustainability, I think, is absolutely key. I keep saying this to treasurers and banks, because sustainability in supply chains is where there can be a real behavioural change and that is what is really exciting. Because if you’ve got a normal supply chain programme, and we say this to treasurers, tell your sourcing and your procurement team, make sure that when you get your suppliers, try and get their ESG rating from them because then what you can do is take all that data and put it in a sustainable table. You can then take that to the bank and say I want cheaper finance because I’ve ranked all the suppliers and I’m going to make a behavioural change, so you should give me cheap financing for it and be ready to credit.

The banks are really trying to incentivise big customers to do better things. I think that’s certainly one area we’re going to see a major shift in. So corporates need to get better data and banks need to think about what their sustainability objectives are, because that’s what customers are looking for at the moment.

MB: Sustainability is a word that seems to be creeping into all aspects of business life at the moment. Do you see a lot of potential for growth in the APAC region for supply chain finance? Do you really see this moving forward in the coming years?

JER: I do, yes. I know we’ve been talking about supply chain finance in Asia, but it’s always been about the institutional banks. I think that, with FinTechs and data becoming so important, there will be more visibility and certainty, which is what has traditionally been lacking in Asia, because the standard of financial accounting is less homogenised. But you can now track where all the buyers and sellers and routes are in real-time – that data is far more valuable than a bank’s credit rating on an SME. So I do see a dramatic increase in where the supply chain is, but it won’t be the same form as it’s always been. It will be from alternative providers and massive logistics providers in China. It will just take a different form I think.

MB: So watch this space, I suppose! It looks like the future is bright for supply chain finance and we’ll see the sector evolving quite a lot in the short- to medium-term. Well, we’re out of time now Jolyon, thanks so much for your time today. We’re looking forward to seeing you in Singapore in October at the BCR conference. Thanks very much.

JER: Thank you very much.