The International Chamber of Commerce (ICC) Banking Commission has released its 2017 Trade Register report—Global Risks in Trade Finance. The report reveals the low-risk nature of transactions that support global trade, and confirms that trade finance products continue to present banks with low levels of credit risk.

The 2017 report, produced with support from ICC’s project partners – The Boston Consulting Group and Global Credit Data – draws on information from 22 member banks to present a global view of the credit risk profiles of trade and export finance transactions.

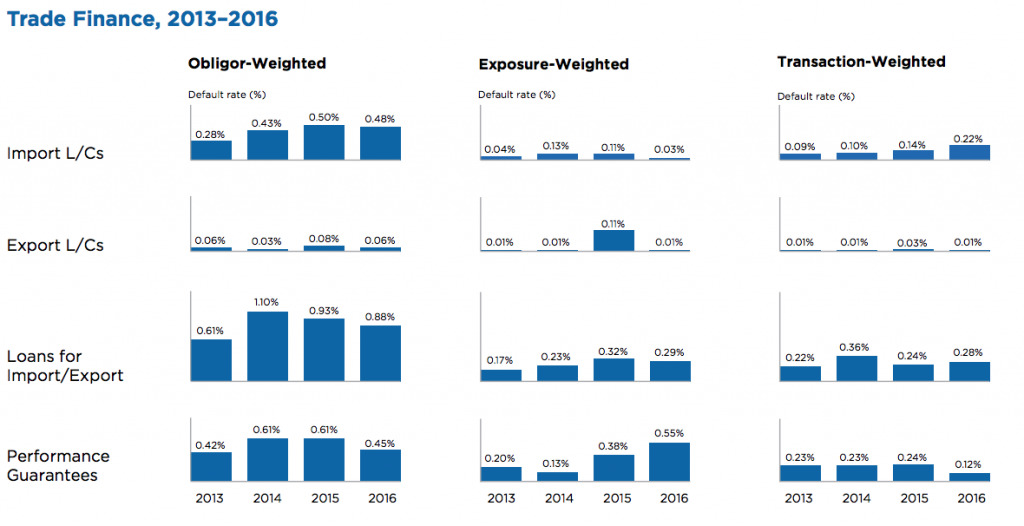

It is based on over US$10.5 trillion of exposures and more than 20 million trade finance transactions from 2008 to 2016. The trade finance products in the register are Import Letters of Credit (L/Cs), Export L/Cs, Loans for Import/Export, and Performance Guarantees, and the 2016 Trade Finance data set includes approximately 40% of global traditional Trade Finance flows, excluding Loans for Import/Export.

The latest trade finance findings reveal that the expected loss of trade finance products continues to compare favourably against other similar asset classes such as large corporate and small/medium enterprise lending. Obligor-weighted default rates from 2008 to 2016 are low across all products and all regions, at 0.38% for import L/Cs, 0.05% for export L/Cs, 0.80% for loans for import/export, and 0.47% for performance guarantees. This is coupled with short times to recovery and relatively similar loss given default rates to comparable asset classes.

Figure 1: Summary of Default Rate Trends. Source: ICC Trade Register 2017.

Export finance also presents a very low risk for banks, with low expected losses deriving from a combination of low loss given defaults (LGDs) and probability of defaults (PD). Export finance’s particularly low LGD is partly because most transactions are covered by OECD government-backed ECAs at approximately 95% of their value, minimising the sum a bank may need to pay out. In 2016, export finance saw a slight increase in expected losses driven by small growth in annual default rates, consistent across all asset categories except financial institutions.

The Trade Register provides critical information for banks about trade finance modelling and presents a strong case for the appropriate treatment of trade finance as an asset class by regulators. The low loss rates presented provide an important input into modelling for the recently introduced IFRS 9 accounting rules, which require timely recognition of credit losses.

Figure 2: IFRS 9 Impairment Provision modelling stages – Banks are required to build models of future impairment and to regularly re-appraise their loan portfolios to make sure that every asset is placed within the correct stage or bucket

ICC has also identified opportunities to improve and evolve the project, such as enhancing data quality and methodology, and further aligning data quality with regulatory practice. ICC plans to include supply chain finance on a trial-basis for 2018 to reflect its increased global usage. Export finance analysis could also be expanded to transactions covered by non-OECD ECAs and—on a longer-term basis—the project has had interest from the private insurance market to include insurance data.

Download the Report here.