Estimated reading time: 15 minutes

Blockchain technology has been described as a game-changer in trade finance for its capacity to digitize the most complicated sector. But legal challenges hamper the transformation process, as current outdated laws in most countries and jurisdictions do not recognize the digital version of the negotiable instruments.

Negotiable instrument explained

A document containing a payment order or undertaking is a negotiable instrument, given that:

- It is capable of being transferred from one holder to another by delivery (or endorsement and delivery) so that the holder of the instrument may sue on it in his name. If the instrument is payable to a bearer, it may be transferred by delivery to the transferee. If the instrument is payable to a specified payee or his order, it must be endorsed (that is, signed on the back by the transferor) and delivered to the transferee.

- It gives the bona fide purchaser for value legal title to the instrument free from any equities or defects of title of the transferor and any other prior holder of the instrument, as long as the purchaser had no notice of any such equity or defect in the title before the transfer being made.

There are three types of negotiable instruments, bill of exchange, promissory notes, and checks. Bill of exchange & promissory notes are the most widely used in trade transactions.

Significance of negotiable instruments

To enter new markets and compete with other suppliers, exporters take the risk of selling and shipping goods on an open-account basis against buyers’ accepted bills of exchange or other negotiable instruments.

Selling goods on an open account basis imposes a burden on the working capital of the exporter and leads its liquidity to a shortage. Exporters, therefore, use these receivables to secure immediate funding from their financing providers using Receivable Finance techniques.

The same applied to importers wanting to extend their payable tenors to establish a good relationship with their suppliers at the most attractive rates to get finance on their payables.

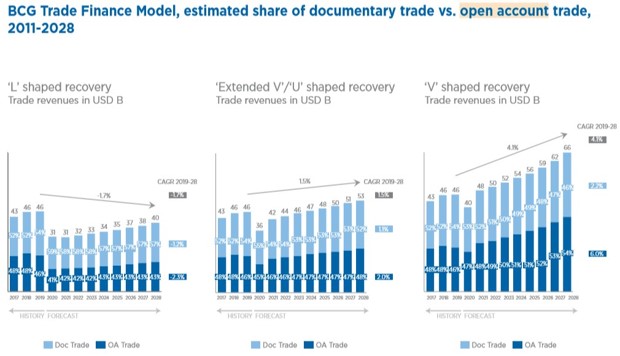

About 80% of the export trade finance business and long term growth expectations are driven by open account transactions, forcing banks to provide fully digitized solutions as well as cost savings combined with payment assurance and financing options.

According to the ICC Trade Register Report, open account trading generates revenues of around $21 billion, representing 46 percent of total trade finance revenues, compared to 42 percent five years ago, with expectations of 2 percent growth per year, taking into consideration that there is a short shift towards documentary trade (collections & LCs) as a result of COVID19. It’s expected that documentary trade to jump from 54% of the total in 2019 to 59% in 2020. For the best scenario, an absolute decline in trade finance revenues may fall from USD 46 billion in 2019 to USD 40 billion this year.

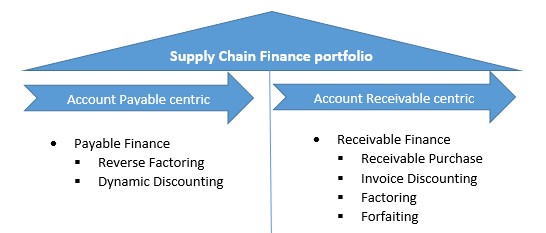

The application of the new technology helped to promote the rapid adoption of SCF by making it more operationally viable and thus scalable. As such, technology is used to minimize operational costs, and efforts.

Supply Chain Finance techniques work on both sides “the importer on his payables leg & the suppliers on his receivables leg”

Current Legal Implications

Negotiable instruments are well-established antiquated tools that have been invented to facilitate trade between parties instead of carrying money. Therefore, the laws and regulations were compatible with the market needs at that era, for instance, the English bills of exchange act was issued in 1882 which is considered a reference for the majority of many jurisdictions till now. That’s why efforts should be targeting it to have expedited and expanded effect.

The majority of laws across different jurisdictions require the negotiable instruments to be signed in writing form, moreover, to be physically on a paper form. Moreover, the electronic signature is not recognized in many jurisdictions.

Any disputes will encounter the digital form of negotiable instrument won’t have any legal backbone to protect participants, that’s why, it is not an option to update the legal framework clearing up the legal uncertainty status, and encouraging financial institutions to grasp the benefits of the new technology and paving the way for achieving the ultimate goal of digitizing trade finance documents and processes.

The problem is that changing laws across the globe requires a lot of time and sincere efforts that have to get aligned to expedite the reforming process of the legal framework.

Using a rule guide for the use of electronic negotiable instruments between participants as governing rules like UCP for LCs without changing the current law won’t give full protection in case any dispute raised, as rules are not codes and courts will always refer back to the law.

It is complicated to force all participant to use blockchain technology or other digital networks, one of the main characteristics of a negotiable instrument that it could be transferred by delivery to any sub holder who may don’t use a digital platform.

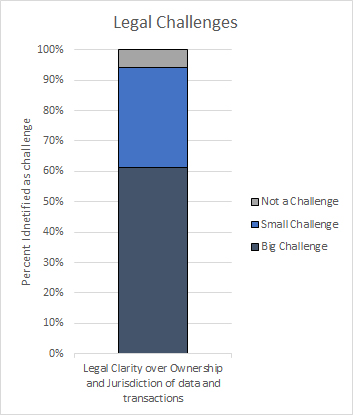

According to the ICC, TFG, and WTO survey on DLT in trade, legal clarity over ownership and jurisdiction of data and transactions is a significant challenge. By implementing rights for certain nodes to retroactively edit the contents of blocks will raise break the main features of DLT and will be less secure than the other centralized database it seeks to replace.

Market response

Market players are pulling together their efforts to set the Standards for trade digitization and develop new technological solutions that overcome the legal barriers, let’s have a glimpse on the market response and who are the key players in the market.

The Digital Trade Standards Initiative “DSI”

The International Chamber of Commerce ICC after setting a road map for digitizing trade finance has launched the DSI to benefit from what already have done by other initiatives and collaborate with stakeholders in the standardization of data formats and processes and facilitate interoperability between other platforms, rather than duplicating existing efforts.

The adoption of the (UNCITRAL) Model Law on Electronic Transferable Records.

The ICC encouraged lawmakers and governments to adopt the model and use its provisions that don’t differentiate between the manual and electronic form of transferable records as long as they are functionally equal and by applying the standards for verifying the electronic signature and other security aspects will expedite the trade process, and cover the legal concerns.

ITFA Digital Negotiable Instruments (DNI) Initiative

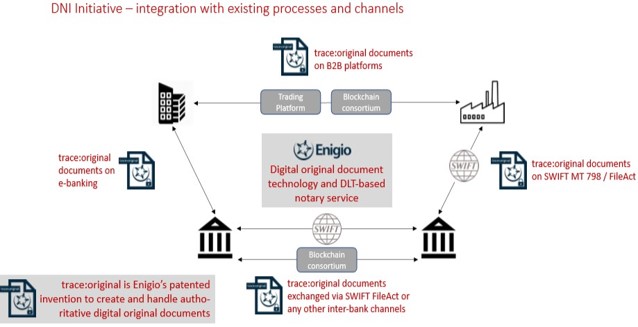

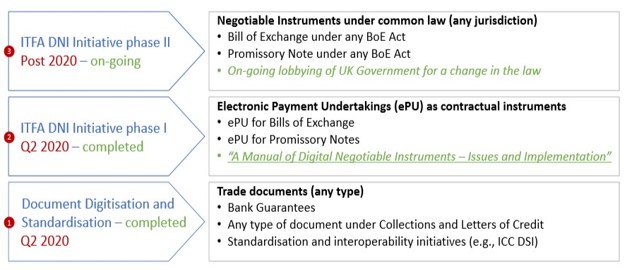

The International Trade and Forfaiting Association cooperates with Enigio using the DLT technology combined with electronic signature and data management technology to provide a fully digital version of bill of exchange and promissory note that have the same attributes of the traditional paper version by identifying the legal options, market use cases, and documents tags in liaising with English law-makers and the ICC in the UK to align the law with technology.

Andre Casterman, Managing Director, Casterman Advisory and Chair Fintech Committee, ITFA said, “The move to digital trade finance needs to be mandated, not just enabled.”

Innovations in trade finance instruments are targeting specific segments and clients. To be relevant, they need to be highly specialized and digital. New entrants such as fin-tech platforms and alternative lenders represent a target market for new instruments, as those players have no legacy to protect, are keen to act as pioneers, and win market share quickly. We witness this today in the SME financing space. However, to move the bulk of the market, regulatory intervention is needed to increase the digitization of trade flows and trade finance practices. We witnessed such a regulatory move in electronic invoicing which has become a common practice in many countries around the world.

Electronic Payment Undertaking” ePU”

As an interim solution, the initiative has proposed to create a functional equal version of negotiable instruments under the English bill of exchange Act 1882. The solution represents a digitally irrevocable, unconditional, and independent payment undertaking that fulfills all requirements of a traditional negotiable instrument subject to contract law rather than common law.

Lars Hansen, Partner at Enigio Time AB said, “We are applying an evolutionary approach to the digitalization where paper and digital documents can be used in parallel in the same trade finance workflow”

As for the trace: original technology it is designed to cater to any document where original is required or practical. The solution creates a digital document with the same properties as its paper equivalent. The document is stored “of a chain” in the possession of the holder, it can be, delivered (endorsed) and the holder in due course can add text to the document but not change anything previously written. The trace original document is furthermore readable by both man and machine, it is freely transferable by the safe electronic messaging system, e.g. secure mail, SWIFT, or through a blockchain consortia such as Marco Polo, Contour, Komgo, etc. If you have access to the internet and a browser, you can possess and manage a trace: original document. You can think of the trace: the original solution as adding a new “digital printer” to your trade finance system. The first trade finance software supplier that has implemented the trace: original technology is China Systems.

Joel Schrevens, Global Solutions Director at China Systems said, “The first instrument we have implemented is a Digital Guarantee, which allows us to substitute a paper-based transaction with a fast and secure digital document exchange between the different Guarantee parties, using the same processing flows and capabilities defined for SWIFT and paper-based Guarantees. We can now reuse the framework to provide support for the ePU and replace the printing and physical exchange of other trade documents with a fully digital process, irrespective of business content, standard, or network.”

Digital Ledger Payment Commitment “DLPC” by BAFT

The Banking Association for Finance and Trade working with a group of 15 global banks published its technical and business best practices for a digital ledger payment commitment which has the features of trade finance instruments as payment undertake registered on DLT platform, the documents represent a guide or rule book that reflects the common best practices across the industry for a DLPC, to achieve the full digitization and interoperability between all DLT platforms and networks.

Samantha Pelosi, Senior Vice President, Payments and Innovation, BAFT “The industry is just beginning to implement distributed ledger platforms for trade finance and that BAFT will likely update the specifications periodically as advances are made”

Q: The Technical Best Practices and Business Best Practices were available for industry review, what are the main comments that have been received?

SP: Members of the industry provided few formal comments on the “best practices – proposed specifications for trial use” that BAFT published in April 2019. To obtain input, the working group members individually and proactively approached technology, banking, and legal experts involved in building various blockchain solutions for trade and trade finance. These conversations lead the working group to provide additional detail in, rather than to make substantive changes to, the original papers.

Q: What are your expectations about the DLPC’s market adoption?

SP: BAFT expects that the BAFT DLPC technical and business best practices will be widely adopted by the industry for all trade finance transactions leveraging a blockchain solution or platform because they meet the needs of the trade finance industry and facilitate the interoperation of the emergent technology”

Catalyst’s Factors

The COVID19 pandemic has emphasized the importance of the digitization trade finance documents and processes and release the legal obstacles. As a swift action, the ICC has urged governments to take swift measures to remove the legal restrictions on the use of electronic documents and amend the regulations to get aligned with the application of the new technology.

Tech developers have tackled most of the technical issues and are ready to provide a fully automated process, like Marco polo & Bolero.

Jacco De Jong, Global Head of Sales at Bolero International said, “The biggest challenge is to enable this change in a rather conservative trade finance business environment, this requires domain expertise and persistence”

Q: Bill of lading and bill of exchange are negotiable documents in terms of its ability to transfer the ownership from one holder to another, how did bolero pass the legal barriers and get the identification of the electronic version of BL?

JD: Allow me to take the first pass at explaining how we managed to get e-B/L working all around the world for over 2 decades now; It all starts with the Bolero dedicated Legal Framework, which we call the Rulebook. All the parties in the electronic chain of the e-B/L over Bolero have adopted this Rulebook which is subject to English Law. Next to that Bolero act also as a sort of notary by having a dedicated Title Registry functionality to ensure there can be no misunderstanding on authenticity, holder, transferring and pledging of e-B/L’s

Since all parties (e.g. carriers, corporates, and banks) agree to the same (Legal) rules and the title registry, you can use this structure all over the globe, regardless of the underlying Laws in the respective countries. In a way it is somewhat similar to having the ICC Rules for Letters of Credit (UCP600). L/C’s work around the globe because all parties know and stick to the rules.

The devil is in the detail, whereby one major detail is realizing the acceptance and adoption, which is a task we have been focusing on for over two decades now. It also requires an excellent user experience, that is why we are now rolling out our new platform named Galileo which put us ahead of that curve too.

The unfortunate COVID 19 crisis has a spin-off effect too, never before we have seen this much interest in e-B/L’s and e-presentations as we do now.

It’s a Marathon, Not a Race

Negotiable instruments play a vital role as a tool for facilitating trade and finance, therefore, the current paper-based negotiable instrument will not be replaced on the foreseen future, while the electronic form will get the legal recognition by time and both types will be used in parallel depending on the participant’s readiness and the applicable laws.

The change in law will come but, it needs sincere efforts of governments, lawmakers, and international bodies, changing efforts should be targeting the English Law and the G20 lawmakers to curtail the changing period and get an expanded and faster effect.

Technology will always be faster than law, and both are existing to serve and protect the people and businesses, therefore, lawmakers should keep an eye on the technology applications and set a mechanism to make sure that the regulations don’t consider as an obstacle against the business and people’s needs.

In my view, trade digitization and electronic documents will be the new-norm as a result of the COVID19 pandemic which will accelerate the transformation process and the way we are doing business won’t be the same as before.

Now launched! Summer Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out!

This summer 2020 edition, entitled ‘Coronavirus & The Fourth Industrial Revolution’, is available for free online, covering the latest in trade, export credit insurance, receivables and supply chain, with special features on fintech and digitisation.