Background to Factoring

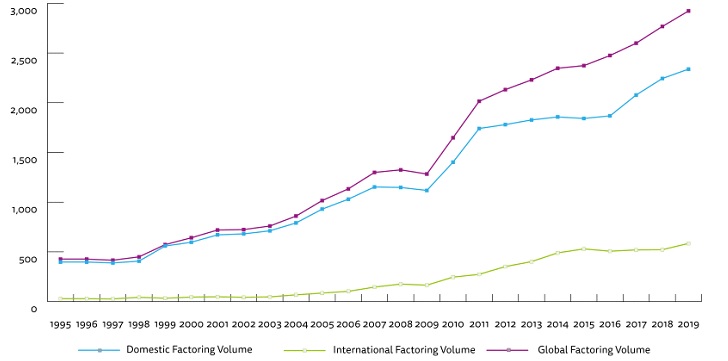

Factoring, as an important method to extend credit, is a type of financial transaction where the creditor assigns its receivables to an assignee at a discount. In recent years, there has been a large growth of factoring transactions around the world. According to an FCI Report, global factoring volume reached 2.9 trillion Euros in 2019, with new markets accounting for the highest growth in factoring volume, starting with the Middle East (12.4%), Africa (10.8%), and South America (8.9%).

At the same time, many emerging countries do not yet have proper laws to govern factoring transactions. When drafting a contract for the assignment of receivables, relevant parties would normally rely on general provisions in contract law as its legal basis. Consequentially, these practices result in frequent legal disputes regarding the creation, priority, and perfection of the assignment of receivables. In the absence of a solid legal framework for factoring, legislative loopholes and lacunae are incrementally remedied by a mixture of legislative interventions and judicial interpretations. However, a healthy and value-producing factoring industry is impossible to create without reshaping the legal apparatus and incorporating a comprehensive framework in national law. In this sense, joint efforts at both national and international level are urgently required to incorporate facilitative principles of law and directly introduce functional legislation in place to complement and support the advancement of factoring transactions.

Keeping such concerns in mind, the World Bank Group proposed a project to the UNIDROIT Governing Council with regard to the development of a Model Law on Factoring. This was subsequently approved by the UNIDROIT General Assembly as a high priority project at its 78th session in December 2019. It is envisaged that the Model Law will provide a set of black letter rules governing the creation, perfection, registration, and priority of an assignee’s right in a receivable. It will also include provisions on enforcement and choice-of-law, as well as rights and obligations of the parties and third-party obligors. Moreover, in the long term, each provision will be accompanied by a commentary in order to explain its operation and assist States to adjust and adapt based on their own needs.

Relationships with Existing Instruments

Over the past three decades, international private law organisations have adopted various uniform instruments in the area of receivable financing. One of the most recent undertakings in this regard was made by United Nations Commission on International Trade Law (UNCITRAL), a “sister” organisation of UNIDROIT. Adopted in 2016, the UNCITRAL Model Law on Secured Transactions (hereafter “UNCITRAL Model Law”) aims to provide a functional, integrated, and comprehensive approach to all types of transactions that fulfill security purposes, in all types of tangible and intangible movable property. It applies to receivables and provides a number of asset-specific rules for outright transfers and for security right relating to receivables. As the Model Law on Factoring is expected to be served as an instrument for States that want to introduce a new factoring law or update their existing laws, it is essential that the Model Law on Factoring is consistent with UNCITRAL Model Law. Therefore, States who implemented the Model Law on Factoring could have the possibility to undertake a comprehensive secured transactions law reform according to the UNCITRAL Model Law at a later stage.

Model Law in the Making

Up until now, two sessions of the Factoring Model Law Working Group have taken place where various legal aspects of factoring have been thoroughly considered and discussed by legal experts and professionals in the factoring industry. Final decisions have not yet been made regarding some aspects of the scope of the instrument. However, considering the very nature of a model law to provide practical solutions for heterogeneous national legislations, and the variety of forms which factoring has assumed in practice in different parts of the world, a wide application is being considered so as not to hinder the expansion of activities which already are, or may be, regarded as factoring.

During the Working Group meetings, many experts have indicated that governments might be unwilling to adopt law reform for receivable financing unless it is ascertained that the types of factoring arrangements practiced in their jurisdiction could be covered by the law. Hence, the Factoring Model Law Working Group is working towards a pragmatic yet flexible approach to capture the intricacies of factoring transactions while maintaining legal accuracy in the drafting process to cover a variety of factoring arrangements, such as factoring with/without recourse, reverse factoring, non-notifiable factoring, etc. It is emphasised that providing such legal clarities to a comprehensive spectrum of factoring transactions would boost investor’s confidence and thus promote easier and greater access to credit.

Moreover, the Working Group will also give consideration to the fast-growing application of blockchain, smart contracts and other distributed ledger technologies (DLT) in factoring transactions. The use of these technologies in factoring should ideally be regulated by the model law. Hence, the Working Group considers if any legal recognition or clarity could be given to the application of DLT technologies, either in the rules or in the commentary, as well as to consider the challenges they might bring in applying the law.

Final Remarks: Model Law on Factoring

The principal objective of the Model Law on Factoring is to facilitate the efficient financing of receivables. Its impact in a jurisdiction will depend on its implementation – if sufficiently drafted and effectively implemented, the provisions of the Model Law on Factoring should result in a national legal system that is predictable and provides more effective protections to debtors, creditors, and factors. By substantially reducing legal risks and due diligence costs, the Model Law on Factoring has the potential to have a large impact on economic growth by reducing the cost of credit and improving its availability. This is especially useful to allow States to recover from the economic disruption caused by the COVID-19 pandemic.

As the Model Law on Factoring is anticipated to be completed in 2022, the UNIDROIT Secretariat welcomes any States and other interested parties for further inquiries.

This article was co-authored by Hamza Hameed and Tian Shu Liu