Invoice discounting allows a company to receive funds soon after sending out an invoice and can be done on a batch or single invoice basis. This allows capital to be used in the business for general cash flow or expansion purposes. It also removes pressure from the company in looking for alternative types of funding and having additional assets to offer as security for these facilities.

Invoice discounting can be used for many reasons. It is usually the chosen form of financing where an established business is growing and has a specific customer or a number of invoices that they would like to raise finance against.

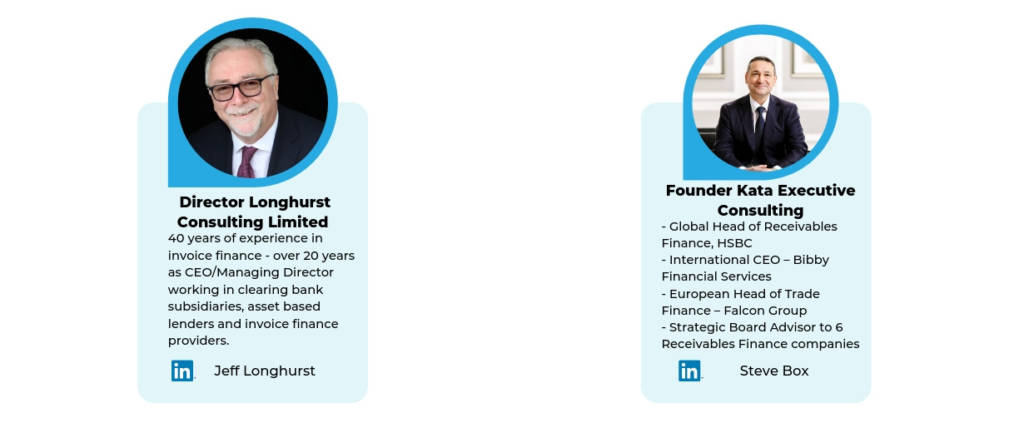

In this interview series, we heard from two invoice discounting experts and learned more about the confidentiality features of this product and the fundamental differences to invoice factoring. TFG’s Persiana Ignatova spoke to Jeff Longhurst and Steve Box, who are members of World of Open Account (WOA).

Persiana: Please tell us about your involvement with the WOA community.

Steve: I have operated in open account solutions across many businesses over the past 27 years and have known Erik Timmermans through membership of many associations. When Erik invited me to assist with input to his ambitions to build and launch the World of Open Account community, I wanted to support Erik and continue to share my learning and give back as much intellectual capital gathered over the year as I can to others. So far, we have been achieving this goal through product and theme-specific webinar building up to the very first WOA convention in October of this year.

Jeff: I am very pleased to have been involved with WOA from its very early stages and am proud to be a member of its Steering Panel.

Introduction to Invoice Discounting

Persiana: What is invoice discounting: Can you tell us more about your experience in the invoice discounting sector?

Steve: Invoice discounting is an invoice finance facility that allows business owners to leverage the value of their sales ledger. As a trading business, when you send out an invoice to your customer, a proportion of the total amount can become available from the invoice lender (discounter) providing an invaluable source of ongoing and immediate working capital bridging a liquidity gap until the invoice gets paid.

The invoice discounter (could be a bank or not bank discounter) can purchase the invoices from the seller business and immediately pay up to 85% to 100% of the invoice value with the outstanding balance being released to the seller business (less the discounters costs), once the buyer of the goods/services have made payment under the invoice.

The beauty with invoice discounting is that it is a confidential service whereby the companies who buy goods/services and receive invoices for payment will not know that that the company selling its invoices to an invoice discounting firm are doing so.

I have spent more than 28 years in Invoice Discounting companies with offerings in many parts of the world and enjoyed seeing the increased use of this solution by businesses over the years. Technology and awareness of invoice discounting as evolved with some pace over the past decade with data extraction, on-line connectivity between the client, the discounter and credit reference agencies improving speed to market and decisions.

New versions of discounting have emerged too over the years with the evolution of Payables and Buyer centric schemes, names debtor funding, Off-Balance Sheet solutions all attracting more businesses to invoice discounting and taking global turnover of all invoices factored and discounted to more than $3trillion.

Jeff: Invoice Discounting is the predominant invoice finance product in the UK at some 92% of invoices assigned – over £260bn. Like factoring it involves the sale of invoices to the invoice finance provider by a supplier, but it is predominantly confidential (the customer is unaware of the assignment) and the supplier is responsible for the collection of sums outstanding.

As you will see from my biography above, I have been involved with the invoice finance industry for 40 years. I have worked in sales, credit and operations in a business owned by clearing banks, foreign banks and private businesses. Latterly, my positions as CEO, MD and Chair of the UK Industry trade association has given me the widest experience of the businesses working in our industry in the UK as well as exposure, through the EU Federation of Factoring and Commercial Finance and the FCA, to invoice finance worldwide.

These roles also provided me with exposure as an influencer of lawmakers and regulators in UK Government and a notable success was persuading the government to pass a law to prohibit ban on assignment.

Invoice Discounting vs. Invoice Factoring

Persiana: There has often been confusion between the purposes of Invoice Discounting and Factoring. What’s the difference and would they be confidential?

Steve: There are many different terminologies used in the world of receivables finance (the common word used to capture many examples of discounting invoices). The most prevalent will be “Factoring” and “Invoice Discounting”. The difference between Factoring and Invoice Discounting ……….. With factoring, the provider of the service takes over the role of managing the sales ledger, credit control and chasing customers for settlement of their invoices. With Invoice Discounting, the business selling the goods/services and raising the invoices retains control of its own sales ledger and chases payment in the usual way.

Factoring as a service tends not to be confidential with all parties being aware that invoices are being discounted/funded. This is usually because the discounter will be undertaking the credit control and collection of the outstanding invoices when they become due for payment by the company who purchased the services/goods.

Invoice discounting tends to be confidential in its nature and will tend to be offered to a more established company who has a few years of positive trading history, some strength in their balance sheet by way of retained profit/net worth and just as importantly the firm looking to discount its invoices to gain accelerated liquidity, can also demonstrate that their internal administration and credit control capabilities are strong in order to retain control of their own credit collection as agent to the invoice discounter.

Jeff: The key differences between invoice discounting and factoring are in the areas of disclosure and debt collection. In Factoring the customer is notified of the sale to the Factor and thereby its obligation to pay the Factor. In Invoice Discounting the customer is unaware of the sale to the Discounter and the supplier is responsible for the collection of sums outstanding. The supplier in these arrangements is under an obligation to ensure that the customer pays the sums due into an account (in the supplier’s name) but which is in fact an account held by the Discounter.

You will see from the above that the risks for the Discounter in providing finance are greater than that of the Factor. So it is usual that Invoice Discounting is made available only to more established businesses with a better financial track record than those businesses to which factoring might be accessible.

Persiana: What is the most interesting part of your role within Invoice discounting?

Steve: This is a really difficult question to define one answer as there are so many interesting elements to my role. Helping like minding CEO’s on strategy, fundraising, building diversified and dynamic teams, identifying domestic industry sectors and international trade flow opportunities whilst also blending human and technological solutions designed to work for the intended target audiences built from the customer “insight-out” not company “inside-out”. However, if I really had to place something at the pinnacle of all parts of my role, it would be to give back and share as much knowledge from my experiences within the receivables finance industry to leaders and next-gen leaders who have ambitions to continue the growth and success of working capital asset finance solutions.

Jeff: Now that I act as a non-executive Director (NED) and Advisor I am able to get involved in a number of different areas within the industry and its suppliers. Using my experience to assist fledgeling businesses is probably the most exciting part – helping them grow and develop new ideas and products is fascinating and invigorating. Some positive disruption of the industry is necessary for its growth.

Persiana: Can you share any stories or examples of how your company is making a difference to others, or how you’re making an influence in your sector?

Jeff: The cost of onboarding new clients has historically prevented finance providers from offering invoice finance to very small businesses. Paid Ltd, of which I am a NED, has developed a platform and system which makes onboarding very simple and cost-effective so that Paid can provide finance to not just small but micro-companies and sole traders and even the self-employed. This meets the needs of a market which has previously been unserved and underdeveloped by invoice finance in the UK.