Businesses today are facing a landscape defined by uncertainty.

The fact that more than half of the global population is set to go to the polls in 2024, adds a degree of legislative uncertainty to the already stark geopolitical tensions and environmental changes that our world is facing.

Geopolitical tensions can disrupt traditional trade routes as we are seeing with the events in the Red Sea, while elections in key markets may result in policy shifts that prompt rapid adjustments in international operations.

Climate change further compounds these challenges. Water shortages in Central America are impacting the Panama Canal’s operational capacity causing some shippers in the region to turn more towards rail transportation to get goods to their final destination.

In response to these challenges, a paradigm shift is occurring in how businesses approach their operations. It is no longer feasible for businesses to operate under the same assumptions and mental models that they did even five years ago.

In this decade, resilience is key.

On 8 April, Lloyds Bank released its latest report exploring supply chain resiliency across the global market.

The shift in supply chains – Just in Time

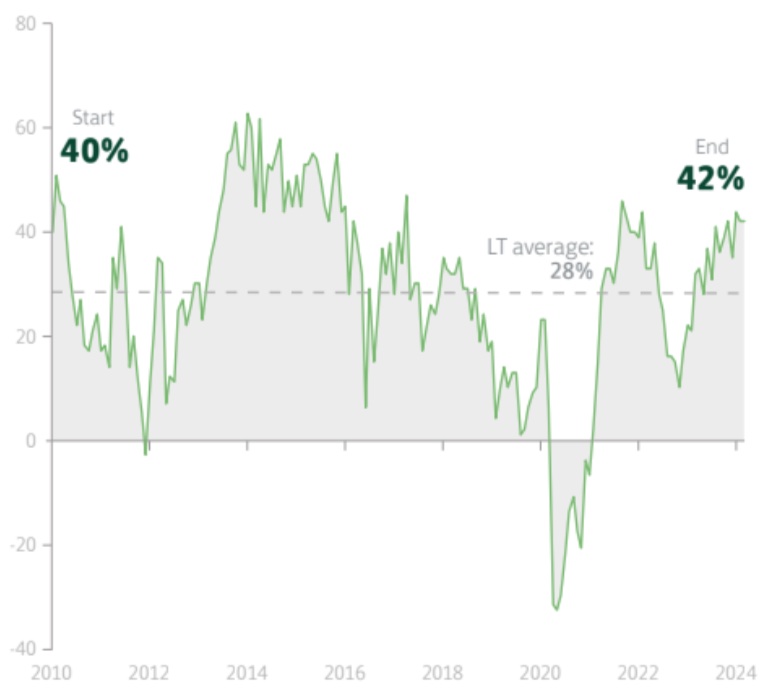

In light of these conditions, the Lloyds Bank Business Barometer anchors confidence at near recent highs (Figure 1), even though supply chains continue to face change.

The traditional ‘just in time‘ inventory management model, popularised in the 1970s by Toyota manufacturing plants in Japan, is giving way to a ‘just in case’ model, where businesses hold more inventory as a buffer in case of significant disruption.

This approach, while prudent, required firms to hold additional inventory, tying up funds that could otherwise be deployed towards growth or innovation. This introduces complexities in managing working capital for small and large firms alike.

Businesses must learn how to balance the need for additional inventory with the need for working capital, ensuring they have sufficient stock to weather supply chain disruptions without compromising their financial health.

Alongside these changing supply chain conditions and drive for resilience comes changing demands for working capital management, a task that has risen to the forefront of corporate strategy discussions.

This is where the work of treasury professionals becomes critical.

But not just any treasury professional.

What is needed now is a treasury professional with a new set of skills and aptitudes.

The evolving role of treasurers

Historically seen as custodians of cash, corporate treasurers are now emerging as key strategic players, bridging the gap between physical supply chains and financial mechanisms.

Treasurers are no longer just managing funds but are integral in crafting strategies that enhance supply chain resilience, optimise working capital, and meet sustainability objectives. Rather, their role has expanded to include risk management, financial planning and strategic advisory, making them indispensable in the corporate command structure.

Likewise, effective treasurers in 2024 and beyond must have a complete and holistic understanding of the operational and commercial runnings of their business.

This involves a deep understanding of the digital resources available at the firm and industry levels. By leveraging data and technology, treasurers can gain deeper insights into cash flow patterns, supply chain efficiencies, and financial opportunities, enabling more informed decision-making and strategic financial planning.

Supply chain finance and trade finance solutions are also proving instrumental in strengthening supplier relationships, mitigating risks, and enhancing liquidity. These tools not only facilitate smoother operations but also foster a more collaborative ecosystem between businesses and their suppliers.

For example, under a supply chain finance scheme, a smaller supplier can leverage the stronger financial standing of its larger buyer to secure financing at a more favourable rate than it would be able to on its own.

This has the power to enhance the overall stability and resilience of the supply chain, providing a buffer against the shocks of unforeseen events.

An inside perspective: Lloyds Bank Trade Insight

The Lloyds Bank Trade Insight report focuses on these changing economic conditions and their implications on working capital from a treasury perspective.

The report shares insights on managing working capital from Abel Martins-Alexandre, managing director and head of infrastructure, energy, and industrials at Lloyds Bank.

It is essential for the treasurer to be part of strategic conversations with all areas of a business so that working capital is optimised, processes are improved, sustainability objectives are addressed, and supply chain resilience is built.

The report also includes an overview of Lloyds Bank’s trade and supply chain finance offerings that can businesses and treasurers tackle the challenges they face amid the uncertain economic landscape.

For those interested in learning more, the full report is available here.