Trade Finance Global surveyed firms throughout Europe to gain an understanding of SMEs’ trade finance usage norms and their propensity to pay for new or additional trade finance products and services.

The survey was designed to gain insight into both letter of credit usage by European SMEs and their likelihood to pay for new trade finance services at a 4%-8% per annum price point.

This structure allowed TFG to better understand how letters of credit are used by SMEs in Europe, why they may not be used by some SMEs, and whether the use of letters of credit impacts a firm’s propensity to pay for new services.

A total of 64 firms with operations in 31 countries responded to the survey.

Over 80% of the firms surveyed self-identified as either small businesses, traders, or producers, and less than 20% self-identified as corporates or financial institutions.

The majority (60%) reported annual revenues between $0-$10 million, while 14% reported annual revenue of $50 million or more.

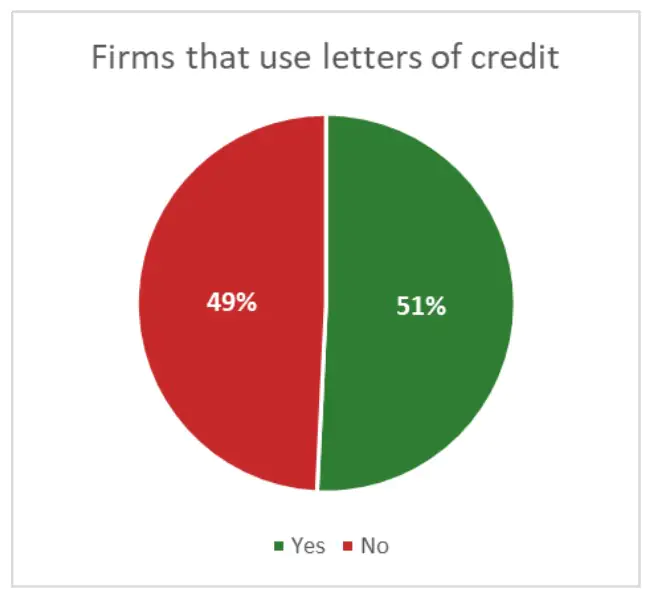

Letter of credit usage

Among all respondents, there was a near-equal split between those that use and those that do not use letters of credit (LCs).

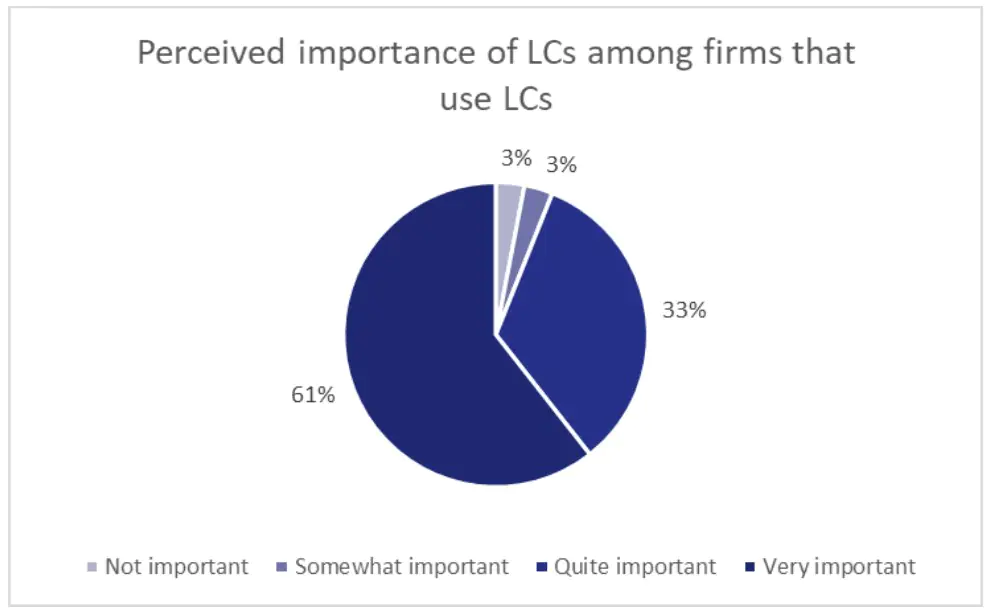

View from firms that use letters of credit

Among those that use LCs, nearly all consider them to be of significant importance to their operations.

Some 61% said LCs are “very important” to their operations, and 33% said LCs are “quite important” to their operations.

Only 6% of firms that use LCs consider them to be “not important” or “somewhat important”.

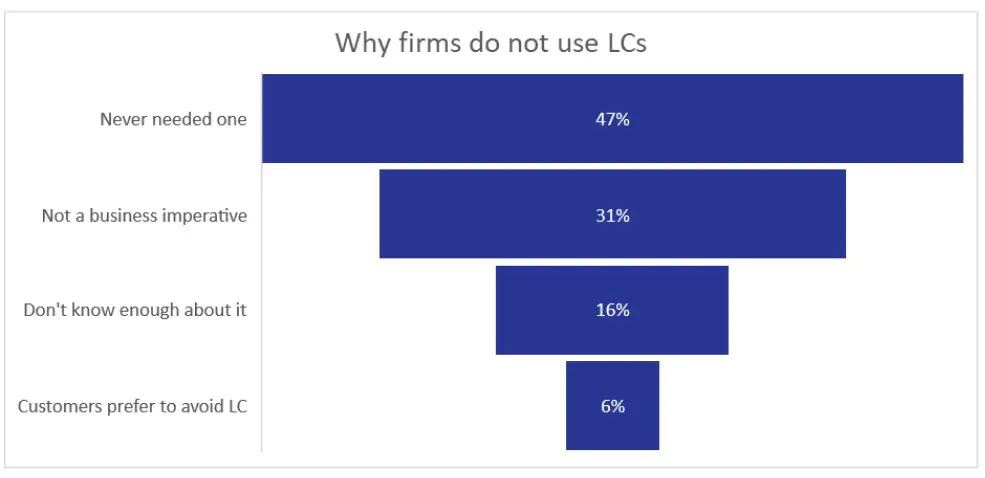

View from firms that do not use letters of credit

Of the firms that do not use LCs, 47% said they have never needed to use one, and 31% said they do not consider them a business imperative.

Only 16% of respondents that do not use LCs cited a lack of knowledge as the reason why, and 6% said they avoid using LCs because their customers prefer to avoid them.

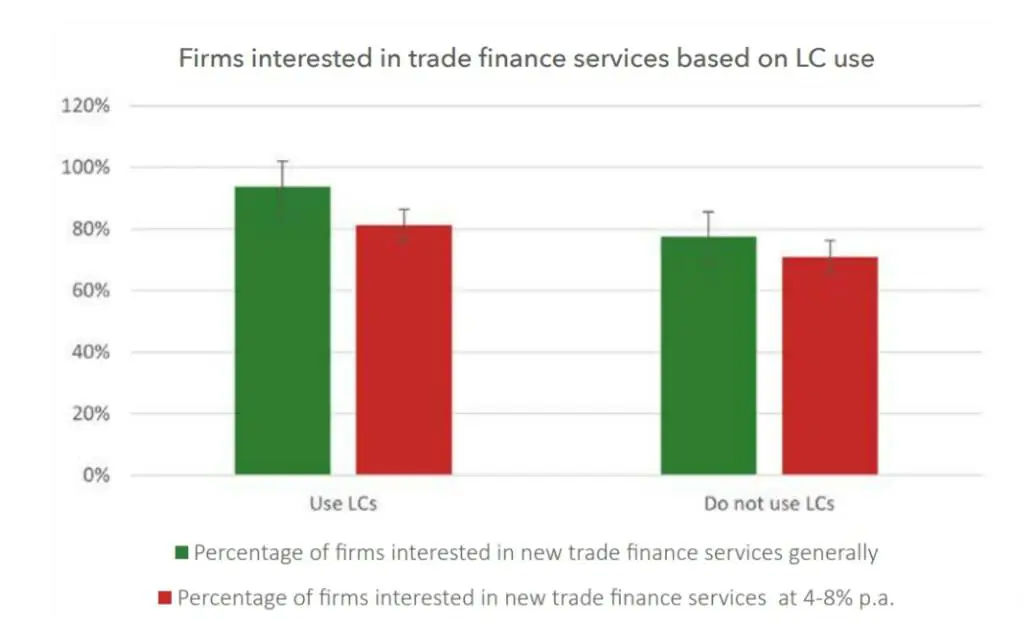

Propensity to pay based on LC usage

The next section of the study focused on whether using LCs has an impact on the propensity of a firm to pay for new trade finance services.

Firms that use LCs showed a higher interest in trade finance services than those that do not use LCs.

Even at the 4%-8% price point, 81% of firms that currently use LCs said that they would be interested in trade finance services.

This is statistically significantly higher than the 77% of firms not using LCs that said they would be generally interested in trade finance services.

This is also higher than the 71% that said they would be interested at the 4%-8% price point.

Read the full report

TFG’s full report, Is SME Finance Viable: a Europe outlook, explores several other factors to determine which have the greatest impact on SME interest in new trade finance services.

The report also explores business type, operating location, annual revenue, use of third-party financing, average inventory levels, current number of lenders, current debt utilisation, and current cost of debt financing, in addition to letter of credit use.