The month of June started off with Interest Rate cuts in Australia, followed by woes at the UK Tory Party leadership contest. Meanwhile, on the other side of the pond, Trump continued trade talks with President Xi and interest rate custs in July seem likely for July in the US. TFG heard the latest FX news from expert Erin Harding at Smart Currency Business.

Interest Rate Cuts Down Under

June kicked off with an interest rate cut from a Central Bank, the RBA of Australia. Ironically the Australian dollar went up, not down, following the cut. This was mainly due to the language within the statement that accompanied the decision, and would become a theme right across the other side of the world as the month unfolded.

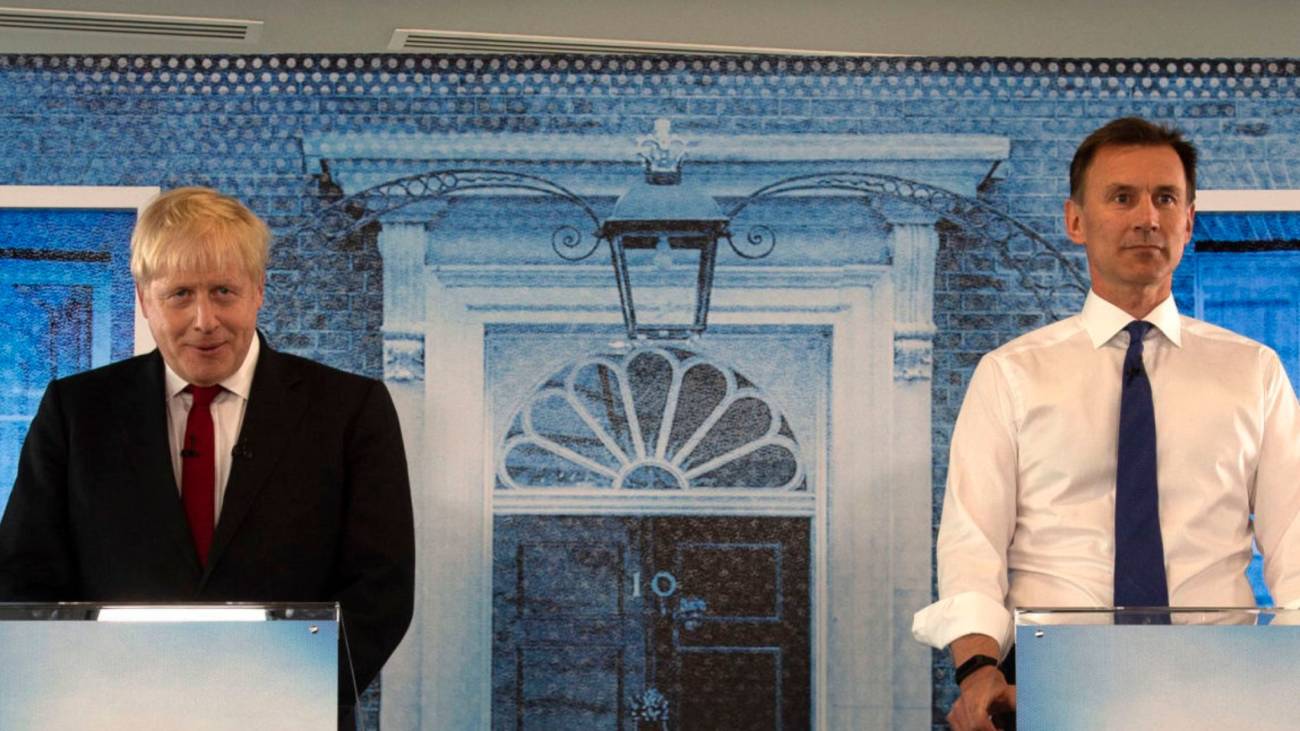

UK Leadership Contest Underway

In the UK we saw the Conservative leadership contest get underway. A series of votes from Conservative MPs gradually whittled a field of over ten starters all the way down to the final two contenders, favourite and former Foreign Secretary Boris Johnson against current Foreign Secretary Jeremy Hunt. It will now be down to Conservative Party members to elect one of them as the new leader and Prime Minister. Boris promised to deliver Brexit by the 31st of October ‘come what may’, including both the prospect of a no-deal and, if necessary, suspending Parliament to make that happen. Needless to say, none of this was seen as good news for the UK economy or currency, and the pound slipped against all currencies.

Data confirmed the damaging effects of the Brexit impasse as GDP and manufacturing figures both came in well below expectations. England’s women’s football team, the Lionesses, did at least give us something to shout about. They played well during the World Cup in France and made it through to a semi-final match against the impressive United States team, already the world champions.

European Elections

Europe continued to experience issues politically. Replacements for Presidents of the European Commission (Jean-Claude Juncker) and ECB (Mario Draghi) needed to be elected, but it was soon clear that the populism that swept through the European elections in May would make it more difficult for the French and Germans to simply push things through as they have always done. None of the original selections won enough support, and a lot of behind the scenes negotiations finally resulted in the promotion of two new candidates, both of them women. German Defence Minister, Ursula von der Leyen, was nominated to replace Juncker while Christine Lagarde, Managing Director of the IMF was the likely successor to Draghi. The question of whether the ECB will cut rates this year, even if only by 10 basis points, remains open.

Taken from: https://www.nbcnews.com/think/opinion/trump-s-north-korea-meeting-was-good-photo-op-don-ncna1025841

Trump’s Photo Opportunity with Kim Jong-Un

In the US, two events grabbed the spotlight. The June meeting of the Federal Reserve and the G20 summit, at which President Trump (according to the Donald Store) was due to meet President Xi with the hope of reengaging the trade talks. With the FOMC meeting coming before the G20, it was always unlikely they would move rates, so focus was even sharper on the statement and speech from Chairman Jerome Powell. His comments were broadly taken as a green light for a rate cut in July and he even alluded to the fact that a cut of 50 basis points had been discussed. If it happens, this would be the first rate move of more than 25 basis points since the Global Financial Crisis.

Right up until the day before the G20 summit, communication from the White House suggested the meeting between the two leaders might not even happen. In the end it did, and while the tweets suggested good progress had been made and that more was hoped for, there were no concrete results or statements in the days that followed. President Trump rounded off his visit to Asia by visiting Kim Jong-un and becoming the first sitting US leader to step onto North Korean soil. However, apart from a great photo opportunity, nothing came from the meeting.

We’ll be keeping a close eye on trade war updates, interest rate decisions and the twists and turns of Brexit throughout July.