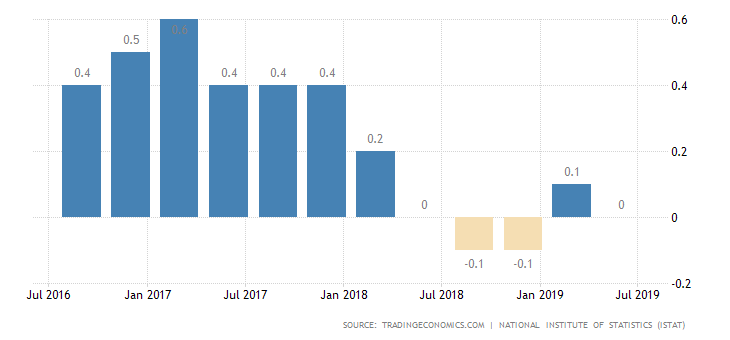

Over the past few years, Italy’s economy has gone through a recessionary period. A recession is defined as two negative quarters of contraction and is a sharp slow-down in the rate of economic growth. In the final quarter of 2018, Italy’s economy shrank by 0.2% and is the third time the country’s growth has fallen into recession over the last decade.

However, Italy’s economy came out of the recession in the first quarter of 2019. Gross domestic product rose by 0.1%, 60,000 jobs were created in the second quarter of 2019 and the employment rate climbed to 58.9%, its highest level since April 2008. There is uncertainty as to whether Italy’s economy can sustain positive economic growth in the years ahead.

What are the reasons that have caused a recession in Italy?

Reduced economic activity: Economic activity is the amount of buying and selling (transactions) that take place in an economy over a period and fluctuates from year to year. In most years, the production of goods and services rises. Due to increases in the labour force, increases in the capital stock and advances in technological knowledge lead to more production over time. In some years, however, this normal growth does not occur, as is the current situation in Italy. Firms find themselves unable to sell all the goods and services they have to offer, so they cut back on production. Workers are laid off, unemployment rises, and firms have excess capacity. With the economy producing fewer goods and services, real GDP and other measures of income fall whilst unemployment rises.

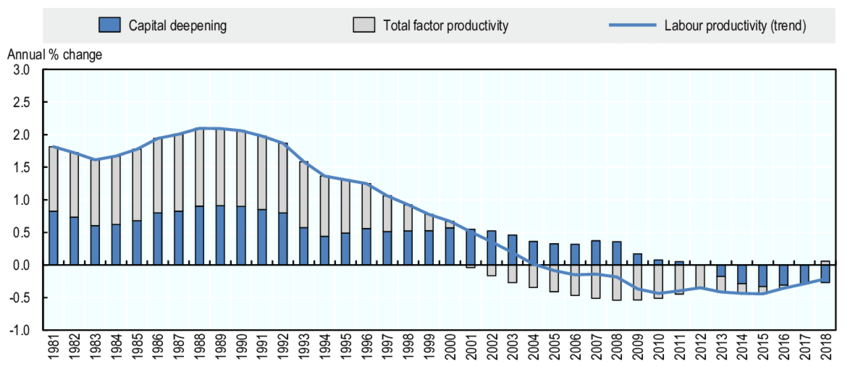

Low productivity: Productivity and growth are positively correlated which means that the higher a country’s productivity, the higher its growth and vice versa. During recessionary periods, productivity levels are generally low. Italy’s economy over the last few years has seen extremely low productivity growth and the major decline in the sectors agriculture, forestry, fishing and industry have all contributed to the economic downturn. Compared to the US and the UK, Italy has invested much less in technology. Slower global trade in recent quarters has also reduced productivity levels. Sales of Italian goods abroad grew in 2018 by three per cent compared to a six per cent increase in the previous year.

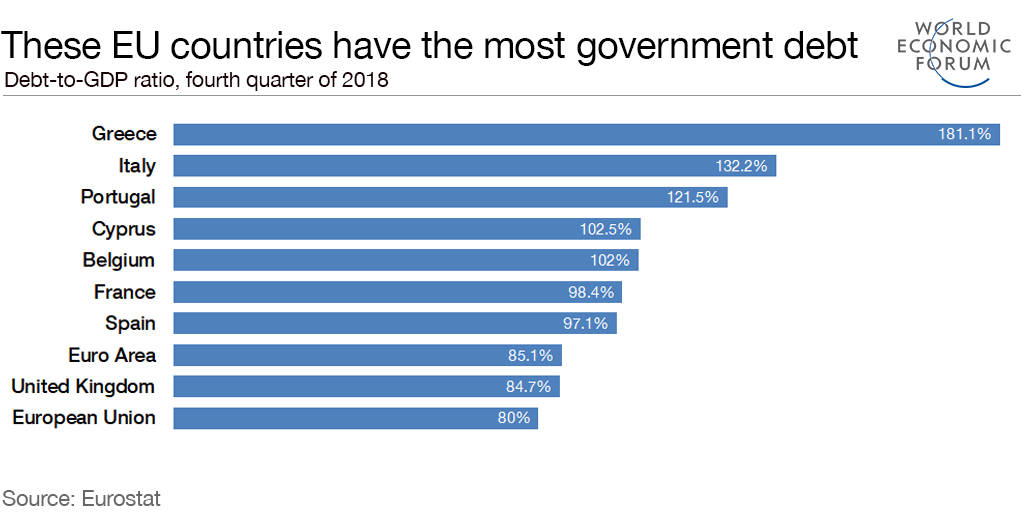

Government debt: Countries that are going through recessions are generally facing high levels of government debt. The recession in Italy aggravates the problem the government has with its finances. Italy has the largest government debt in the European Union at more than €2.3 trillion, the fourth- largest government debt in the world. The country’s debt burden as a percentage of annual economic activity is second only to Greece in the EU at 132%.

External factors: Many external factors have contributed to the recession in Italy. The trade war between the US and China is one of them. Brexit uncertainty has also contributed to the low growth levels and investment has been volatile. These factors have reduced the overall gross domestic product of the economy.

Immigration/Emigration: An effective labour force contributes to a higher level of productivity. The Italian labour force is shrinking with low levels of immigration to make up the difference. There is also a problem of mass emigration with many young Italians looking for more opportunities abroad as they sense that they have little prospect of a stable working future and a decent salary in Italy. This is contributing to a lower GDP, leading to lower economic growth.

What is the future of the recession in Italy?

The recession in Italy presents a huge problem for the Italian economy. There might be a trigger for uncertainty and vulnerability within the eurozone. Consumption demand may fall, and investment opportunities will become unprofitable. Higher interest payments may cause business failures, production and employment could fall as a result as well as prices and profits. Investment from abroad will be reduced as investors will look for better opportunities elsewhere, worsening the GDP of the economy. Lack of emigration and increased immigration will reduce overall productivity affecting the domestic citizens. The huge public debt of the country is the major cause for concern. High taxation levels can reduce demand and be a disincentive to further investment. A lack of economic planning by the government can lead to a fall-off in growth. Consequences can include a rise in interest rates cost of capital, and the price of labour.