Following the release of the International Chamber of Commerce (ICC) Banking Commission’s 2017 Trade Register report, we interviewed Krishan Ramadurai, the new Chair of the ICC Trade Register Project to on the low risk nature of trade finance.

How has the trade finance market changed in the last 10 years?

In the short-term trade finance market, we are seeing a move away from traditional trade finance products such as Letters of Credit (LCs) towards what is generally referred to as “open account trading” – with a focus on receivable finance and supply chain finance (SCF) products, both of which are growing significantly globally.

That said, approximately 40% of the market is still dependent on traditional trade finance products – especially in certain regions such as Asia where it remains very much the “bread and butter” of the business. Traditional trade finance is also useful from a risk mitigation perspective, especially when offsetting country credit risk. And so, while the percentage of the market dependent on traditional trade finance has decreased, these products will continue to play an important role in the industry.

Meanwhile, the market environment – particularly in the context of compliance and regulation – has evolved globally. Compared to 10 years ago, the market has arguably become more constrained by new regulations and compliance requirements that have, albeit indirectly, led to banks reviewing their product offerings and associated services – which, in turn, have impacted transaction volumes.

Finally, in the coming years we also expect to see a greater focus on technology leading to a market evolution, as well as innovations to banking products and the continued influx of new entrants such as FinTechs.

What are the most surprising findings of the Trade Register report to you?

Based on the findings, it is not a surprise to see that the average level of risk remains low compared to last year – therefore reaffirming the low risk nature for these products covered by the Trade Register.

How do you feel the perception of risk in trade and export finance differs from the reality?

At this point in time, the Trade Register only covers credit risk. Therefore, for the scope of the products covered within the Trade Register – and given that it is heavily data driven and factual – there is no difference from perception and reality. What’s more, the fact that we’ve also added obligor default rates means we now have all the necessary dimensions of defaults, with the proviso that operational and other risks have not been covered.

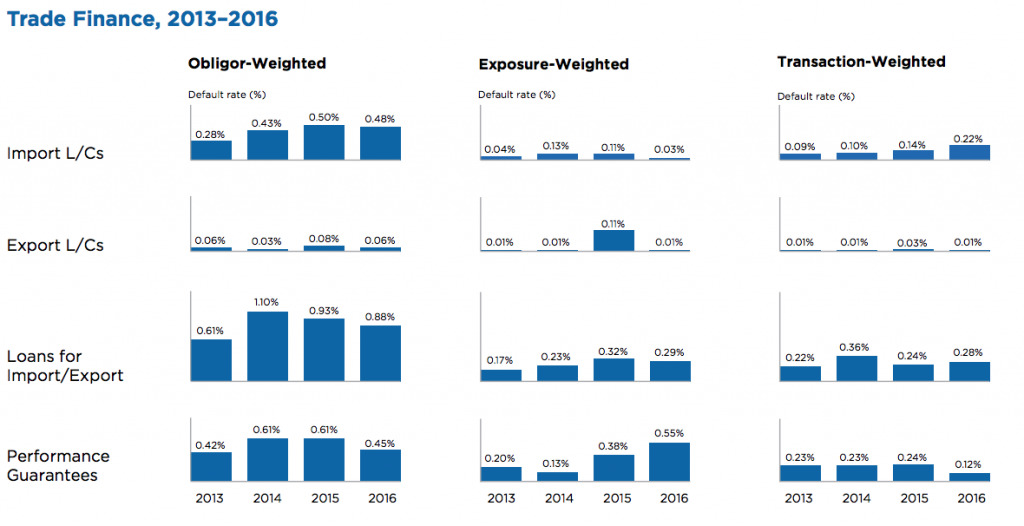

Figure 1: Summary of Default Rate Trends. Source: ICC Trade Register 2017.

There are a lot of new players coming into this space – in turn, changing the profile of the industry. What impact is this having?

In recent years, we have seen a lot of new players (FinTechs and non-bank institutions) entering the trade finance space. The profile of the industry is therefore changing, and as more players enter this market it can only be positive from a risk perspective as risk can be transferred to a broader spectrum of participants. In this respect, the industry is becoming more diversified, as well as more inclusive – particularly with respect to the SME sector, which some argue is being underserved by banks.

While banks still have a role to play in originating and transferring risk, this is a positive development for the industry. More specifically, new players increase capacity overall, and may potentially be able to absorb a certain portion of the financing gap; which is estimated around US$1.5 trillion.

Being the new chair of the ICC Trade Register Project – what changes would you like to implement?

Looking ahead, we anticipate an expansion in the scope of the report to include products such as supply chain finance (SCF), as well as accounting for other types of risk category – such as operational risk. Currently, the report’s export finance analysis is limited to transactions covered by export credit agencies (ECAs) from OECD countries and so expansion to cover non-OECD ECAs would be a valuable addition in next year’s report. As always, we also aim to expand the number of banks participating in the report in order to add new insights, expand the data set and further strengthen the comparability of results for member banks.

Download the Report here.