TFG’s Persiana Ignatova spoke to Richard Crecel, Executive Director and Daniela Thakkar, Methodology & Membership Executive, Global Credit Data about their recent report on IFRS 9, which showed that banks’ expected credit loss estimates may vary by at least factor 4. Results from the study suggest that the IFRS 9 framework is yet to stabilise, given a significant degree of variability. Richard and Daniela explain.

What is IFRS 9?

PI: In layman’s terms, what is IFRS 9 and why is this framework important to banks?

DT: Following the financial crisis, the International Accounting Standards Board (IASB) recognised the need for a forward-looking approach to account for credit losses. Previously, the IAS 39 accounting standard for assessing provisions was based on an incurred loss model. This approach has been criticised as “too little, too late” as it was perceived as delaying the recognition of potential turbulences while favouring forbearance.

In turn, this led to the creation of IFRS 9, the International Financial Reporting Standard for the accounting treatment of financial instruments, which came into force on January 1st, 2018 and replaces the earlier IAS 39 standard. IFRS 9 requires a shift in the manner of assessing provisions by requiring that banks estimate their historic, current and projected losses – including a one-year and a life-time expected credit loss (ECL). These measurements are expected to be responsive to macroeconomic developments and include a forward-looking perspective.

Expected Credit Loss Explained

PI: Why is benchmarking data such as ECL important for banks, and who is this information beneficial for?

RC: As the first IFRS 9 statements are released, banks, investors, auditors, regulators and other financial industry participants are attempting to understand the variability of loss projections, provision charges and ECL estimates. As a relatively new framework, there is a need to understand and fine-tune the standard and, as such, discussions relating to the standard, its implementation and impact are to be expected.

Benchmarking is a key component to this finetuning process and can be very useful, for example, in helping banks to answer key questions, such as how their models compare to their peers, and what drives any difference in these numbers. It is also important for institutions to regularly validate their credit loss estimates, and benchmarking is an integral part of the process.

At Global Credit Data, we help banks and regulators understand the potential effects of IFRS 9. Results are discussed with banks in detail, based on a sound and profound auditing process. What’s more, we provide banks with the ability to anonymously compare their results to their peers.

Our study is the first worldwide to quantify the differences in the methodologies that banks use to calculate credit loss estimates. Benchmarking calculations will enhance institutions’ credit loss forecasts going forward.

PI: What were the key findings of your recent IFRS 9 report?

DT: As a complex principles-based standard, the IFRS 9 framework inherently provides significant room for variability. This variability is therefore to be expected across banks’ benchmarking results and should not come as a surprise.

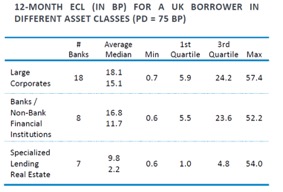

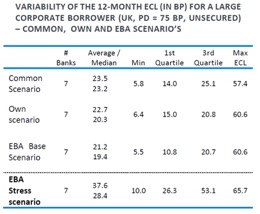

Our study confirms that variability of ECL estimates is noticeable for all asset classes. The variability between bank estimates is mainly caused by differences in model assumptions, data sources, techniques and processes between banks rather than by different macro-economic forecasts.

This variability between banks’ estimates is also noticeable across all the various scenarios (bank’s own scenario, a common scenario assumption, EBA baseline and EBA stress scenarios) and all ECL drivers analysed – such as obligor type, geography, industry, rating and probability of default, facility type, guarantees and collateralisation. Projections of stress-test scenarios naturally increase ECL levels. But, notably, they also increase the variability between banks.

The question of how much variability is too much remains to be settled, however. As such, we encourage all banks to join our benchmarking study, to help enrich their understanding of the data, and help advocate for appropriate regulatory treatment.

IFRS 9 Data – Implications for Regulators and Governments

PI: What are the implications of this data for regulators and governments?

RC: We work very closely with regulators to ensure our data can be put to best use. As financial institutions develop more precise methods to improve future credit loss estimates, we can expect regulators and auditors to closely focus on any differences and push for greater consistency.

Although we remain in the early stages of monitoring and analysis, the high level of ECL variability is something that the industry will need to address in time. If it doesn’t, banks may find the regulators eventually act for them, and potentially imposes more restrictive standards than many would like. However, it remains important to note that we are not looking to implement a one-size-fits-all calibration.

PI: What’s next for Global Credit Data?

DT: With regard to the IFRS 9 report, we will be running the study again next year, providing participating banks with detailed data and peer comparison reports, in line with our give-to-get principle. This latest study gathered data from 26 international banks. We hope to increase this number and thereby enrich the data set by encouraging all banks to participate in the benchmarking process.

Importantly, we would like to continue strengthening our relationships and building our dialogues with regulatory bodies worldwide. We are increasingly recognised and trusted for the quality of our data and will continue to advocate for appropriate benchmarking and analysis of key credit standards, such as loss given default, probability of default, IFRS 9 and CECL.

We have a proven track record of data pooling while ensuring data quality, security and confidentiality. As our motto “by banks, for banks” attests, our mission is to help banks understand and model their credit risks, through independent audit. We are a not-for-profit initiative jointly owned by our member banks, and objective analysis is key to our work ethic.

Read the full IFRS 9 benchmarking study here.