We spoke to Head of Global Trade & International Banking, Francisco Javier Fernández de Trocóniz at BBVA about the first blockchain based trade transaction between Europe and Latin America, following their TFG International Trade Award for best business finance provider in Latin America.

Short summary of the transaction

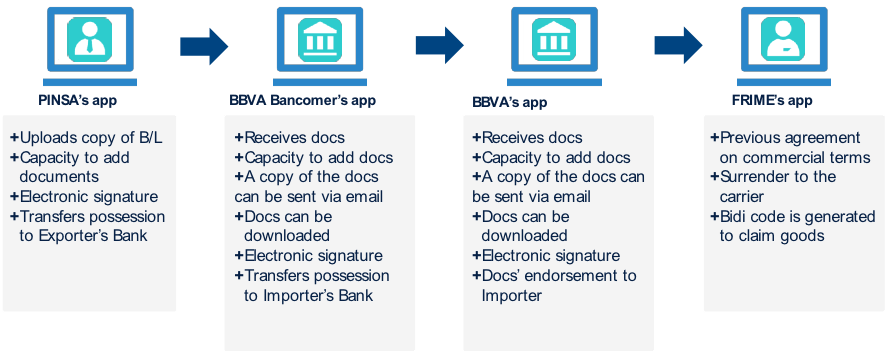

This was a transaction between Mexico and Spain, in which Barcelona-based Frime bought more than 25 tons of frozen tuna from Pinsa Congelados, of Maztlan, México. The payment was made using a letter of credit issued by BBVA in Spain and processed by Mexican outpost BBVA Bancomer.

The letter of credit wording, especially regarding what documents are concerned, needs to reflect the fact that the presentation will be an electronic one, thus subject to the eUCP version 1.1 that supplements the UCP 600 in force. Besides, a mention to Wave as the platform supporting the e-presentation has to be included, as well as a definition of certain technical terms.

What were the biggest risks of transacting over Blockchain and how did you mitigate this?

We identified two categories of risks:

- technical (accessiblity of the platform for all involved parties, knowledge of how to proceed once accessed and successful processing of the transaction in blockchain); and

- commercial/documentary, which were no different from a non-blockchain L/C. In particular, due to the relevant tenor required in the L/C, the time window to present documents was small and serious technical issues would have required a renegotiation of the L/C to allow for additional time.

We mitigated those risks by training all involved parties, which included executing several trial runs on the platform, and maintaining frequent contacts in the previous weeks to clarify any doubts and verifying technical requirements in advance. Also, two of our senior trade specialists were monitoring the pilot to propose solutions on line (as they would have done with conventional transactions, if required).

Is blockchain the future for trade finance at BBVA?

Experiences such as ours show that DLT has the potential to connect all participants in Trade Finance transactions (Financial Institutions, Importer / Exporter, other parties) previously in siloes, generating transparency and a reduction in operational risk. That said, we are not a technology developer and for us technology is the means to provide a better customer experience and to achieve efficiency, a key requirement to streamline trade finance processes, and we believe that any successful solution will require a widespread adoption by the market, especially the key stakeholders associated with the trade business, namely regulators, customs, carriers and insurers.

Our positioning as of now:

- it is immature, but evolving very rapidly

- it has a real potential for Trade Finance, but it needs a general adoption. Collaboration among all the participants in the Blockchain landscape is crucial

- as far as we are aware, it does not exist any solution in production, all players are on a POC/Pilot phase. Currently several choral and bilateral initiatives are taking place. Media coverage is high, but there hasn’t been any commercial launch yet

To conclude, we don’t know whether blockchain will be the future of trade finance for BBVA or for the entire industry, but what we do know is that the lessons learned from this technology will contribute to shape that future. That’s why BBVA’s involvement with blockchain initiatives is significant: we are part of Hyperledger (open source DLT platform of the Lynux foundation) and Ethereum (also open source), have contributed equity and other resources into the R3 consortium, that for the Trade Finance space generated a first initiative called eLoc, now we are in second phase of the project (Voltron). And we will continue exploring additional avenues individually to further expand the application of the technology to trade finance processes, with the end goal of envisaging how an end-to-end blockchain process, fully integrated with the bank’s platform, would perform.

What’s next for BBVA in terms of trade finance?

Our ambition and also our challenge is to maintain the right balance between managing the business in its current environment and having as many experiences as possible with new technologies/capabilities/tools to prepare for the future. The key, and this is how we see it at BBVA, is to ensure that the adaptation to the new technologies is internalized by the teams and becomes part of our DNA as an organization. There is evidently a long way to go, but as long as the external environment continues evolving, we must advance in parallel in adapting our internal processes and, above all, assuming a change in mindset. This must be our goal if we want to continue being a reference for our customers and creating opportunities for them.

Regarding blockchain, we aim to extend the experience of this pilot to other actors of the trade finance value chain such as carriers and customs.

How does BBVA deal with AML, KYC and compliance when dealing with cross-border transactions powered on Blockchain technology?

So far our pilots have dealt with certain parts of the trade finance process only. KYC and other requirements are for now executed in our existing “conventional” platforms. When we talk of widespread adoption of the technology this is obviously one of the main challenges and key efficiency generators.