Change is not just coming; change is here today, now. The impact of using electronic trade documents instead of hard copies of bills of lading, invoices, packing lists, and certificates to settle trade transactions via the Internet will be as profound to global trade finance as the containerization of cargo was to logistics. From the Temple of Solomon to a $45bn annual revenue industry, TFG heard from Internet Trade Finance, demystifying international trade finance.

INTERNATIONAL TRADE FINANCE. This article explains a dozen of the myths and misconceptions surrounding trade finance services that have kept the industry from moving forward from paper to online transactions.

I heard from John Dunlop, a trade finance expert with over thirty years of experience in managing letter of credit and collection transactions from purchase order to final payment.

Rise of the “trusted” third party

Firstly, what is international trade and trade finance?

International trade is the exchange of tangible goods and services across borders between a buyer and a seller. Trade finance is the exchange of documents representing ownership of those goods from the seller, or exporter, for something of value from the buyer, or importer; usually money. Trade finance includes documentary letters of credit, standby letters of credit, guarantees, supply chain finance, collections, invoice and bill of exchange discounting. All of these various financial instruments fall into three categories;

(1) credits; which are payments to the seller when the goods are shipped;

(2) collections; which are payments to the seller when the goods arrive;

or (3) open accounts; which are payments to the seller after the goods are delivered.

In all three cases documents representing value are exchanged for actual value represented by the trade finance instruments.

This exchange of documents for money or a promissory note, is a simple enough concept that has always been complicated by distance and lack of trust between parties that may or may not know each other. The quandary has always been, “I the seller will send my goods after I receive the money”; or “I the buyer will send my money after I receive the goods”. From this age old corundum arose the “trusted third party” industry we call international trade banking today to handle the exchange on behalf of both parties.

From the Temple of Solomon to a $45bn rev industry

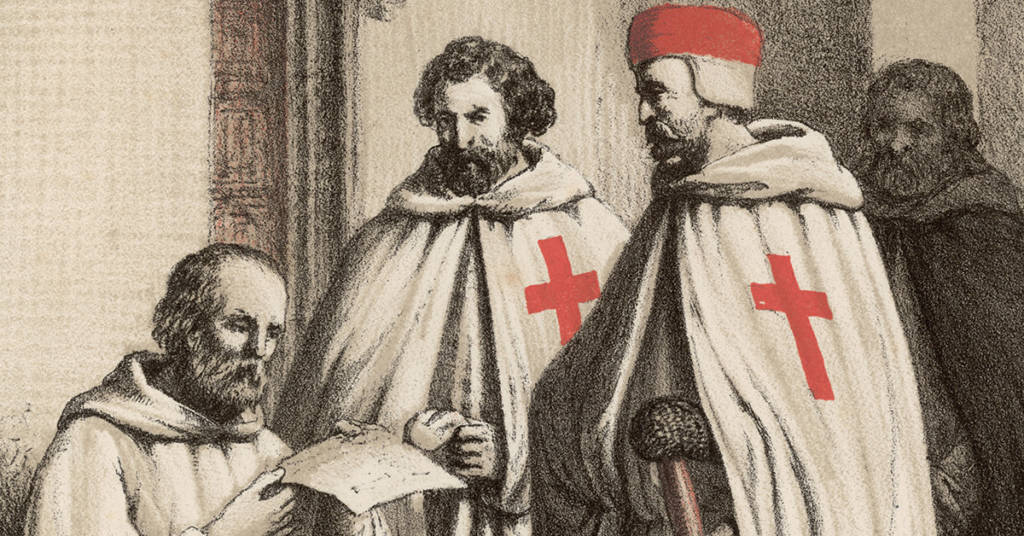

This third party industry has a fascinating history going all the way back to the Crusades with the Poor Fellow-Soldiers of Christ and of the Temple of Solomon, or the Knights Templar as they were known. In 1150 the order began generating letters of credit for pilgrims journeying to the Holy Land: pilgrims deposited their valuables with a local Templar preceptory before embarking, received a document indicating the value of their deposit, then used that document upon arrival in the Holy Land to retrieve their funds in an amount of treasure of equal value.

This innovative arrangement was an early form of international banking, one that persists to this day as documentary letters of credit issued between banks. What is equally fascinating, is that the procedures for negotiation of today’s documentary letters of credit by banks, is almost the same as it was almost 1000 years ago by the Knights Templar. Banks issue letters of credit in one country and transfer the value to be redeemed in another country. Indeed, actual paper (or parchment then) is still used today by banks to settle transactions between buyers and sellers as it was a thousand years ago. Just as the service made the Templar Knights order rich then, it makes international banks rich today. Trade finance bank revenues in 2016 were $45,000,000,000; billion with a “B” (ICC Global Trade and Finance Survey 2016.). These revenues are gleaned from global trade transactions that reaches over $10 Trillion annually; of which 18% are done on commercial letters of credit with millions of issues and 17% on collections (Note 1).

However, there have been some improvements to the process. In 1933 the International Chamber of Commerce in Paris, France, published the Uniform Customs and Practice for Documentary Credits, or UCP. The UCP is utilized by bankers and commercial parties in more than 175 countries in trade finance. The latest version, called the UCP600, began usage on 1 July 2007. In 2002 the eUCP was developed as a supplement to the then UCP (UCP500) due to the sense at the time that banks and corporations together with the transport and insurance industries were ready to use electronic commerce. This has not happened, and will not happen in the foreseeable future.

The eUCP rules supplement the UCP allowing for the direct substitution of electronic documents for parchment (paper). These rules could have been and could be implemented by the banking industry if they so desired except they would lose most of their trade finance services revenue; which is over $45 billion dollars annually. These revenues come from the fees imposed by the banks to include: issuing fees: advising fees; amendment fees, negotiation fees, reimbursement fees, courier fees, wire transfer fees, discount fees and discrepancy fees. Also included is the value of money held as security and the delays in payment. When electronic documents are used instead of paper via the internet, the average documentary letter of credit can be negotiated in four (4) days instead of the present average of twenty-four (24). The cost to a buyer can be a fraction of the present issuing fees between 25-95 basis points; and the cost to a seller can be $0 for negotiation (zero) instead of 1/10 of a credit value. This is the new world of trade finance using electronic documents over the Internet instead of hard copies being courier around the world to the numerous banks in the chain, all adding their own fees.

However, electronic negotiable documents via the Internet is not the world the international banking community is going to embrace or participate in. To help protect their source of perpetual revenue, the banks have perpetuated and promoted myths surrounding trade finance so as not to reveal the real reason the Internet has not been adopted; “It’s about the money stupid”. Let’s explore some of these myths and raise (open) the curtain from (and expose) the wizard.

The Dirty Dozen: Trade Finance Myths, Debunked

Myth No. 1: International trade banks “finance” trade.

Not True. Trade finance is a cash-cash business, there is no bank ‘financing’ involved. A negotiating bank only credits the exporter’s account after they receive the funds from the issuing bank. In turn, the issuing bank only sends the funds to the negotiating bank after it receives the funds from the buyer. There is simply no financing involved in ‘international trade finance’ services.

Myth No. 2: The Uniform Customs and Practice for Documentary Credits (UCP) is a bank regulation.

Not True. The UCP is published by the International Chamber of Commerce in Paris, France. It has been adopted by the international Banking Commission for use by the banking community. Its guidelines can be used by any company to issue, negotiate and honour credits to a supplier.

Myth No. 3: The UCP’s Articles are regulations international banks are required to follow.

Not True. The UCP provides guidelines for the common application of credits between banks. These guidelines are, however, often codified into local country statues. In the United States, Article 5 of the Uniform Commercial Code deals with transactions involving letters of credit and reflects the UCP guidelines.

Myth No. 4: A documentary letter of credit is a guarantee of payment after shipment.

Not True: A documentary letter of credit is only a ‘conditional promise to honour’ by the issuing bank; not a guarantee of payment. The condition is the documents must conform with the exact terms, conditions and wording of the credit. In 2016, only 64% of document presentations worldwide complied upon first presentation; in other words, they did not have any discrepancies. With only one discrepancy, the issuing bank is no longer obligated to pay the credit and reverts to the buyer to pay the money to the seller. The credit becomes a collection by default. Risk mitigation of non-payment with the banks promise to pay is virtually a coin toss.

Myth No. 5: Confirmation of a letter of credit guarantees payment after shipment by the confirming bank.

Not True. One discrepancy negates the obligation of the confirming bank at the same time it negates the promise to pay by the issuing bank. Documentary letters of credit with or without confirmation by a second bank are not guarantees of payment. They have no commercial value prior to shipment. Letters of credit only have value with the generation of a transport document conveying ownership of tangible goods, which does have value.

Myth No. 6: The negotiating bank ‘authenticates’ the seller’s documents for authenticity.

Not True. Under Article 14 of UCP 600, the documents are accepted ‘on their face’ as being authentic. This is no investigation or checking of any document presented for negotiation by the bank.

Myth No. 7: Hard copy (paper) original documents are required for presentation under a letter of credit.

Not True. Under Article e3 of eUCP Supplement 1 for Electronic Presentation, “Document shall include an electronic record.” Electronic documents are interchangeable with paper documents.

Myth No. 8: Invoices must be manually signed by the issuing company

Not True. Under Article 18.iv of UCP 600, invoices need not be signed electronically or manually. There is no requirement for an invoice to be signed manually or electronically.

Myth No. 9: All ocean bills of lading are negotiable instruments.

Not True. Ocean bills of lading that are consigned to the buyer are no longer negotiable instruments. Once the consignee is specified in any transport waybill, the consignee becomes the owner of the goods at shipment. Cargo can be claimed by the consignee at a seaport the same as it can at an airport with an air waybill.

Myth No. 10: There must be a physical address to present negotiable documents to.

Not True. Under Article e3 of eUCP Supplement 1 for Electronic Presentation, the place for presentation means an electronic address (email address). The eUCP allows banks to use an email address and/or a physical address to receive transport documents for negotiation.

Myth No. 11: Direct contact to the bank via video is a security risk (such as Google Meet or Skype)

Not True. The risk to the bank is not data security from video technology, but rather the risk of being involved with their customer and having to answer questions about their transactions; such as “why is this a discrepancy?” or “where are my documents?” or “what is a reimbursement fee?” or “what is taking so long for my payment?”. The banking network relies on SWIFT for written communication concerning trade finance transactions, which has no provision for video or visual communication (implied in 1972; half a century-old technology).

Myth No. 12: Banks only take five (5) days to examine and pay letters of credit.

Not True. A negotiating bank may only take five days as allotted by the UCP to examine submitted documents. However, seldom mentioned is the time needed to courier the documents between the negotiating bank and the issuing bank in another country or the five days allotted for examination by the issuing bank. The average time from the bill of lading date to payment to the exporter with a letter of credit is 24 days not 5.

As a side note, bank employees involved with trade and trade finance within the banking community are highly professional and strive to assist their customers. They are the unsung heroes that make their bank’s archaic system work.

Summary

Although the outlook for the world’s trade finance banking community adopting eUCP electronic documentation and the Internet is bleak, all is not dark and lost. Non-bank Internet companies are now offering documentary trade credit and documentary trade collection services. These services follow the same UCP guidelines as the banking community at a fraction of the cost and time of payment. The documentary trade credit is a direct alternative for a commercial bank issued documentary letter of credit. The documentary trade payment is a direct alternative for a commercial bank issued documentary collection. There are no international banks involved with issuing, advising, examining or negotiating payment. They do however, follow the exact same UCP procedures and protocols as commercial trade banks worldwide. When the party’s use a non-bank company for foreign exchange and transfer the entire process is outside of bank processing.

Conclusion

The future is happening. Just as courier and containerization provided global businesses with new and profound capabilities online trade is providing a new and profound capability for the hundreds of thousands of importers, exporters and freight forwarders worldwide to decrease the time and cost of financing trade and getting paid.

About John W Dunlop

Mr Dunlop’s trade finance expertise comes from over thirty years managing letter of credit and collection transactions from purchase order to final payment. He has developed proprietary software systems based on the eUCP (patent pending) to assist exporters and importers to move online (Internet) instead of using paper hard copy documents.