Enterprises in emerging and developing economies (EDEs) face enormous financing challenges to respond to new export market opportunities and grow their businesses sustainably. Medium and long-term investment financing for capital equipment and projects is constrained by poor fundamentals and lengthy due diligence for SMEs.

Enterprises in emerging and developing economies (EDEs) face enormous financing challenges to respond to new export market opportunities and grow their businesses sustainably. Medium and long-term investment financing for capital equipment and projects is constrained by poor fundamentals and lengthy due diligence for SMEs.

Innovative trade financing trials combining de-risking products, technology, and in-country support have tested risk mitigation measures and yielded positive results for business expansion and supply chain sustainability. In this article, we examine the challenges and how financing opportunities could be scaled for widespread application.

The Business Opportunity

Whilst European countries economies are in the doldrums, other parts of the world see growth opportunities. The African Continental Free Trade Agreement, AfCFTA will be formally launched on 30 May 2020. All African Union countries except Nigeria have now signed-up to the agreement. AfCFTA is expected to generate $4Tn in new trade between African countries over the next ten years. By 2030, according to the Brookings Institution, 2/3 of the global middle-class population is expected to be in Asia, which will need to source much of its inputs for rising consumption from Africa and other low or middle-income Asian countries. In the Western hemisphere, growth in trade around the greater Caribbean region is forecast by the World Bank to top 5.6% in 2020. Increasing the income from value-added trade is a priority for highly indebted producer countries to reduce economic vulnerability, but 80% of productive capacity in these countries is provided by SMEs, who we know have limited access to financing for expansion.

AfCFTA is expected to generate $4Tn in new trade between its 54 member countries over the next ten years. By 2030, according to the Brookings Institution, 2/3 of the global middle-class population will be in Asia. Most of their needs will be supplied from Africa and other low or middle-income Asian countries. The World Bank forecasts growth in trade around the greater Caribbean region to top 5.6% in 2020. Increasing income from value-added trade is a priority to reduce economic vulnerability for highly indebted producer countries. In each of these regions, SMEs provide >70% of productive capacity yet have limited access to affordable financing for expansion.

Supply chains are already vulnerable to climate events and poor labour conditions so, if we are to learn from past mistakes, this new expansion of trade must have a lower environmental impact and be more inclusive. Responsible international buyers and consumers are demanding that the Banks involved also demonstrate their contribution to sustainability.

Whilst European countries economies are in the doldrums, other parts of the world see growth opportunities. The African Continental Free Trade Agreement, AfCFTA will be formally launched on 30 May 2020. As cross border friction recedes, AfCFTA is expected to generate $4Tn in new trade between its 54 member countries over the next ten years. By 2030, according to the Brookings Institution, 2/3 of the global middle-class population will be in Asia. Most of their needs will be supplied from Africa and other low or middle-income Asian countries. The World Bank forecasts growth in trade around the greater Caribbean region to top 5.6% in 2020. Increasing income from value-added trade is a priority to reduce economic vulnerability for highly indebted producer countries. In each of these regions, SMEs provide >70% of productive capacity yet have limited access to affordable financing for expansion.

Supply chains are already vulnerable to climate events and poor labour conditions so, if we are to learn from past mistakes, this new expansion of trade must have a lower environmental impact and be more inclusive. Responsible international buyers and consumers are demanding that the Banks involved also demonstrate their contribution to sustainability.

Two key questions need answering:

- What role short-term trade financing can play alongside investment financing?

- How can trade financing improve sustainability and be commercially viable?

What is holding back sustainable development financing?

At the September 26th meeting of the UN High-level Dialogue on Financing for Development, participants noted that “despite massive pledges of funds for achieving the sustainable Development Goals, capital was not yet getting to where it was needed” and “… progress, particularly on environmental impact and climate change, is a long way behind schedule”.

Realising that financing beyond overseas development aid capacity would be required to meet the 2030 SDGs, many leading aid donors and development finance institutions (DFIs) in 2016 turned to “Blended financing arrangements”. These provide de-risking guarantees through fund managers to attract private sector investment. Whilst de-risking guarantees can shore-up bank returns and reduce retained capital, financial structuring on its own cannot compensate for the shortcomings in country business development support, weak enterprise management skills, poor governance and unsustainable business models.

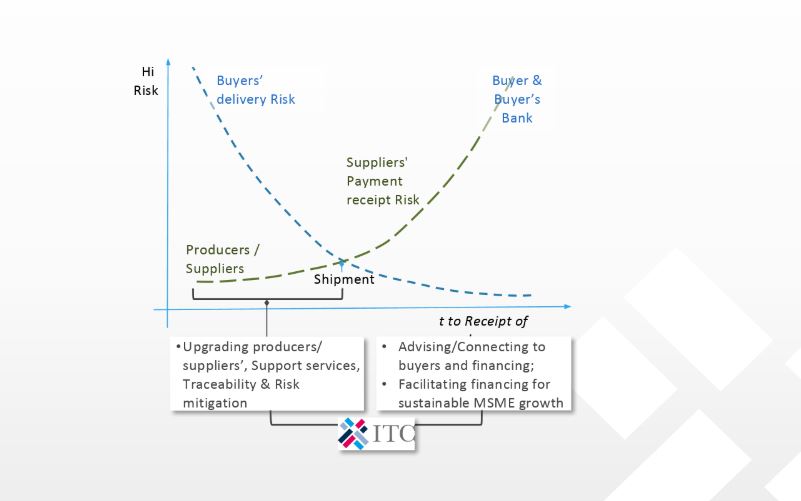

Climate change is accelerating and time is not on our side. Initial investment due diligence in EDEs takes more than 9 months for medium and long-term capital allocations. Investment financing is essential, but alone cannot drive progress towards the SDGs quickly enough. Trade and supply chain financing involving international buyers and fewer short-term risks is approved much more quickly and releases additional cash to suppliers immediately. Could this financing mechanism that thousands of buyers and suppliers use every day play a role in improving sustainability? If the higher perceived risks associated with advance payments in EDEs could be offset, then low interest rate international money advances from buyers could open access to lower cost financing for SME suppliers. This financing would liberate cash flows, which, when guided by local advice and monitoring, would allow even the smallest enterprise or community to use for more sustainable growth.

Our challenge: Re-thinking traditional trade financing structures

The majority of all international trade financing is now concluded through “Open Account” under various forms of payables and factoring arrangements with international buyers rather than through bank-arranged documentary credits. Traditionally, payments to producers in low and middle-income producer countries pass through exporters’ national Tier 1 banks, “international” local agents and financing providers before getting to recipients. Whilst buyers and importers in their own countries may access rates at <3%, recipient country financing actors in the chain each take some risk and add some cost. Buyers’ local agents are paid to ensure that products packed into containers match specifications and transportation requirements.

Default rates are historically <1%, but buyers rarely advance more than 30% of a shipment’s value. Even where payables and receivables financing exist, exporting SMEs and producer communities in their supply chains generally face short-term working-capital financing rates well beyond 20%, limiting their ability to increase factors of production to expand sales. A different set up will be required if lower cost trade financing is to be fully extended to producers and suppliers to accelerate improvements in sustainability and inclusiveness.

New approaches test collaborations & risk mitigation

Trials of potential new structures and implementation partnerships between 2018 and 2019 involved multi-national retail importers, major trade finance banks, academic institutions, financial technology providers, in-country NGOs and de-risking collateral guarantee providers. Distributed ledger technologies (DLT) where used to reduce the time and cost of digital identity on-boarding, monitoring and outcome verifications. The trials applied reduced trade financing rates and advances to improve supplier cash flows and incentivise sustainability. Participants have been quick to point out that these multiple collaborations required discretionary funding to ensure success, particularly for the supervision of recipients’ use of transaction cost savings, sustainability and quality claims verifications and for the preparation of smaller producer beneficiaries.

Banks are constantly balancing financing risks against interest rates, liquidity ratio regulations and returns on assets. In the models tested, costs to MSMEs were reduced by up to 50% and advances increased. Bank collateral guarantees allowed RoA to be preserved, despite reduced interest rate income and higher risks from moving the locus of concessionary rates up the supply chain closer to producers.

Practical technical advice was provided by local services, whilst monitoring and validation using DLT was prepared by NGOs or development agencies. The results showed that short-term cash advances in frequent, smaller amounts were more easily assimilated and applied by MSMEs than large cash injections from investors. This led to continuous incremental upgrading of supply chain sustainability practices. Reports from the 2018-2019 trials show four key elements need to be brought together:

- Responsible trade buyers, trade financing banks and development finance institutions: To provide concessionary trade financing linked to time & purpose-specific collateral de-risking guarantees and sustainability actions;

- Donors: To fund parallel projects with development agencies for recipient country preparation and reinforcement of sustainable business development services;

- Technology providers and in-country financing institutions: To build applications for recipient country enterprise payment tracking, transaction records and sustainability verifications;

- Experienced development agencies: To advise financing providers and regulators, strengthen in-country MSME development and sustainability support capabilities, outcomes verification, supply, processer and shipment risks mitigation.

Globally, such approaches have the potential to stimulate sustainability practices across a massive volume of traded goods if supply-side enterprise operational and delivery risks can be managed. Implementation challenges may be country specific, but strong collaborations with experienced development agencies like the International Trade Centre (ITC) can help to move pilot trials to scale.

ITC’s own projects prepare support services and 1,000s of exporting enterprises and producer communities each year to expand their businesses, reduce risk ratings, meet international standards, upgrade production and financial management. By forming closer alliances with organisations like ITC in donor-funded projects, responsible trade buyers and trade financing banks can internalise development agency experience and move from pilot to commercial viability more rapidly. Examples of ITCs experience can be found in its Annual Reports https://www.intracen.org/itc/about/working-with-itc/corporate-documents/annual-report/ .

How to move ahead at scale

The donor community is recognising the necessity to support projects that combine traditional capability building and access to innovative financing. Both are vital to address structural deficiencies and establish the eco-systems and frameworks required to effectively support sustainable trade development. In this way, affordable advisory services, changes to regulations and financing incentives will be integrated to provide clear business advantages that motivate MSMEs and producer communities to change practices, reduce inequalities and find new, sustainable higher-value markets for their products.

Building mechanisms at a global scale that fill the gaps in trade and capital financing will enable them both to play a role in improving sustainability that will dramatically accelerate attainment of the SDGS. In the words of Mr Mark Carney, The UN Special Envoy for Climate Change and Finance for CoP26, “financing will go a long way to bringing climate change resilience into the heart of every trading decision”.

What do potential target improvements in sustainability look like?

Examples of where concessionary trade finance could stimulate a true multiplier impact on sustainability, inclusion and employment in large and small scale exporting enterprises:

Saffron and Dried Foods: Herat, Afghanistan – 1,000s of saffron farmers and 20 dried foods processers follow organic methods that are being upgraded and certified with support from a 4-year EU-funded project. They require Shari’a compliant trade financing to cover the cost of sustainable inputs, market compliance, community welfare, health and education with an estimated increase in exports by 2021 of US$ 4 Mn pa.

Coconuts and Coconut Products: 9 Caribbean Countries – Sustainable farming practices and good labor practices are being introduced to farmers, processors, and exporters under a 5-year EU-funded project. The project will expand the supply of products already reserved for supplying multinational and inter-island food and cosmetic buyers. Concessional rate trade financing would halve transaction costs. Savings could be managed to provide for plantation re-generation, mixed agriculture, new fair paid jobs and the procurement of sustainable export preparation inputs.

Smallholder Tea Producers: Malawi – Under the TradO pilot project hundreds of smallholder tea farmers in Malawi benefited from savings in trade financing costs that, with the help of local NGOS, were used to improve working practices, reduce environmental footprints and pollution. New technologies supported traceability and transparency along supply chains. Shared data from smallholders improved performance and lead

to earlier, pre-shipment financing, long-term benefits for suppliers and buyers, with net zero impact on production costs.

Donor funded projects, in parallel with trade financing, are vital to address structural deficiencies, establish the eco-systems and frameworks to mitigate risks and effectively support financing of sustainable trade development across all countries. MSMEs and producer communities will fully adopt sustainability practices if supported by clear business advantages, affordable advisory services and financing incentives to find new, higher-value markets for their products and services.

Now launched! Spring Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out, taking a deep dive into trade finance in emerging and developing markets.