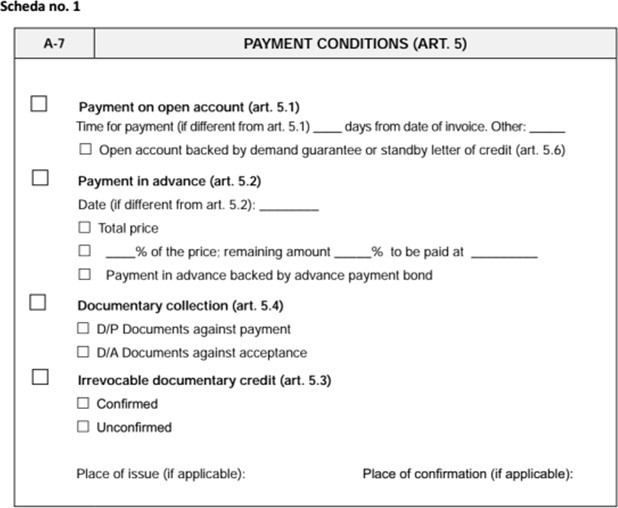

As part of the “ICC Model International Sale Contract” proposed by the International Chamber of Commerce (ICC) of Paris, the following Payment Conditions are reported:

- Payment on open account

- Open account backed by demand guarantee or standby letter of credit

- Payment in advance

- Payment in advance backed by advance payment guarantee

- Documentary collection (D/P – D/A)

- Irrevocable documentary credit

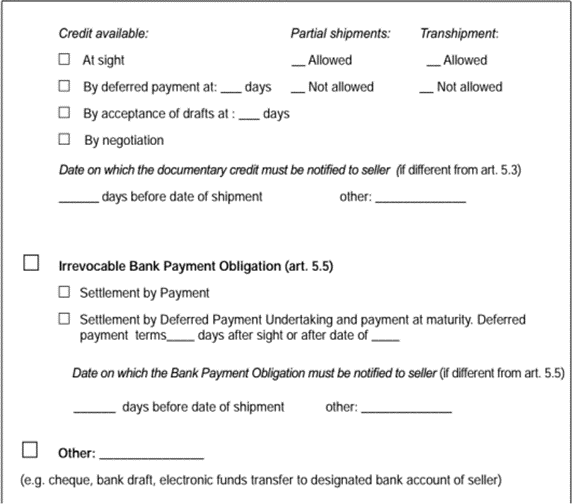

- Irrevocable Bank Payment Obligation

- Other: (e.g. cheque, bank draft, electronic funds transfer to designated bank account of seller)

International Payments Market

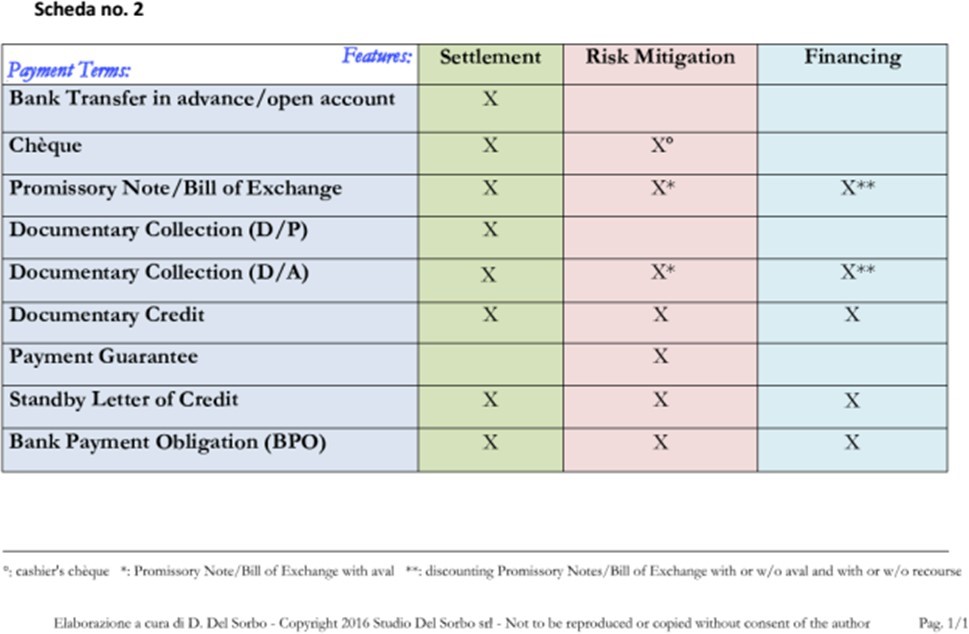

Therefore, there are numerous forms of payment that can be activated in an international sale transaction. The international payments market has been structured to offer tools and solutions to meet the countless needs of a seller and a buyer. In particular, all these forms of payment can perform, at most, 3 “functions”: Settlement, risk mitigation, and financing.

“Settlement” means payment instrument, “risk mitigation” means payment instrument that allows to mitigate the credit risk for the seller, and “financing” means a payment instrument that allows a buyer to defer payment but at the same time, to the seller a sight collection.

Below is a summary sheet:

As can be seen, payment in open account (or by chèque) carries out the mere “settlement” function, as the seller assumes the risk of non-payment by the counterparty. A Cashier’s Chèque, in addition to the settlement function, also carries out the risk mitigation function as it is issued by a bank. A draft bill / Bill of Exchange (or a Promissory Note), instead, is a tool that performs the mere function of settlement, unless it is avalyzed. In this case, it also performs the function of risk mitigation, as the seller knows that the bill will be honored by the avalyzing bank if the drawee does not honor it. In addition, a bill of exchange, whether avalyzed or not, can be discounted by allowing the seller to receive at sight (without recourse or with recourse) and, at the same time, to allow the buyer an extended payment. (It should be noted that the Bill of Exchange Act of 1882 which governs international bills, codifies the “demand draft”.)

The documentary collection (Documentary Collection), on the other hand, is only a tool of the settlement but, in compliance with some conditions, it can become a tool for risk mitigation and financing. Let’s see how.

In the formula D/P (Documents against Payment or more commonly CAD Cash Against Document) with sight payment, the instrument is settlement only, but in version D/A (Documents against Acceptance of a Bill of Exchange), the scenario changes. The c.d. financing facilities that allow documentary collection to become a risk mitigation and financing tool. Let’s see which ones.

1) Foreign Bills for Negotiation (FBNs)

The seller/exporter may be interested in receiving the funds of the sale immediately by asking the remitting bank to purchase, without recourse or with recourse, the Bill of Exchange or the documents (to negotiate) not yet accepted by the drawee/importer. This solution can be implemented if the exporter has an active credit line with the remitting bank. In this situation, the beneficiary of the Bill of Exchange will be the remitting bank. With this solution, documentary collection performs the function of financing and/or risk mitigation depending on the type of discount implemented by the remitting bank (if the discount is with recourse, there is no coverage of the credit risk).

2) Avalisation

To guarantee the payment, the exporter may request, in the collection instruction, the collecting bank to add its own guarantee (or aval) to the Bill of Exchange accepted by the buyer. With this solution, the documentary collection also performs the function of risk mitigation, in addition to the settlement function.

3) Discounting

In the first option, the exporter may request, in the collection instruction, that the Bill of Exchange, after acceptance of the drawee/importer, be discounted by the presenting bank.

Obviously, the presenting bank can decide, independently, whether to make the discount or not and on what basis. Alternatively, the exporter may request that the accepted draft, possibly avalized, be returned to the remitting bank to which the exporter may request to carry out the discount without recourse or with recourse. The exporter could also, alternatively, consider discounting the Bill of Exchange on the free market.

It is specified that, in documentary collection, the described risk mitigation and financing functions are only potential, in the sense that the seller/exporter needs the availability of his own bank (remitting) to discount the Bill of Exchange (or to “buy” the documents), and/or the willingness of the importer to accept the Bill of Exchange and the collecting/presenting bank to aval the draft.

Finally, the letters of credit, the standby letters of credits and the Bank Payment Obligation (which will no longer be operative since 2020) carry out all three functions.

Demand guarantees, instead, perform only the mere function of risk mitigation. A bank guarantee, in fact, cannot be indicated as a means of payment or financing since, if governed by the URDG 758 ICC rules, these rules only require payment undertakings at sight. The standby letter of credits, on the other hand, performs settlement functions as it can be indicated as a form of autonomous payment, without therefore providing for an underlying form of payment. In this case, the seller/beneficiary may engage in the standby declaring that he has fulfilled his contractual obligations (and not that the buyer/applicant has not fulfilled his obligations).

A standby letter of credit can be discounted if governed by UCP 600 ICC or ISP98. This is because unlike the URDG 758 ICC, these rules govern deferred payments.

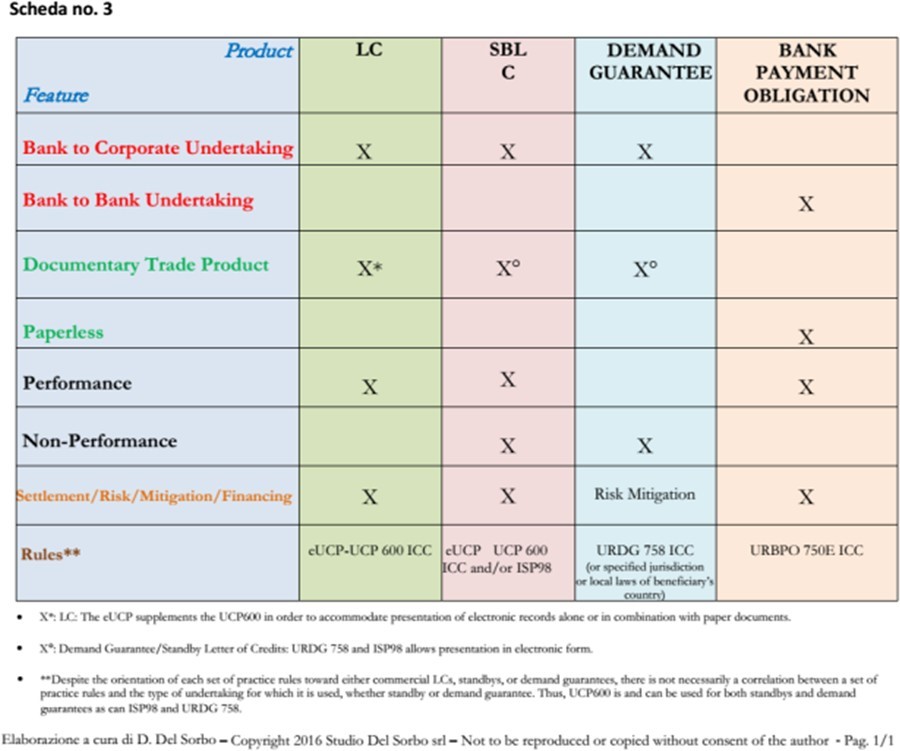

Below is a summary sheet:

This article has been already published on Volume 21, Issue 4, October – December 2019 of TSU – Trade Servive Update Covering practical aspects of payment instructions in international trade edited by Kim Sindberg