Invoice finance in Australia: Introducing Skippr, Innovating and Disrupting the Australian Invoice Finance Market

Australia’s debt finance market is booming, although invoice finance is still in its infancy. Total invoice finance turnover in Australia for the 12 months to the end of December 2015 was $64.4 billion. This is split in $59.1BN in invoice discounting and $5.2BN in invoice factoring.

Historically, invoice financing in Australia has been dominated by the major Australian financial institutions. The larger players have been exiting the arena in recent years. Between 2008 and 2011, BankWest, ANZ and CBA ceased to offer invoice related finance products leaving NAB and St George who have limited appetite for the SME space with most of their invoice discounting books servicing the corporate and institutional space.

The main reason that banks are exiting the market is due to regulatory change resulting from the Basel Accords.

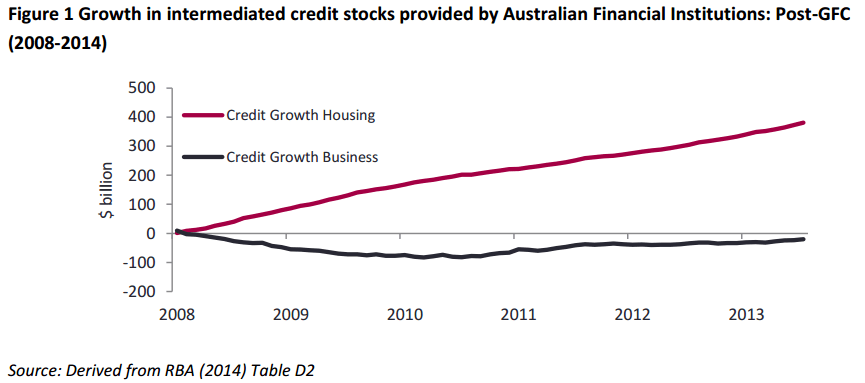

Under Basel III the minimum capital adequacy ratio (CAR) for a bank increased in 2015 from 2% to 7%. One of the ways that a bank can achieve the new CAR targets is by reducing its exposure to higher risk assets. The higher risk weighting attributed to SMEs disincentivizes the banks from lending money to this market segment. The impact is already being felt by SMEs. According to the Reserve Bank of Australia, credit growth for business lending in the period between 2009 and 2014 reduced by 0.04% per month.

The exodus of the major players has fragmented supply in the invoice financing market at a time when there is a growing demand. This has created an opportunity for new invoice financing models.

Invoice finance in Australia is still in its infancy as an asset class. It currently provides more than $60 billion in funding to business a year in Australia and represents less than 5 per cent of GDP. In the UK, invoice finance represents 15 per cent of GDP. Until recently, transactions in this asset class have largely been offline and investors have had limited access to invest and invoice pricing is inefficient. This presents an opportunity for investors to generate good returns from exposure to this asset class.

We spoke to Alistair Lamond and Patrick Crivelli, the founders of Skippr.

TFG: How important are SMEs to our economy?

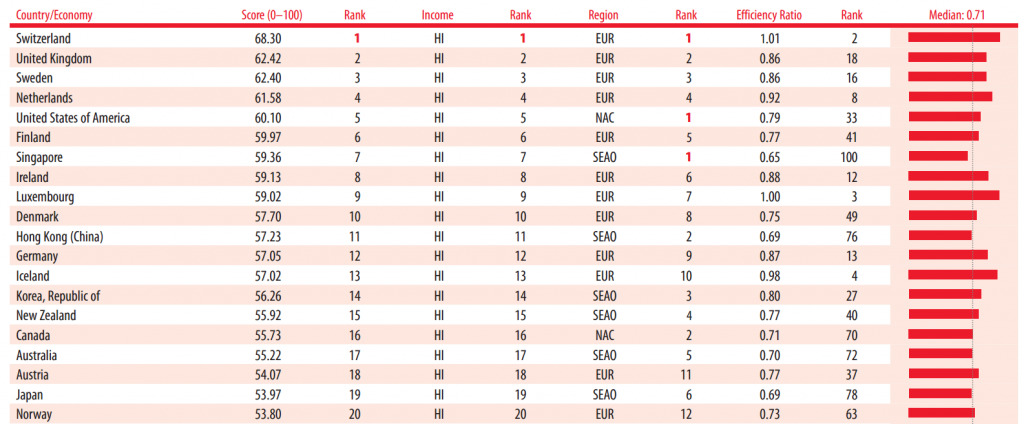

Skippr: There are 2.1m SMEs that make up over 50% of Australia’s GDP and employ roughly 65% of the Australian workforce. SMEs are the foundation to a nation’s innovation and development. Check out the impact SMEs have on the UK economy here. In Australia, the government has finally embraced SME innovation with the announcement of the innovation policy late 2015. Although not nearly as comprehensive as the UKs initiatives, it is still serving as a catalyst to cultural change for SMEs. It couldn’t come sooner as we are currently ranked 17th on the Global Innovation Index. The UK is 2nd.

Global Innovation Index 2008-2015, top 20 markets:

TFG: How did Skippr come about?

Skippr: We saw the huge opportunity in the SME lending space following the success of alternative lending in the UK and US markets. Alistair just spent 4 years working in the UK working for a fintech P2P lender, MarketInvoice, and recognised how this model could be evolved for the Aus market. Pat spending 8 years in HK as a Fund Manager. He saw how otherwise strong businesses were constantly raising expensive equity to fund working capital. This opportunity coupled with the structural problems in the SME lending space caused a lack of investment in banking technology, justified us taking the plunge.

At Skippr we take a more holistic approach to cash flow management. There are quite a few moving parts in the purchase-order-to-payment cycle such as invoicing, credit checking, bank reconciliation and chasing debtors. Instead of building tools to manage with each step in this cycle, our tools help businesses understand cash flow drivers and how to optimise cash flow through invoice funding. What does this mean?

Firstly, through our cash flow forecasting tool businesses can identify particular points in the future when they are likely to run low on cash. Businesses can see how accelerating invoice payments from customers can help them take control of their cash flow and avoid cash crunches. Secondly, we provide the mechanism for businesses to actually accelerate invoice payments through invoice finance. Having more clarity and understanding of cash flow drivers, businesses can smooth out their cash flow cycle using the selective invoice finance tool.

Download our invoice discounting infographic

[rev_slider alias=”invoice finance”]

Download now

TFG: What is Skippr, what do you aim to do, and what are the main features?

Skippr: Skippr is a cash flow management platform. Our vision is to make the cash flow tool into a SME robo-advisory app where a user can easily understand the key drivers impacting cash flow but also give them the levers or tools to control and ‘optimise’ their cash flow. A strong growing business needs to be able to drive as much value out of every dollar in their business. We want our platform to give them the knowledge and tools to achieve that.

A SME can begin their journey with Skippr using the free Cash Flow Forecasting tool that syncs to their online accounting software. Once connected, the user can simply model their cash flow based on expected sales and expenses based on their current cash balance and outstanding invoices and payables. Building and testing scenarios, a predictive analytics model will advise on receivables and payables behaviour based on retrospective data.

Understanding their future cash flows, the user can then optimise cash flow using the invoice finance tool. The user selects invoices they wish to accelerate payment to boost cash flow when required. These invoices reviewed and approved for sale by Skippr, are then sold to an investor and the funds are then advanced within 24 hours. This all occurs in one app.

TFG: Who are your main competitors?

Skippr: Really depends on how broad or narrow you want to look.

From a lending perspective, short-term lending for SMEs has become far more accessible in the last 18 months with a plethora of short-term lenders complemented by a handful of invoice funding platforms fighting to fill a reported $60bn funding gap left by the big four banks. Looking ahead, over the coming 18 months, the true market leaders will be defined by the strength of their customer origination, risk management and strategic partnerships.

Looking at forecasting tools in the market, there are also a plethora of apps available that provide forecasting and cash flow management. Some are built for an accountant, some are built for an SME. Based on these users, there level of sophistication varies, as does the monthly cost.

Looking at our competition there are very few that have tried solving the problem cash flow problem holistically. There are many moving parts to the cash conversion cycle – purchase order to payment. The funder or technology provider that builds or partners with tools that make the cash flow cycle process more transparent, seamless and lower risk, will be the market leaders in the SME space.