In the past 25 years we have witnessed the Russia melt-down, the 2008 financial crisis, commodity frauds, earthquakes, and coups, but throughout operational effectiveness, personal safety, logistics, and cross border movement continued, albeit slightly disrupted; however, with the pandemic this has not been the case.

The last twelve months has been a challenge for all concerned, with the situation still remaining incredibly fluid. Operations managers and human resources departments have had a torrid year, and have valiantly kept all the chess pieces on the multiple boards across all projects, which in the current storm has been quite an achievement.

Global governments rightly responded with ‘stay at home’ orders to protect their citizens; however, for global companies who have to move personnel in and out of projects continuously, these sudden events and changes in the law, were and remain a constant headache.

The purpose of CMA & SMA providers is of course to ensure that the lender knows that their inventory is secure, that there are no surprises, and certainly no unauthorised movements or releases. The frauds of 2020 additionally and justifiably put this under a greater spotlight, yet simultaneously COVID-disrupted operations. Companies have therefore had to adopt a military-style “phased” approach to everything, flippantly referred to in the army as the ‘7xPs’ or Prior, Planning & Preparation, Prevents a Piss, Poor Performance. This focuses on getting the right people into the right project, at the right time to allow for the now standard quarantining to be completed prior to full engagement. We, and as far as I am concerned, other companies have achieved this, albeit on occasions by the skin of our teeth.

“The focus is getting the right people into the right project, at the right time”

Auditing has and continues to be one of the great challenges. When deploying teams one can factor in quarantining, accommodation, and repeat testing, however with audits, whether internal audits or operational managers, this is not always a viable option, as teams would be deployed for weeks to audit a single storage facility. As borders closed, lockdowns came into effect and logistic options dwindled, companies have had to be creative in using new ‘checks and balances’ to undertake an audit. This has included the use of drones, desktop analysis, ‘live link’ remote audits, and limited due diligence on borrowers and storage facilities to identify any developing or potential issues. These measures have in particular had to be brought in where countries such as Australia, Italy, or Spain ‘closed’ and no PCR test, Letter of Authority, Contractual instruction and or other documentation would allow access.

As we come close the pandemic’s global anniversary the commodities market is now reawakening and developing in certain areas. This includes the classic CMA operations inserted as part of inventory financing, yet increasingly the CMA is being inserted to ‘instruct’ and establish forward controls in borrowing base facilities and other forms of commodity financing. I hope these positive developments continue.

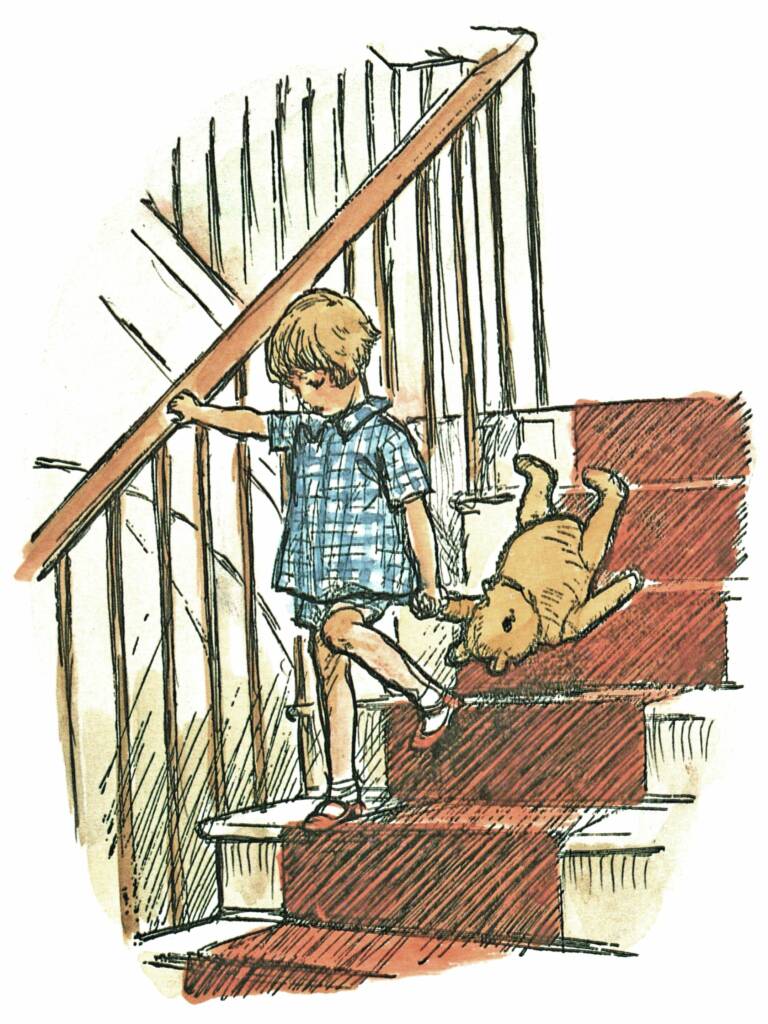

In conclusion the past twelve months have been operationally fraught, to ensure the CMA company can fulfil their obligations. Yet after 12 months, companies have had time to reflect, plan, and adapt their services ‘unlike Edward the bear’ and I am unaware of any major issues or claims hitting the market in the coming weeks, so operations must be working!

‘Here is Edward bear coming downstairs.

Bump, bump, bump on the back of his head behind Christopher Robin.

It is as far as he knows the only way of coming downstairs,

But sometimes he feels there really must be another way,

if only he could stop bumping, for a moment, and think of it.’