2020 was an unprecedented year and its long-term implications are still being debated. The pandemic has had an undeniable impact on trade, from an exponential increase in fraud cases to a surge in default rates. Therefore, addressing some of the key issues surrounding cross-border trade and trade digitisation has become crucial.

A session by Loh Sin Yong from Infocomm Media Development Authority (IMDA) at TXF’s Global Trade Virtual 2021, explored one potential solution to the now highly paper-reliant trade.

Why is paper still needed in trade in 2021?

According to IMDA, the cost of documentation is 20% of the total cost of shipping. Dealing with paper in transactions is complex, costly and time-consuming, as well as being prone to human error and subject to potential fraud.

Despite this, paper is still used. Why? The primary reason why paper documentation is still vastly utilised is due to the nature of trade, normally involving multiple parties and requiring the transfer of large amounts of information. This information should, ideally, be shared directly through digitised data management systems, however, this is not often the case. The parties involved will, oftentimes, utilise data management systems that are not integrated with the ones used by the other parties. This results in the responsibility of accurately and effectively transferring the data to fall on individuals, and individuals are prone to making mistakes.

Different companies having different levels of digital integration and diverging perspectives on the need for digitisation, resulted in the current lack of interoperability between companies and the need for paperless trade.

Why do companies not utilise systems that are easily integrated?

The main reasons are costs and lack of standardisation. It can be quite costly and complex for smaller companies to digitise their information systems. The lack of standardisation is another contributing factor since if companies are not clear on what is required, they are likely to be confused by the vast number of standards in different countries.

This is not a new challenge, however. The industry has been trying to surpass this challenge for decades and the term cross-border paperless trade has been heavily explored.

The next step towards paperless trade

TradeTrust was highlighted in this session as possessing one possible solution. TradeTrust believes that to tackle this issue, it is paramount to start at the root and to digitise the most common trade documents. These include normal documents and transferable documents.

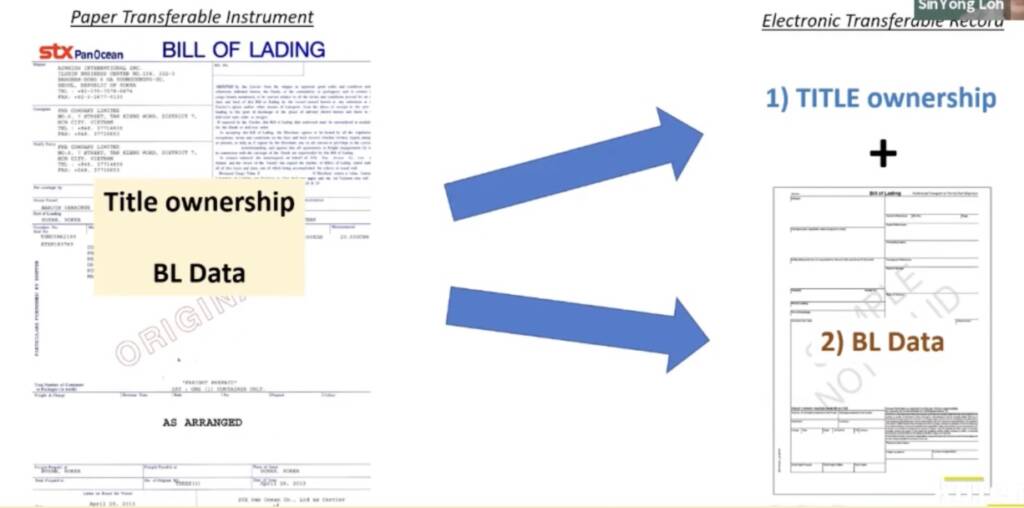

Normal documents such as invoices, purchase orders and certificates of origin, are relatively easy to digitise. The challenge lies in the transferable documents, such as bills of lading, as these have legal implications. To address this issue, TradeTrust has built a framework that provides technical methods to create cost-effective, trustworthy digitised documents.

With a paper bill of lading, for example, the endorsement chain must be carried with the certificates of goods received. However, with the electronic version of a bill of lading one can deal with both components separately without compromising the integrity or validity of the document

For this framework to reach its ultimate goal, however, it will require global government support, as businesses cannot do it on their own.

TradeTrust’s principles:

- It utilises a public blockchain to ensure no singular party has singular access to the information

- Data is not kept on the blockchain to preserve commercial information

- No data format or standard restriction is imposed thus increasing the versatility of the adoption of the framework

- Open source to create full transparency and increase the adoption rate

- MLETR-complaint

Decentralising verification methods

The framework put forth by TradeTrust appears to solve a significant problem in trade by addressing the costly nature of digitisation, and removing the interdependency of the exchanging parties’ systems. The latter enables companies to update their systems whenever required without the need to wait for certain transactions to be finalised and to conduct trade in a much more effective, speedy manner while limiting the potential for fraud.

Successful trials have been conducted in both Australia and the Netherlands. This indicates TradeTrust’s framework may provide a solution to an outstanding problem in the trade industry. Its success, however, depends heavily, like many other initiatives in the world of trade, on the adoption and collaboration of market participants. Should the string of successful trials continue, implementation of this framework will continue to rise as more evidence appears of its efficacy. A problem that has lasted decades appears to be close to an open-sourced, digital solution, as for the first time, we are witnessing the ability to create an electronic document on one singular platform that is verified without the need to put in place costly data exchange infrastructure.