Estimated reading time: 6 minutes

In the shadows of the interconnected world of international trade lies a pervasive threat that silently endangers the security of global markets. Financial crimes, with their detrimental effects on stability and integrity, cast a dark cloud over the world economy, threatening the trust upon which international trade relies. From money laundering to terrorist financing, illicit activities can have far-reaching consequences.

Amidst these challenges, organisations like the Financial Action Task Force (FATF) along with the policies of Anti-Money Laundering (AML) and Know Your Customer (KYC) have emerged as crucial lines of defence, protecting the global financial systems.

But what exactly is the role of FATF and AML/KYC in combating these crimes? How do they contribute to the reliability and transparency of international trade?

In partnership with the ICC UAE’s annual conference, TFG’s Editor, Deepesh Patel, had an insightful discussion with Mohammed Daoud, Director and Industry Practice Lead at Moody’s to understand the role of FATF and KYC/AML in the relentless fight against financial crimes.

The global guardian against financial crime: The FATF mission

The Financial Action Task Force (FATF) is an intergovernmental organization established by the G7 summit in 1989. It serves as the global watchdog for money laundering and terrorist financing, promoting the implementation of AML/CFT procedures.

The FATF encourages jurisdictions worldwide to incorporate measures combating illicit financial activities into their legislative frameworks through a set of recommendations known as the “40 plus nine” recommendations. By advocating for updated laws, the FATF facilitates a country’s ability to freeze assets, close accounts, and conduct thorough investigations.

Moreover, every few years, the FATF conducts a mutual evaluation, which is a review process to assess if a country has effectively implemented new legislation, policies, and supervision against those crimes. Based on this evaluation, a country may pass, or be placed on a scrutiny or grey list in a bid to help the country improve its efforts in fighting money laundering and terrorist financing.

According to Daoud, the enforcement of FATF regulations has evolved over the years. Initially, the focus was primarily on tier-one banks and large financial institutions. However, Daoud clarified that this approach has gradually changed and expanded to encompass cross-border remittances due to their perceived high risk.

Establishing KYC guidelines and customer due diligence has been instrumental in mitigating these risks. Subsequently, the insurance sector and capital markets were also impacted by enforcement measures. Most recently, the non-financial sector has come under scrutiny, with countries facing more stringent evaluations.

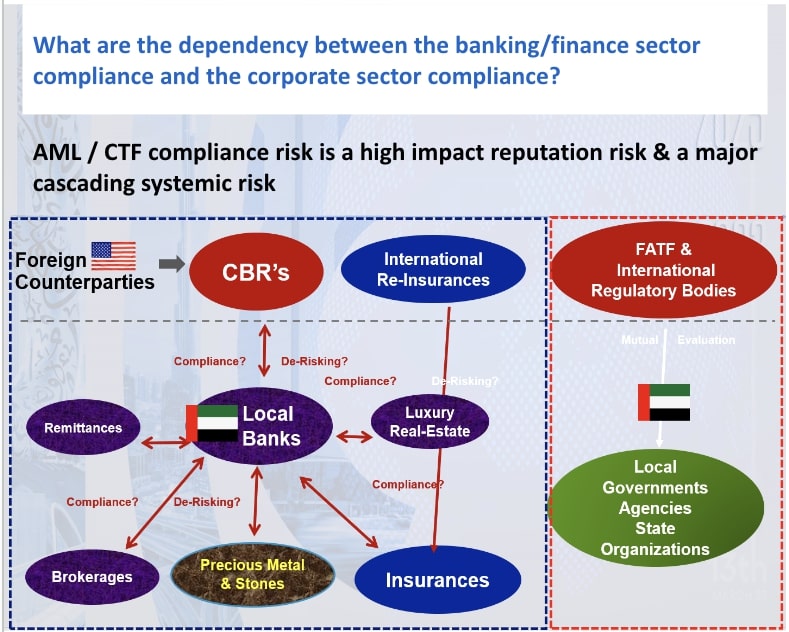

The interdependence of banking and corporate sector compliance: Defying the cascading risks

In today’s global economy, the banking and corporate sectors are intricately interconnected, forming a symbiotic relationship that significantly impacts financial stability and regulatory compliance. This close interdependence between these two sectors creates a delicate balance, where the failure to uphold compliance standards in one sector can trigger a cascading effect of risks throughout the entire financial system.

Compliance within the financial landscape is driven not only by local and international regulators but also by the inherent connectivity of the banking system. When banks engage in cross-border transactions with counterparties in other countries, they are bound to adhere to the regulations of those counterparties’ jurisdictions, particularly in emerging markets that heavily rely on third-party transactions and international currencies like the US dollar.

As Daoud explained, this principle of reciprocity, along with the expectation of shared values and guidelines among business partners, creates a complex compliance network.

While there was once a misconception that banks alone were solely responsible for transaction integrity, regulatory authorities have clarified that the corporate sector also holds liability to adhere to AML principles and KYC. Shifting the focus to the corporate sector recognises the potential misuse of shell companies for illicit activities, prompting the need for thorough due diligence and scrutiny.

Aggregators: Empowering effective compliance screening

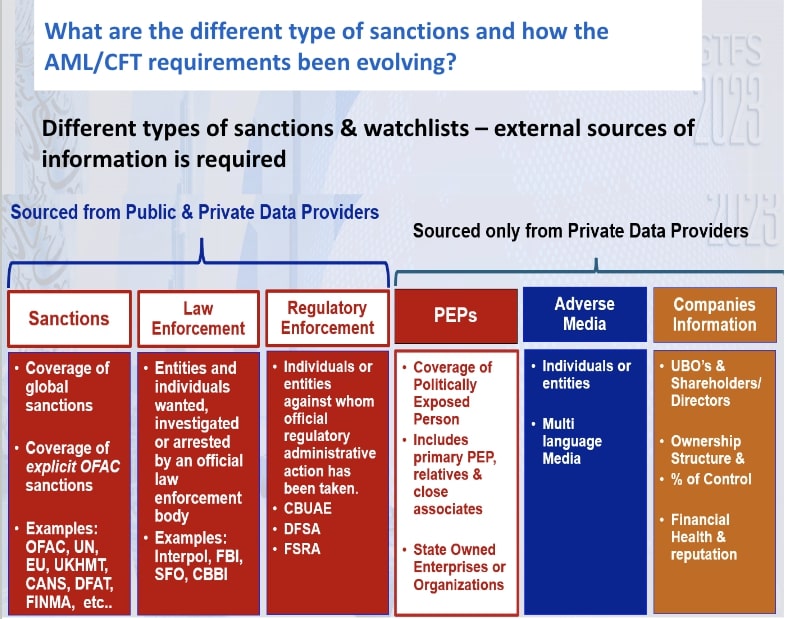

Compliance screening plays an indispensable role in safeguarding the integrity of transactions and mitigating risks associated with illicit activities. The utilisation of external sanctions data, not only influences the effectiveness of compliance programs but also determines their ease of implementation. As Daoud highlighted, “There is a lot of external sanctions data that has a significant impact on the easiness and effectiveness of compliance.”

With over 300 lists issued by international regulatory bodies, each with its own set of criteria, navigating the vast array of sanctions lists can be troublesome. This challenge is further compounded by the diverse formats employed by different regulatory bodies such as the OFAC 50% sanctions rule, which extends sanctions to corporate entities with more than 50% ownership by a sanctioned party.

To address the complexity of diverse sanctions lists, aggregators, such as Moody’s, act as intermediaries, curating, standardising, and simplifying the data. Furthermore, aggregator databases not only include sanctions information but also cover the three compliance screening levels: sanctions, politically exposed persons (PEPs), and enhanced due diligence (EDD).

In addition, Daoud emphasised that it is equally essential to consider the impact of compliance regulations on other key actors within the industry. This includes verifying the identity of import-export clients, examining vessels and carriers, and assessing the role of agents, customs, and transport companies.

The complexity of trading operations makes trade-based money laundering a considerable concern, particularly during periods of geopolitical tensions. Instances of shell companies being used to evade sanctions and circumvent scrutiny have been observed, calling for increased diligence and monitoring in the threat finance domain.

Unleashing the power of technology for robust trade finance compliance

Trade finance compliance has undergone a remarkable transformation with the aid of technology, revolutionising processes and elevating compliance standards.

Daoud presented the transformative impact of technology in trade finance, shedding light on the following key applications and the tangible benefits they bring to all stakeholders involved:

- KYC and Due Diligence Solutions: Technology-driven solutions streamline customer onboarding and ongoing monitoring, by verifying identities, assessing risk profiles, and ensuring AML/CFT compliance.

- Document Comparison and Reconciliation: Advanced technologies can swiftly scan and analyse complex trade documents, reducing errors and ensuring compliance with documentary credit requirements.

- Tracking and Monitoring Systems: Technology empowers institutions to track threat finance over time, identifying patterns, profiling transactions, and uncovering suspicious activities related to dual-use goods or sanctions evasion.

With an abundance of technology-driven solutions, it is apparent that the integration of technology in trade finance heralds a new era of compliance, where streamlined processes and enhanced monitoring capabilities facilitate secure and transparent trade transactions.