- In 2019, global trade flows declined 2% from USD 18.5 trillion to USD 18.1 trillion, underpinning a trade finance revenue pool of USD 46 billion.

- ICC Trade Register data confirms default rates from 2008-2018 are low across all products and regions surveyed.

- The report can be used as a reference point for policymakers when considering how to support trade and trade financing during, and after, the COVID-19 crisis

The International Chamber of Commerce (ICC) Banking Commission has released its 2019 Trade Register Report, revealing COVID-19’s potential to disrupt global trade, while also highlighting the low-risk nature of trade finance. The report reiterates the importance for all stakeholders to take this into account to ensure accessibility of trade finance to all businesses around the world, especially to micro and small and medium enterprises (MSMEs).

“The ICC Trade Register is indispensable for global banking, policymakers, and fostering dialogue with regulators on a global scale,” says Olivier Paul, Director, Finance for Development, ICC. “It provides an objective and transparent view of the credit risk profile and characteristics of trade, supply chain and export finance.”

As we enter a new decade, the trends of the past decade will doubtlessly accelerate and continue to shape both trade and the world around us: growing digitisation, the rise of industry disrupters, the world’s march towards increased interconnectedness, the rise in the impact and awareness of climate change, and political tensions disrupting the long-held assumptions of the world order. Indeed, the ways that trade and trade finance operate today look radically different from what they did at the start of the past two decades. Since 2000, global trade flows have trebled from USD 6.2 trillion to USD 18.1 trillion in 2019 – undoubtedly made possible through trade finance products which offer liquidity and risk mitigation solutions for importers and exporters, allowing them to transact with confidence across borders.

Two decades on: affirming trade finance’s decade-long low-risk profile

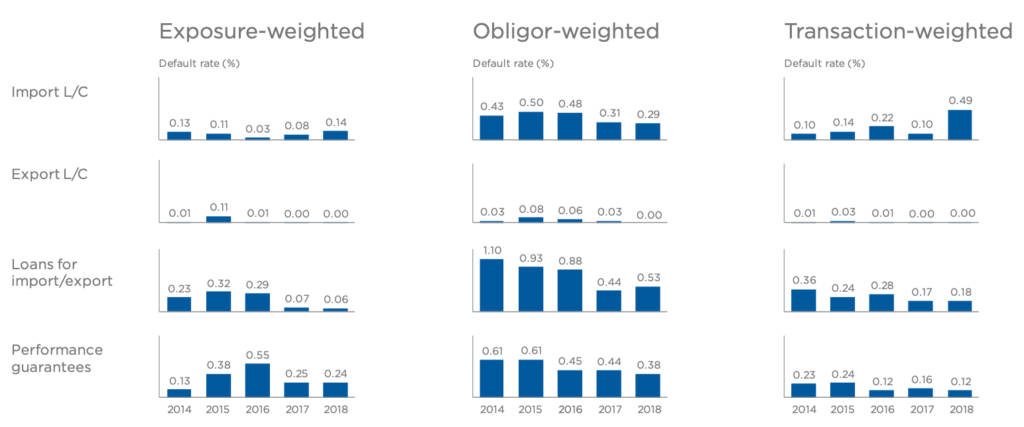

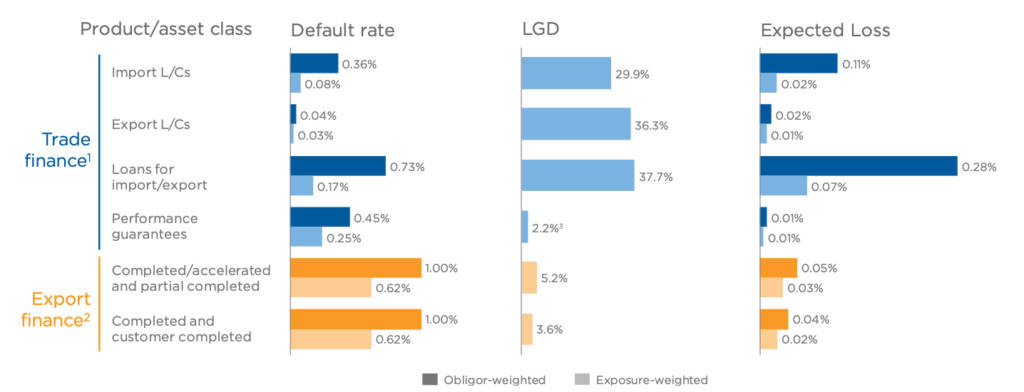

This year’s report captures a full decade of trade finance-related data – containing nearly USD 16 trillion of exposures from 32 million transactions across six products and 25 banks worldwide. Results indicate that default rates for trade finance products from 2008-2018 are low across all products and regions, averaging 0.36% for import letters of credit (L/Cs), 0.04% for export L/Cs, 0.73% for loans for import/export, and 0.45% for performance guarantees (all when weighted by obligor).

These results are broadly in line with the decline in risk seen in 2017 into 2018, likely driven by strong GDP growth and the increased use of open account products, mitigated in part by ongoing trade tensions and the 2018 defaults of a few large corporates.

For trade finance products, the latest Trade Register data suggests that default rates have largely remained the same as, or lower than, in 2017. Import L/Cs are a notable exception to this, with an increase in default rates when weighted by exposures and transactions.

This rise was driven by the default of a major French retailer, whose impact was felt across its global supply chain. While it is encouraging to note that the rise in import L/C defaults was not driven by an industry-wide issue, it is still revelatory to observe the wide-scale impact of a single corporate default.

Expected Losses, on the other hand, are similar across products when compared to 2017. This is consistent when viewed from either an obligor-weighted or exposure- weighted perspective.

Default Rates: The Winners and Losers

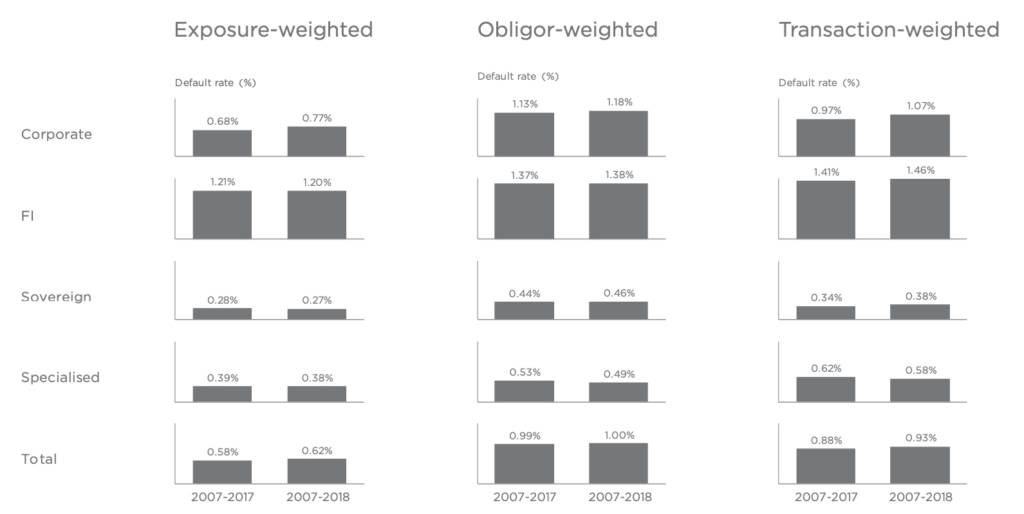

Conversely, export finance has seen increases in default rates in 2018. This growth in default rates is not uniform across asset categories; the corporates asset class had the largest increase while specialised asset class defaults decreased. The regional perspective is mixed, with North America in particular and Europe to a lesser extent seeing increases in default rates while the Middle East saw a decline (even though it retains the highest default rates across the regions). In spite of these increases and the geographic variance, export finance credit risk for banks remains very low, driven in particular by Export Credit Agency (ECA) backing, which is typically at around 95%. As such, recovery rates for defaulting transactions are typically above 95%, resulting in low overall Expected Losses.

The supply chain finance data set, specifically covering payables finance, is only in its second year of ICC Trade Register coverage and is hence comparatively small; however, initial indications are that the probability of default for SCF is comparable to other short-term trade finance products. Nevertheless, 2018 saw an increase in SCF defaults due to the default of a single UK-based construction firm, which impacted suppliers around the world. Over the coming years, ICC will collect further data to substantiate and disaggregate these results so that they can be used to inform regulatory, capital, and accounting policies.

The impact of COVID-19 on trade flows and the risk profile of trade

The report also features a number of topical contributions and commentary on global trade from leading experts – including a comprehensive analysis of COVID-19’s impact on global trade. ICC partnered with Boston Consulting Group (BCG) to model scenarios around the potential impact of COVID-19 on trade. While the ultimate impact of the virus will depend on the scale and duration of the pandemic itself, BCG assesses scenarios in which global trade could fall by anywhere between 11% and 30% in 2020.

“It is important to remember that, relative to other forms of financing, trade finance products remain a low risk form of financing,” says Krishnan Ramadurai, Chair of the ICC Trade Register Project. “COVID-19 behoves us to recognise the unprecedented nature of the health crisis – its impact on economic activity- and acknowledge that while credit risk and defaults will increase in the near term, trade finance will likely continue to perform better than other forms of financing, given its strong historical performance.”

The COVID-19 pandemic – and the global economic downturn that has followed – will in the short term likely reverse the growth in global trade over the past decade. As discussed later in the report, various scenarios suggest the 2020 value of global trade could decline by anywhere from 11% to 30%. With supply chains disrupted and consumer demand plummeting at an unprecedented rate, it is understandable that the virus is top of mind for those involved in global trade.

As a result, the risk profile of trade products will likely increase this calendar year – data that is not yet reflected in the bank data utilised by the Trade Register. At the same time, the world will at some point emerge from this crisis. Some variation of business as usual will, slowly, resume – a new normal will take hold. The short-term impacts of COVID-19 aside, the virus will likely disrupt and perhaps accelerate existing industry trends. The risk mitigating properties of documentary trade may grow in popularity (reversing the ongoing shift to open account trade), although this may be less pronounced than in previous crises as more attention has been placed on how to apply risk mitigation to SCF. Further, the challenges in producing original documentation may help speed up the shift to digital in the industry. Importers and exporters, trade banks, and regulators must not only focus on immediate risk mitigation but also on how to incorporate the lessons learned from this crisis into how global trade operates and is governed in the future.

As the banking environment continues to evolve and respond to the changing political, economic, and regulatory milieu, trade finance and export finance will also need to adapt and evolve. This context makes it more critical than ever for banks to understand the risk profiles of their trade finance and export finance products.

To read the full 2019 ICC Trade Register Report, please click link below.