Estimated reading time: 3 minutes

- The ICC DSI has published 22 case studies of actors who are digitalising trade documents across the supply chain

- The study builds on the Key Trade Documents and Data Element (KTDDE) Framework, which in April 2024, compiled 36 key trade documents

- The KTDDE uses interoperable frameworks and globally accepted digital standards to address challenges across their supply chains.

Categorising the 4 billion paper documents that are currently logjammed in paper trade is no easy feat.

In April 2024, the International Chamber of Commerce’s Digital Standards Initiative (ICC DSI) launched the Key Trade Documents and Data Element (KTDDE) Framework, an industry-wide collaboration to align data across key trade documents, promoting interoperability and data sharing.

In an era where efficiency and transparency are paramount, the digitalisation of trade documents is revolutionising global supply chains.

The cited benefits include streamlining operations, enhancing security, and reducing costs.

The project, which began in November 2022, compiled 36 key trade documents, from Letters of Credit to Promissory Notes, across shipping and logistics, commercial documents, cross-border regulatory compliance and financial services and fraud prevention.

The KTDDE Framework does not introduce new electronic trade document standards, but rather, provides a means to connect and interoperate the standards that are already in use in business-to-government compliance processes as well as business-to- business transactions in the international supply chain.

In its most recent report, ‘Key Trade Documents and Data Element on the Frontline’, ICC DSI showcases 22 supply chain actors who are implementing and adopting the KTDDE digital standard.

Hong Kong Monetary Authority and Commercial Data Interchange: Enhancing consent-based data infrastructure to streamline loan approval for SMEs

Another case study involved the Hong Kong Monetary Authority (HKMA), which created a solution that allows for more effective data exchange between platforms, banks, and businesses.

In October 2022, HKMA launched a commercial data exchange (CDI), aimed at enhancing Hong Kong’s consent-based data infrastructure. This infrastructure aimed to encourage and ease data sharing, opening more opportunities for fintech companies.

A beneficiary of the CDI was the fintech platform Tradelink Electronic Commerce Limited (Tradelink), which services small- and medium-sized enterprises (SMEs) during redundant loan processes.

With its clients’ consent, this partnership allows Tradelink to securely share digitalised, standardised, and structured trade declaration data with banks. This reduces paper and streamlines the loan approval process.

Sucafina: Transforming the coffee trade with digital solutions

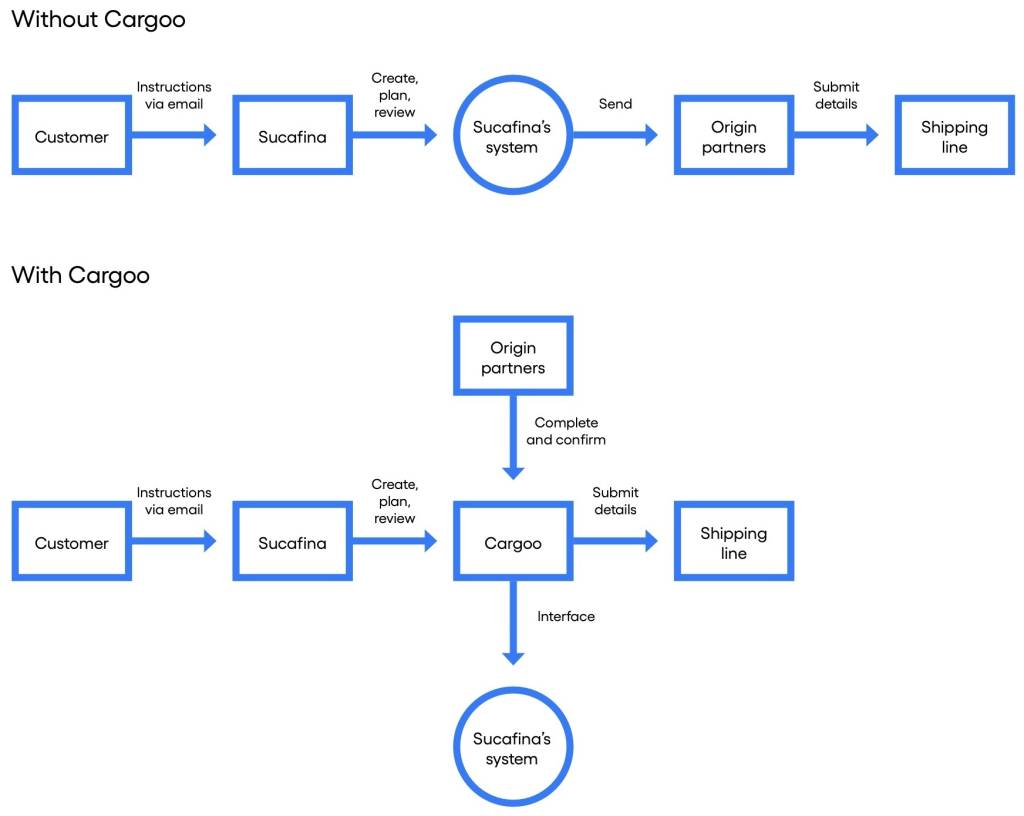

One case study explored Switzerland-based Sucafina, a global coffee trading house, partnering with Cargoo, a SaaS Ocean transportation platform, which was able to handle the submission bookings, VGM (verified gross mass), SIs (shipping instructions), and Bill of Lading (BL) instructions. A link between Cargoo and Sucafina’s planning system ensured automatic updates, eliminating the need for manual data entry.

According to the report, the time to update booking information was reduced from five minutes manually to instant updates. SI submissions were reduced from 10 minutes to four minutes, and client updates were reduced by 50%, from eight emails per month to four.

Raphaelle Hemmerlin, Chief Transformation Officer, Sucafina SA, said, “The use of standardised data elements across the board has led to a leaner approach to shipping by reducing email exchange, cutting down processing time for shipments, and allowing employees to focus on continuous improvement rather than administrative tasks.”

Source: Sucafina, ICC DSI Report: “Key Trade Documents and Data Element on the Frontline”

The report highlighted that “digitalisation can start from anywhere in the supply chain”, suggesting that companies should consider easier opportunities that can automate manual tasks, enhance the customer-processes and demonstrate quick benefit.

Digitalisation solutions are varied, requiring a mix of in-house or off-the-shelf solutions, that greatly depend on the specific challenges and requirements of the organisation.

As companies continue to embrace digital workflows, the global trade community can anticipate reduced costs, faster processing times, and enhanced reliability in trade operations.