Just before the Chinese Rooster Year was about to came, the debt market of China wasn’t in the festival mood. On the 25 January 2017, the government bonds futures market experienced a significant plummet. Not only the 10-year dominant contract declined over 1% at some point of that day, handing debt market its worst day since 29 December 2016, the 10-year inter-bank yield of spot-trading bond rose to almost 3.3%. The true reason behind it was that central bank of China raised interest rates of several financial tools on 24 January, especially the Medium-term Lending Facility (known as MLF). Why would central bank choose to do it? How will this policy affect the debt market and financial market in general? Was the debt market overreacting? A more detailed discussion will be made below.

Introduction

The central bank is a government-run agency responsible for controlling the national money supply, credit conditions, and regulating the financial system, especially commercial banks and other savings institutions. Money supply determines the amount of money in the market, money stock again determines the liquidity.

The basic ways for central banks to do are to raise interest rates or lower interest rates. The magnitude of such policies however, is rather large, thus the central bank won’t frequently use it just for short-term liquidity. Therefore, central bank of China have introduced several approaches to regulate financial markets: like QE (Quantitative Easing), PSL (Pledged Supplementary Lending), MLF (Medium-term Lending Facility) and SLF (Standing Lending Facility).

Differences between several monetary tools

Quantitative Easing is probably the most renowned approach because of China’s 4 trillion programme to stimulate the economy after 2008 financial crisis. However, the most common monetary policy tools used by central banks of China are SLF and MLF. The People’s Bank of China introduced Standing Lending Facility in early 2013. MLF is issued in the form of collateral, with high-credit rating and high-quality credit assets as collaterals. The main issue object is commercial banks as well as policy banks. The most noticeable difference between MLF and SLF is probably that while SLF mainly used in short-term, MLF are aiming to improve liquidity in 3-months period. The another distinction between these two is that commercial banks can renew the contract when using MLF.

Often, commercial banks borrowed from short-term funds to make long-term loans. When short-term funds reach the maturity, the commercial banks have to re-borrow funds, which means they have to bear more short-term interest rate risks and costs. However, with MLF, commercial banks don’t need borrow funds so frequently in order to issue long-term loans.

Was debt market overreacting?

A tighter monetary policy

Before we know whether debt market overreact or not, we have to understand why debt market reacted like this in the first place, that is to say, why an increase in MLF rates would cause a decrease in debt market, especially in government debt. A rise in interest rates will consequently raise financing costs, especially costs of financial institutions. Increased capital costs will slow the pace of asset expansion in financial institutions, reduce their leverage, and reduce the corresponding gains. Therefore this policy can also interpreted as a tight monetary policy.

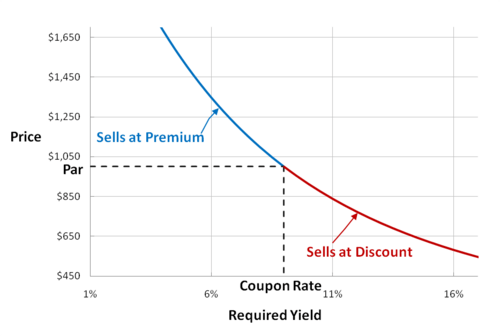

Relationships between bond price and yield

The bond price refers to the price at which the bond is issued. The market price of the bond is often not equal to its face value. In other words, the face value of the bond is fixed, but its price is often changing. The coupon rate is simply the annual payment paid by issuer relative to the bond’s face value. A bond’s yield is the rate which make the present value of all future cash flows equal to the price. The relations of them are listed below.

It can be easily seen that bond prices and bond yields are negatively correlated, the higher the price, the lower the yield and vice versa. When commercial banks raise interest rates, investors will tend to selling more bonds to invest in the bank, thus making bond prices to fall and pushing up the bond yields. This was exactly what happened on 25 January 2017, which was a sign that the central bank’s monetary policy was fully reversed, indicating that monetary easing since 2014 was over. The central bank of China are deepening the “de-leveraging”, making the monetary policy more neutral and prudent.

Projections in 6 months

Regarding to the open market operations in next 6 months, it is believed that central bank of China will continue to raise interest rates, in line with the path of “monetary market invisibly raise interest rates, then raise the MLF rates and finally raise the open market operations rates.” From my point of view, the central bank of China will gradually change their monetary policy from the “hidden tightening” to the “explicit tightening”, which will cause long-term pressure on the debt market.

Impacts on mortgage market

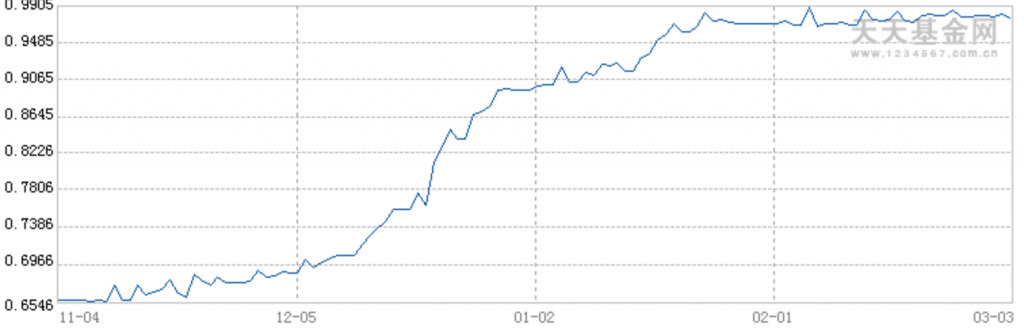

The graph below illustrated the yield of famous “Yuebao fund”, which showed the upward-trend of fund yield. It is hard to believe that when financing costs continually to rise up, banks will still provide the same mortgage rates to borrowers. Therefore the mortgage rates will continue to go up, suppressing the real-estate bubbles. With the real-estate market in China more and more deviating from its fundamental value, housing prices will become increasingly sensitive to monetary policies. Since October 2016, the regulation of limiting purchase of house has been introduced, showing government’s determination to put mortgage markets back in order.

Source :https://fund.eastmoney.com/f10/jjjz_000198.html

Impacts on stock market

Traditionally thinking, if the central bank continued to raise the short-to-long term lending rates, the stock market will fall under pressure. However, this is not the case with the “MLF action”. Unlike the conventional increase in deposit and lending rates, the increase in MLF is more target-specific. Also, the main goal of this policy is to de-leveraging and reduce ongoing risks, not to curb the inflation and overheating economy. By regulating the debt and mortgage market, China pushes the money into real economy. Consequently, it may provide bull news to the stock market, and give the investors sufficient confidence.

Conclusions

The move of Chinese central bank indicating a more neutral and prudent monetary policy, which means their top priority is to reduce the potential risks and to de-leverage. The “MLF action” will give a setback to the debt and mortgage markets, whereas bring rather exciting news to the stock market. Meanwhile, the Chinese economy will be challenged by uncertainty environment even more.