Global trade is made possible by an intricate value and supply chain ecosystem, albeit one that is barely online in the wake of COVID-19. Across supply chains, trade finance has provided invaluable instruments that to date remain vital enablers to the trade ecosystem. Subsequently, Trade Finance Programs (TFPs) are reinforcing financial and risk mitigation capabilities of market players to amply respond to trade finance demands across the globe

The Trade Finance Gap

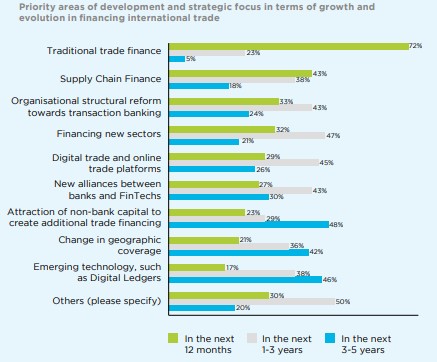

For many years, traditional trade finance instruments like documentary collections, documentary credits, and demand guarantees have been used to facilitate cross-border trade. With trade evolving and expanding, new instruments notably in supply chain finance, have emerged on account of demand-driven innovation across industry. The success and therefore acceptance of these instruments in the market attests to their credibility as enablers to trade.

However, it has become increasingly evident that trade finance support has not expanded in tandem with trade growth primarily in terms of scale and access. To provide context to this inadequacy, a 2019 Asian Development Bank (ADB) survey on trade finance gaps growth and jobs, revealed a whopping $1.5 trillion gap in global trade finance, which gap should have now widened further on account of the economic slowdown coupled with a shift in priority spending in response to COVID-19 and its impact across the globe. This simply means that portions of resources that were either allocated or could have easily been mobilised towards trade have had to be repurposed to humanitarian expenditure. Scaling it down, in 2013, Africa had a gap of $94 billion, dropping only to $91 billion the following year. And to further appreciate the size of the global trade finance gap, the World Bank put Sub-Saharan Africa’s 2018 GDP at $1.714 trillion.

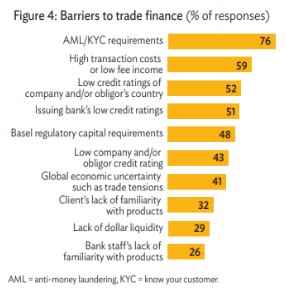

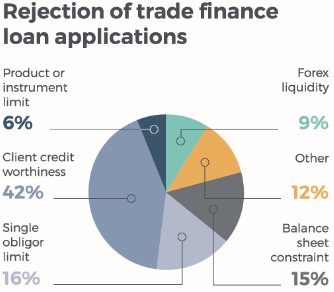

Trade finance providers are typically Financial Institutions, mainly commercial banks although in recent years, with the advent of financial technology, smaller nonbank financial outfits are disrupting this space. However, what is key here is that banks are just as much businesses that seek to create value and operate profitably and at that, operate in a highly regulated environment. As such, risk management is core to banking business with exposures prudently taken on, monitored, and mitigated. Inadvertently, this means that there will be limitations to the scale and depth of offering even in the trade finance suite.

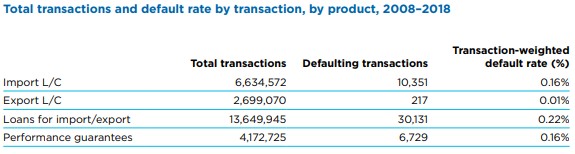

Small and Medium Enterprises (SMEs) appear to bear the brunt and take the lion’s share of this gap mainly on account of higher risk profiling. This risk perception is mostly tagged to governance shortfalls that are evidenced for instance in failure to meet stringent Know Your Customer, and credit application requirements. This disadvantages SMEs as evidenced in AfDB’s 2017 Trade Finance in Africa Survey Report which found that only 28% of banks’ total trade finance portfolios target SMEs, whose 14% default rate in 2014 was far higher than the overall average trade finance default rate of 5%, and more recently, in ADB’s 2019 survey.

This justifies the need for SME applications to benefit from some exemptions and not be subjected to the same stringent scrutiny as structured large and mid-sized corporates and yet this kind of dispensation requires support. The ability to relax some requirements and take on additional risk is well suited to a risk-sharing arrangement. Moreover, support to SMEs tends to extend to helping structure the business better and improve governance to make it more bankable, which in the past justified banks’ subdued engagement with SMEs.

In comes Trade Finance Programs (TFPs) Multilateral Development Banks have increased their support through financing and guarantee lines. A 2018 Global Survey by the International Chamber of Commerce puts MDB support at $168 billion over a decade and according to the World Economic Forum, MDBs support was worth $30 billion in trade transactions in 2018 up 50% from 2016. ADB’s TFP alone boasts of $41.70 billion in transaction support for the period 2009 to 2019

VIDEO: Development Finance – The Role of Export Credit Agencies, Trade Credit Insurers and Development Banks

Trade finance is fundamentally about addressing risks in international trade transactions. A letter of credit enables parties that are completely unknown to each other to do business, the success of which is critical for the credibility of global trade. The substitution of the buyer’s default risk with that of the bank lends greater comfort to the supplier whilst the buyer is assured that settlement will only be against a compliant document presentation. The capacity of banks to provide this kind of cover de-risks international trade transactions and yet this capacity is finite on account of diverse variables including limitations on single customer exposures and inadequate customer due diligence.

Trade Finance Programs come in to deliver two major benefits; scale and risk participation. Expanding financing as well as sharing the risk has provided a lifeline particularly for SMEs. Capacities of participating commercial banks are enhanced so that they can support clients who would otherwise be excluded from this type of finance.

ADB’s Trade Finance Program with over 200 partner banks responded to the plight of SMEs by committing a significant size of its trade finance facility to SMEs, which saw the program support 4,069 SMEs in 2019 alone, many in its developing member nations like Armenia, Azerbaijan, Bhutan, Kiribati, and the Kyrgyz Republic. In 2016, Banco Latinoamericano de Exportaciones, S.A. (Bladex) syndicated a $40m trade finance facility for MetroBank SA (Panama) significantly boosting its capacity to commit to bankable trade applications.

African Export-Import Bank (AFREXIM) and African Development Bank (AfDB) are leading the charge on the African continent with a focus on strengthening capacities of local banks to offer trade finance facilities and drive intra-Africa trade, which was established to be lower in comparison with other continents. Just this year, AfDB entered into a $200 million trade finance risk participation agreement with Sumitomo Mitsui Banking Corporation Europe to support the trade value chain across the African continent, targeting agriculture, manufacturing, construction, and energy.

In 2018, Angola’s Banco Bai received a $100 million trade finance line of credit from AfDB to support SMEs and local corporates in sectors like agriculture and manufacturing, feeding into a national strategy to diversify the economy away from oil dependency. For fragile economies, this is even more critical. Case in point is Afreximbank’s $600 million line of credit to the Reserve Bank of Zimbabwe in 2017 to support the financing of trade and project-related transactions thus providing a lifeline to a nation that has for long been precluded from accessing funding from the foremost multilateral institutions; IMF and World Bank.

In 2018 AfDB extended a $20 million trade finance line of credit to Liberian Bank for Development and Investment, International Bank of Liberia Limited, and Afriland First Bank in Liberia. It was established that the lack of trade finance had adversely affected Liberia’s economy and that this facility, which included a guarantee facility, would de-risk local banks, allowing them access to international confirmation lines.

Greece was the first beneficiary of EIB’s Trade Finance Facility post the Greek government-debt crisis, which provided a much-needed lifeline to companies in Greece by providing EUR 500m in guarantee cover to Foreign Banks covering 85% risk on letters of credit and other trade instruments to mitigate default risk.

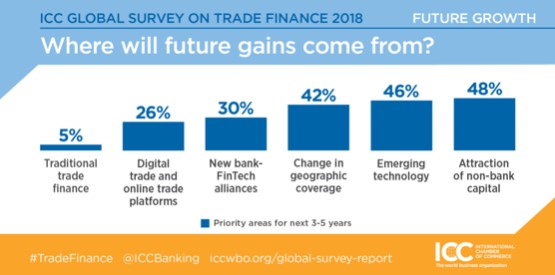

The above are examples of the capabilities of these types of programs to augment the traditional trade finance offering from banks. It signals that banks face limitations particularly for specific segments like SMEs. Larger companies are advantaged due to their structured nature, clear governance, and collateralisation whereas SMEs tend to fall short. There is also an indication that over the medium term, interest is to attract more non-bank capital to boost trade financing, which further lends credence to trade finance programs.

Important MDB Trade Finance Programs

- African Development Bank – Trade Finance Program

- African Export-Import (AFREXIM) Bank – Trade Finance Programmes

- Asian Development Bank – Trade Finance Program

- Black Sea Trade and Development Bank – Trade Finance

- Banco Latinoamericano de Exportaciones, S.A. (Bladex) – Trade Financial Solutions

- Central American Bank for Economic Integration – Foreign Trade Program

- European Bank for Reconstruction and Development – Trade Facilitation Programme

- European Investment Bank – Trade Finance Facility

- Inter-American Development Bank – Trade Finance Facilitation Program

- International Finance Corporation – Global Trade Finance Program

- Islamic Development Bank – International Islamic Trade Finance Corporation

A Peek into the Future

With low default rates, trade finance instruments will continue to grow their influence on the trade landscape and deliver strong value into the future. In the past, MDBs have largely focused on project and infrastructure finance often characterised by big-ticket, high risk, and low return transactions. However the expanding global trading system has placed such a huge demand for finance, that MDBs have risen to the challenge to deploy their capabilities towards financing trade.

Technology will continue to be the game-changer as fintech seeks to address what have been persistent barriers. The current crisis has made this even more important and escalated digitization efforts. Technology is key to solving long-standing challenges associated with KYC, physical documents etcetera. Digital documents will significantly improve turnaround times to hours enabling near-instant transmission of documents as opposed to existing delays associated with the physical movement of documents. This equally has the effect of reducing costs associated with trade finance transactions. We shall continue to see collaborations here in developing and bringing to market, solutions that will drive-up access and convenience. As such, Fintechs will continue to disrupt this space with use cases that demystify financial services.

Putting this all together

Trade finance is an integral component of the trade ecosystem however closing a $1.5 trillion gap is no mean feat. It calls for heightened resource mobilisation capacities, which MDBs are well-positioned to coordinate. Current successes coupled with the need to expedite this effort, further attests to the value of Trade Finance Programs as an important piece of the trade puzzle, which if combined with regulatory and technological innovation, is destined to hasten the closing this gap. Ultimately, this translates into broader positive economic outcomes for nations as trade is a key economic growth driver.

The trade landscape has shifted in the wake of the COVID-19 pandemic, provoking a wake-up call for import heavy regions like Africa to rethink their fragile supply chains. In the coming years, we hope to see increased shifts to local manufacturing. Africa through the continental free trade area is embarking on an ambitious program of building industry and trade capacities on the continent. It is therefore worth concluding that the kinds of bold actions that these shifts call for will need to leverage trade finance programs for success.

Now launched! Summer Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out!

This summer 2020 edition, entitled ‘Coronavirus & The Fourth Industrial Revolution’, is available for free online, covering the latest in trade, export credit insurance, receivables and supply chain, with special features on fintech and digitisation.