There has been discussion on how Blockchain helps to move from paper to paperless for Trade. Let us see how we can leverage Blockchain for Electronic Invoices and streamline the process from Origination to Settlement. We also refer to this as EIPP in many geographies.

Electronic Invoice Presentment and Settlement over Blockchain

Electronic Invoice Presentment and Payment (EIPP) is about sharing and processing electronic version of critical documents in trade and ensuring payment made on successful completion of the process. When used in combination with Blockchain, the multi-party exchange across the entire value chain becomes fast and efficient.

EIPP can be applied to many scenarios like C2B (e-commerce / bill payments), B2C (Salaries), B2B (Trade / Corporate Payments). In the context of this article, let us look at Trade Finance.

As the statistics shows that,

- $20 Trillion Global Mercantile Trade1

- 85% of Global Trade is facilitated by Trade Finance2

- $50 Bn in topline FI trade finance revenues3

- Significant amount in excess Working Capital borrowed by Corporates

- Global cross-border B2B exports are expected to increase from $18T in 2018 to $21T by 2023.This is driven by blockchain based payment networks 5

- Cross-border transaction times lag far behind P2P payments, often taking up to 3 to 5 business days to complete.6

There are multiple instruments in Trade Finance, the most relevant negotiable instrument is Letter of Credit.

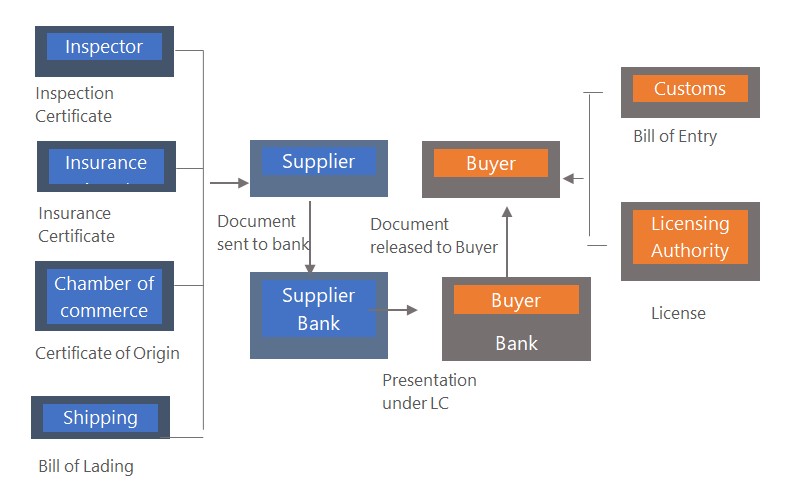

Traditional Process for Letter of Credit:

In the Traditional process using paper documents, the entire Financing process takes anywhere between 5-30 days, and the process is prone to human errors, delay in processing and no visibility to the actual status of the document processing or payments. Besides this, if the buyer and supplier are not customers of the same bank, the process can be longer with the involvement of an advising bank in the cycle. In Financial Institutions, the Invoice information while provided as a scanned document, the information for processing and financing an LC gets manually entered in the back-end Trade Finance systems. Also, all supporting documents are sent as paper to the Bank.

How can we streamline EIPP process using Blockchain?

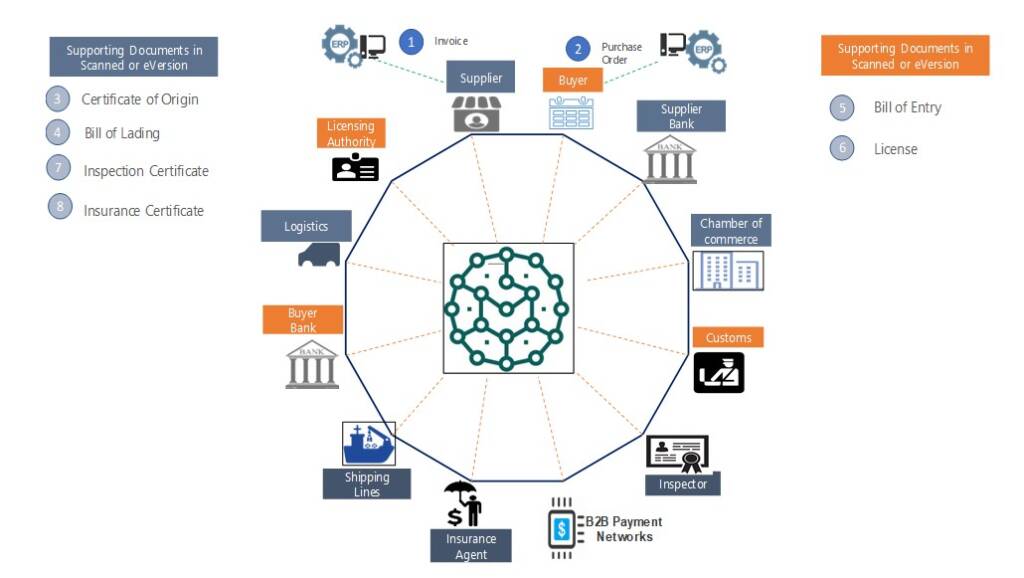

- Listed below are the options using which the Invoice from the Supplier can be made available on the Blockchain.

- The Invoice created in the Supplier ERP System can be either fetched by the Trade Finance application built over Distributed Ledger Technology (DLT) and made available as part of the Blockchain Network.

- The Supplier being part of the Network can provide the scanned copy (considering that as per ICC eUCP Version 2.0, scanned documents are considered valid) and the information is auto filled into the form provided as part of the Trade Finance system.

- If the Supplier does not have an ERP System (SME /MSME types) then they can use the Trade Finance application built over Distributed Ledger Technology (DLT) to create the Invoice.

Note: This is all applicable to bills raised by Exporter, Customs etc for their Charges related to the service provided by them on the Network or to the Supplier / Buyer.

- Like Invoice, we can follow the same process for Purchase Order (PO) and make them available in scanned or electronic version and also enable validations on the Blockchain.

- The Buyer and Seller can provide all other relevant documents as listed above (Diagram 2) in scanned or electronic format, which is checked and digitally validated by relevant parties on the Blockchain.

- By using machine learning / AI, smart contracts the validations, sanctions, country-specific conditions and standards set by ICC, can be checked against the information provided in the documents. Thus, leading to auto-check of the documents. The pattern of such usage by leading banks seen in Asian markets like India, Singapore, Hong Kong and is a capability supported by a product organization leading the establishment of a Consortium in the sub-continent.

- On completion of the required validation and verification that the Bank needs to perform for release of payments. The Bank connected to a B2B Payment Network / Payment rail on the Blockchain can release the payment to the Seller. The B2B Payment rail can be any domestic payment systems like IMPS in India, NPP in Australia or the Cross-Border Networks facilitated by SWIFT, VISA B2B and Mastercard.

- As the status of the flow of goods is also visible on the network, the Bank can also release the required payments to the Shipping and Logistic company on the same network.

Benefits of Electronic Invoice Presentment and Payment over a Blockchain Network

- Banks, Buyers, Sellers, Customs, Ports and other parties maintain the same direct relationship with each other

- Message and document sharing are done on real-time basis for all involved parties increasing trust, reducing costs, and time.

- Flow of goods and money is visible to each party at the same time which reduces risk

- Everyone has a single source of truth and a shared picture of granular trade

- Duplicate Invoice Financing check can be performed on the blockchain and also data repository of invoices can be created for Banks to validate offline if they are not part of the network. Thus, ensure Fraud detection and prevention.

Challenges in Adoption and Execution

- The following system will work effectively when the documents, whether in the scanned or electronic version, are entirely made available on the platform or network. Partial adoption will still lead to errors and delays in completion of the required process to release payments.

- In many geographies, the documents are still provided in local languages. Given that adoption of AI, Automation, intuitive matching of data provided in Letter of Credit vs the document is still limited in the space of Trade Finance; this could still lead to the slower conversion of the paper version to electronic version of the document which then gets automatically validated and processed based on specific rules.

- From a payment perspective, the supplier can only get better visibility to his cash-flow provided that the B2B network and the Banks can work together to provide faster reconciliation and settlement.

Blockchain for Electronic Invoice Presentment and Payments (EIPP)

Usage of Blockchain for Electronic Invoice Presentment and Payments (EIPP) surely has many benefits for corporates as they get faster payments and clear visibility to funds. The banks can perform required analysis on the corporate and use that to provide alternative business models for financing to these corporates. EIPP over blockchain can also help banks avoid duplicate Invoice Financing and perform dedupe effectively.

PODCAST: WEF – The Fourth Industrial Revolution: Inclusive digital trade is the future (S1 E44)

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with their company, Trade Finance Global or London Institute of Banking and Finance’s view.