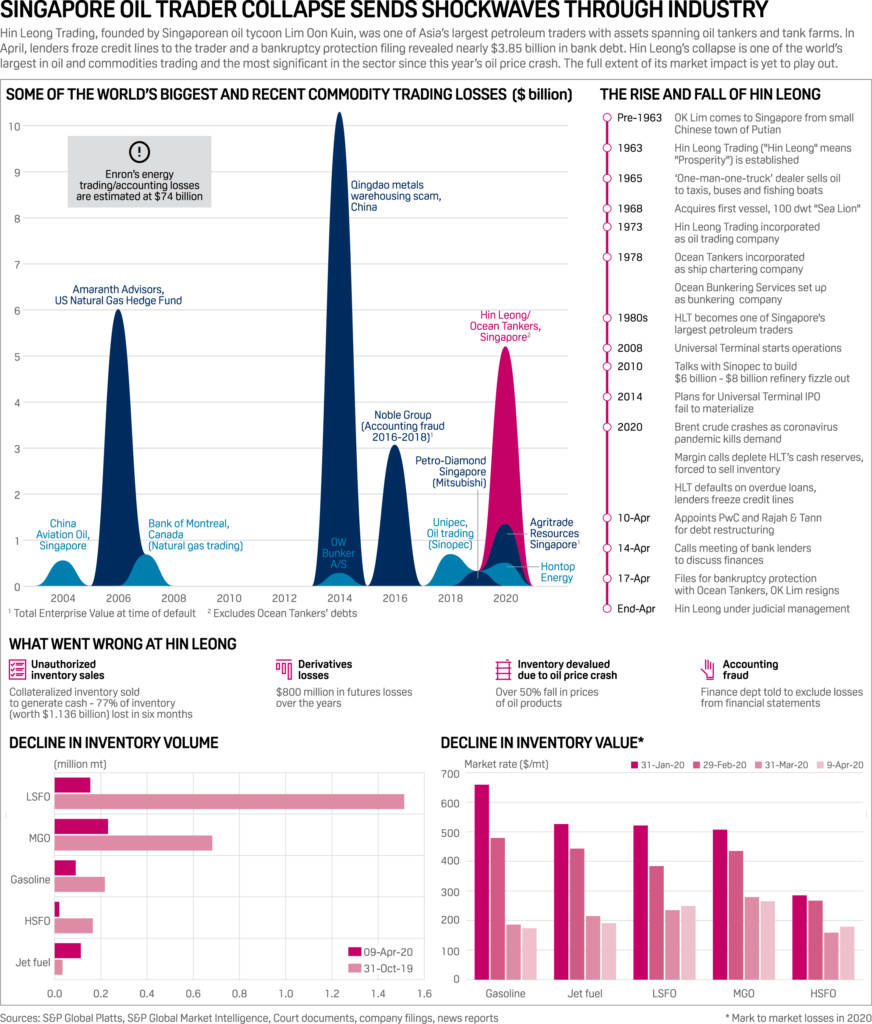

An insight into the collapse of Hin Leong Trading in Singapore

In mid-April, while Singapore and the rest of the world had their hands full amidst the COVID-19 pandemic, bombshell revelations about Hin Leong Trading’s woes shocked Singapore and its markets worldwide. Its reverberations were felt across the globe, with the many pointing to the oil price volatility as one of the major causes of its collapse. With the world focused on the fate of American oil producers following the WTI negative prices for the first time in history, little does one expect that the 2020 Russia–Saudi oil price war would claim its first major scalp on the other side of the world, albeit unexpectedly, in the form of one of Asia’s largest fuel traders, Hin Leong Trading.

As the dust settles following its phone call with its bankers about a debt moratorium, it revealed the scale of the scandal to the disbelief of many trade bankers in the industry. Hin Leong racked up US$3.6b of debt owed collectively to 23 banks, with more than US$598m owed to its largest lender HSBC. With Hin Leong’s founder Lim Oon Kuin further admitting that the oil pledged for collaterals worth $800m had been sold to raise cash instead of repaying debt liabilities, their bankers are staring at the possibility of recovering just 18 cents for every dollar lent in the best-case scenario. Hin Leong Trading has since been successfully placed under interim judicial management of PwC as it seeks to restructure its mountain of debt.

The Mechanics of Letters of Credit

As a commodities trading company, where profits are made of razor-thin margins, access to letters of credit is one of the most important financial tools a trading company could have. Letters of credit (more commonly known as LCs) are essentially a payment undertaking by the buyers’ bank to the supplier, in exchange for compliant document presentation against the terms and conditions of the LCs. Letters of credit are commonly issued according to ICC’s Uniform Customs & Practice for Documentary Credits, more commonly known in its current iteration as the UCP600. In an LC, trade documents are channelled through the banking channel while the goods are in transit to its destination, providing security to both the buyer and the seller of the transaction.

By the virtue of a complying presentation, suppliers can accelerate the receipt of funds by requesting their banks to “negotiate” the documents in the case of where credit is available by negotiation, a form of prepayment that provides the supplier instant access to capital whilst at the same time offering competitive payment terms to their buyers, whom may not have to pay until much later, commonly up to 90 days after the shipment date.

As a buyer, by a combination of collaterals pledged and the market reputation, can request their banks to issue LCs on their behalf at a significant leverage ratio that enables commodities traders to trade at many times their actual asset positions, thus further strengthening the position of the reputable trader in the market as a market mover. By combining prepayment availability in an export transaction with the LC issuance leverage in an import transaction, it is clear to see why LCs are the clear favourite of commodity traders, who are one of the most important groups of customers to any bank with a trade finance business, compared to SMEs who have long baulked at its exorbitant charges and its peculiarity and sensitivity on documentation accuracy.

The Domino Effect

Hin Leong’s woes began when its bankers refused to issue LCs on its behalf and started demanding repayments on loans extended to them, most likely in the form of trust receipt loans. With the understanding of how LCs provide leverage for trading companies, it is easy to see how an overextended commodity trader would struggle in the face of such events.

As banks scramble to the safety of the known, many would freeze credit facilities such as LCs to companies under similar industries. And then the domino effect would happen. Companies who would have avoided such circumstances suddenly find themselves in a bind and it didn’t take long before one surfaces in the form of Zenrock Commodities Trading. Founded by two former executives from well-known oil traders Unipec and Vitol, Zenrock was revealed to have owed more than $600 million to its creditors, of whom 6 are banks, including HSBC and 10 unsecured creditors such as French oil major Total’s Totsa Total Oil Trading Trading SA.

A Bloomberg law article recently quoted an insider within Societe Generale regarding the halt of fresh funding to oil trading firms in the Asia Pacific and the review of its global businesses, in light of the collapse of Hin Leong. Societe Generale’s stance is unlikely to be an isolated one, with many banks now considering a similar course of action behind closed doors.

What’s Next? Enter Technology

While the scale of Hin Leong’s collapse is massive, it pales in comparison to a similar scandal in 2014 involving the metals warehouse scam in Qingdao, China where metals stored in bonded warehouses were found to be traded and/or financed several times, resulting in losses of more than $10bn to the affected creditors.

Recently, Agritrade Resources, also in Singapore, has defaulted on its debt and collapsed in February 2020. As Agritrade has a substantial interest in palm oil trading and coal, it is discernible that trade in fungible commodities are susceptible to trading risk and subsequent defaults in poor credit environments, as is the case with Hin Leong’s.

With that considered, one must now ask, is there truly nothing that can be done? Has the industry truly learned nothing about its failures of the past? The fundamental basis in a bank’s relationship with its client is, foremost, the element of trust. Trust enables a bank to extend credit lines, offer favourable repayment terms, and lend its credibility to its clients’ customers. And when this trust is broken, we often see the full scale of its impact, not just to the affected organization, but many in the same industry.

Whilst no longer at the peak of its hype back in 2018, blockchain still offers much to address trust in any banking relationship. Using its immutability and the need for consensus attributes, it offers a tangible form of trust that can be leveraged in many ways.

One such instance would be to deploy blockchain solutions to offer transaction visibility beyond that of what is currently offered by paper documents. By utilizing blockchain, lenders’ concerns regarding transaction authenticity and the management of related party transactions can be alleviated with the visibility of trade flows via a platform or solution based on blockchain.

Collateral management by utilizing blockchain-based IoT solutions would provide banks with an unprecedented window into the state of asset health of their customers, thus preventing knee-jerk reactions that would cause a negative credit shock to their clients, industry, and financial system. Clients with prudent management of their risk exposure and financial discipline will reap the rewards of the trust established by the use of such solutions by possessing a reliable and mutually beneficial banking relationship that they can fall back and rely on in challenging times.

The need for a concerted effort by stakeholders

With Hin Leong’s collapse, some questioned if the lack of oversight from the regulators was one of the contributing factors. The truth was Hin Leong Trading was an exempt private company with no disclosure requirements typically required from companies listed on public securities exchanges. The question of how Hin Leong accumulated such an enormous debt given its opaqueness is one that banks and financial institutions today have to ponder and ask themselves. Was the prospect of growing revenues at all costs too attractive to turn down, or was it a case of becoming unwitting conspirators to a dishonest client?

The adoption of technology, not just that of blockchain-related ones, in trade finance is sporadic and anaemic, often occurring only in the form of pilots or within close circles of the banking community with customers and their related entities. These solutions now have to be a part of conversations surrounding the consolidation of standards regarding the use of electronic documentation and transaction monitoring from now on, to establish a fundamental understanding amongst industry participants to prevent another repeat.

There are major roles in technology adoption to be played by regulators and global industry-standard players to participate in such endeavours, as trade by itself is facilitated by various instruments that are invariably created, validated and recognised by these stakeholders. Current iterations of technology solutions often preclude one or more key stakeholders. This needs to change if we are to avoid another repeat of a scandal of this magnitude or greater in trade finance.

Now launched! Summer Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out!

This summer 2020 edition, entitled ‘Coronavirus & The Fourth Industrial Revolution’, is available for free online, covering the latest in trade, export credit insurance, receivables and supply chain, with special features on fintech and digitisation.