Estimated reading time: 4 minutes

The Ukraine conflict has replaced the pandemic as the leading strain on global trade. For the first time in 25 years, global trade in the coming decade will grow at a slower rate than gross domestic product (GDP), and familiar trade patterns will shift, according to a new report released today by Boston Consulting Group (BCG).

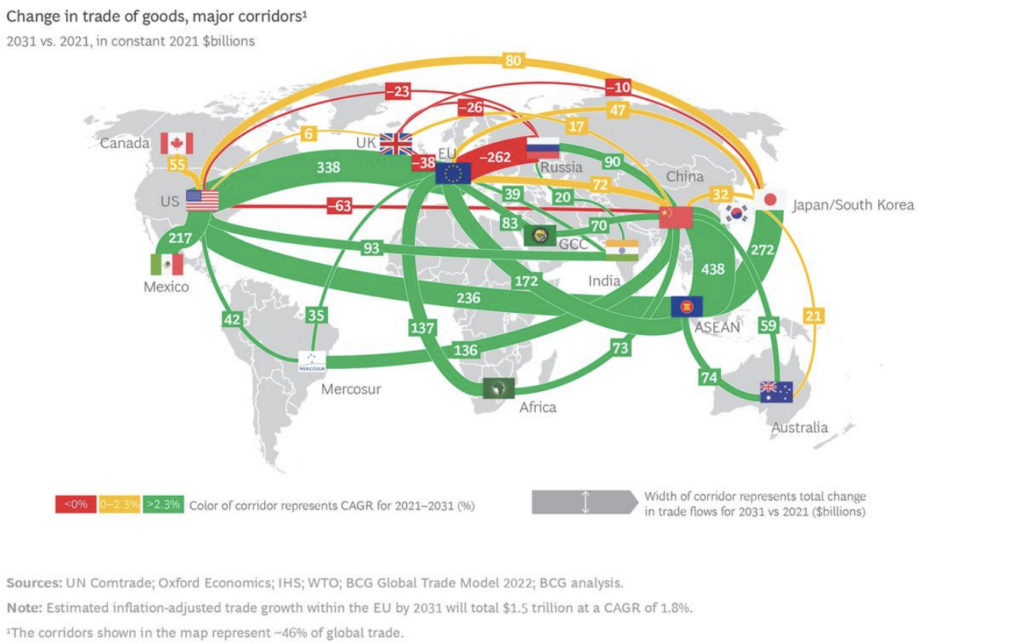

The report, titled “The Future of Trade: Navigating War, Inflation, and Hot New Routes,” predicts that world trade will grow at a rate of just 2.3% per year through 2031—less than the 2.5% projected for global economic growth. This compares with about 1.5 pp of trade growth per percentage point of GDP growth in the 1995 to 2008 period, and about one to one in the period from 2009 to 2019.

While the Ukraine conflict is a primary force in the shifting trade patterns, other factors, including Western nations’ decreasing reliance on trade with China and the rise of economic blocs such as the Association of Southeast Asian Nations (ASEAN) are reshaping global trade.

“Global trade has been significantly disrupted over the past three years, first by the pandemic and now by the Ukraine conflict and growing geopolitical tensions,” said Nikolaus Lang, managing director and senior partner, global leader of BCG’s Global Advantage practice, and a coauthor of the report. “After nearly 30 years of a comparatively secure trade environment, we are in the midst of a new East versus West dynamic, with a US- and EU-led community and a China-Russia counterpart, along with the potential emergence of a third grouping of non-aligned nations.”

“As companies, industries, and countries alike adjust to the changing geopolitical and economic dynamics, the resulting shakeout will produce opportunities for some and challenges for others,” said Marc Gilbert, a managing director and senior partner at BCG, the firm’s topic leader for geopolitics and trade, and a coauthor of the report. “The anticipated changes will continue to dilute the economic globalization and trade opening that characterized the first three decades of the post–Cold War period, resulting in a redrawn trade map that looks vastly different than it did in 2021.”

The conflict in Ukraine has caused the EU and Russia to alter their trade relations. As a result, over the next nine years, the EU will increase its trade with the US by $338 billion, driven in large part by increased US energy exports to Europe, and will also expand its combined trade with ASEAN countries, Africa, the Middle East, and India. Meanwhile, trade between the US and China will decrease by $63 billion through 2031. Trade growth between the EU and China is also cooling, with two-way commerce forecast to grow by just $72 billion, a modest increase compared with previous years. Meanwhile, Russia’s trade with China and India will grow by $110 billion, including $90 billion with China alone.

Southeast Asia will be the principal beneficiary of the redrawn trade map, with an estimated $1 trillion in new trade—due, in large part to new commerce with China, Japan, the US, and the EU—through 2031. ASEAN trade with China will grow by $438 billion, the largest interregional increase, according to the report’s 2031 outlook.

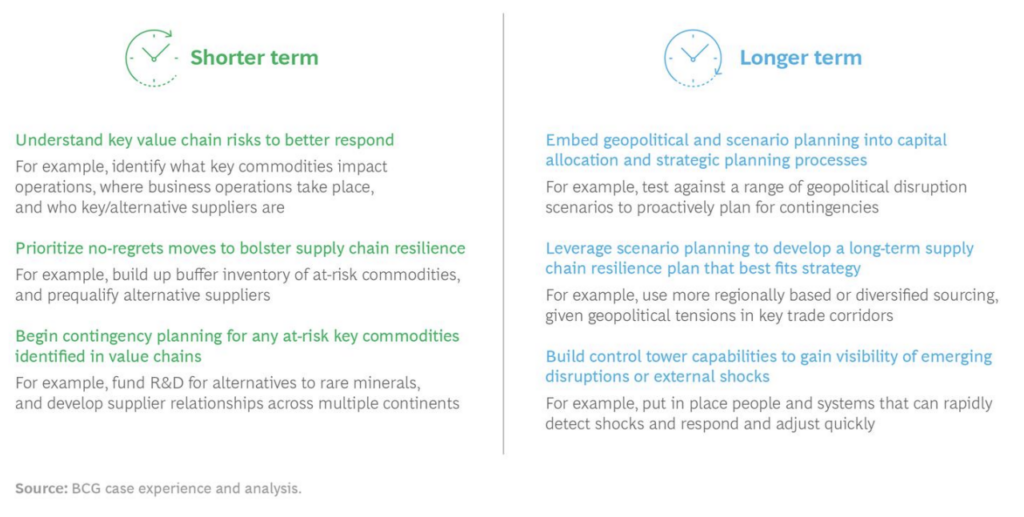

“The new global trade is prioritizing supply chain resilience and global diversification. Companies should prioritize steps to increase resilience, such as building up buffer inventories of essential commodities and components and prequalifying alternative suppliers,” said Michael McAdoo, BCG partner and director of global trade and investment, and a coauthor of the report. “The relatively secure trade environment that enabled companies to develop extensive world supply networks has given way to a more uncertain landscape that demands a balance between the objectives of efficiency and lower costs and a heightened awareness of global risks.”