Estimated reading time: 5 minutes

In TFG’s conversations with industry experts, we have learned quite a lot about trade volumes and commodities, trade technology, and trade credit insurance. While there is plenty of uncertainty regarding the global outlook in 2023, it is clear that there are many areas of optimism for international trade.

To start off our 2023 predictions, TFG spoke with Sean Edwards, the chairman of ITFA, who provided his outlook regarding the energy crisis, trade digitisation, and much more.

The time of year has come again to practise the unscientific art of predicting the year ahead. When I wrote last year, I gave myself a massive hedge – that all depended on there being no war in Europe.

Sadly, this has happened and, whilst it is not the root cause of all the turmoil of this year, it has massively shaped global events. My generally optimistic view on 2022 seemed to be on the road to successful validation – with improvements in supply chains, for example – until that fateful February 24.

Since then, inflation has been the main concern of both policy makers and the public with rapid increases in the price of energy and food hitting households, making control of inflation a target of governments. But against this I still believe that, on a possibly more selective basis, trade finance has reasons to be cheerful in 2023.

Firstly, banks have strong balance sheets and capital positions as they enter the new year. Of course, that doesn’t mean it will all go into trade, but as recent BGC/ICC figures show, trade continues to be a safe asset class with losses having decreased during the second pandemic year.

Arguably, this is because of government support but, as governments face the demands of their voters to ease cost of living pressures mentioned above, there is good reason to think they will need to continue with the same policies.

This masks another trend though, namely that whilst trade volumes might not shrink significantly despite a slowdown in global GDP, a lot of the capacity has been, and will continue to be, taken up by inflated commodity prices. Whilst energy prices have come off the boil, we should not expect them to reduce substantially in 2023.

Europe’s transition away from Russian dependence will underpin natural gas prices. That prices did not rise more is testament to the swift action taken in Europe to secure supplies for the coming winter which reduced upwards future pressure, but left a floor to the price.

Crude oil prices will also remain at their current elevated levels for some time in my opinion albeit with less volatility. The war in Ukraine is unlikely to come to an unequivocal end next year with a thoroughly beaten enemy, à la World War Two, and so current stresses on prices will remain.

Any downward pressure on prices from the oil cap is unlikely too. Just as energy has found a new supply chain in Europe, Russian oil continues to find a market outside of sanctions.

The effect of energy scarcity on the environmental, social and governance (ESG) agenda is interesting, with less pressure to phase out some fossil fuels such as coal. I expect this to be only a temporary reprieve though as regulators and governments, in the Western world at least, will not stop their policy of transformation.

The overall march of change has not yet reached its watershed moment, beyond which incremental change will be difficult, but fossil fuels, especially the most polluting ones, have their cards marked.

Metals prices have been anaemic this year but there was a rebound in some prices, steel and copper amongst them. More is possible next year if China regains some of its lost momentum. The political will seems to be there, and all eyes are on how China will manage its new openness to COVID-19.

Expectations that [China will bounce back] are pricing in increases for both metals. This should help producers in Africa, for example, but local challenges from sovereign over-indebtedness to political instability may overshadow what would otherwise be positive news.

Staying with pricing, but moving away from commodities, as I mentioned above, I think that non-commodity producers, especially in emerging markets (EMs), will face higher pricing from their banks. This will feed through directly and indirectly as liquidity in the FI lending markets for EMs suffers from both a drop in liquidity and a re-pricing of risk-induced margins.

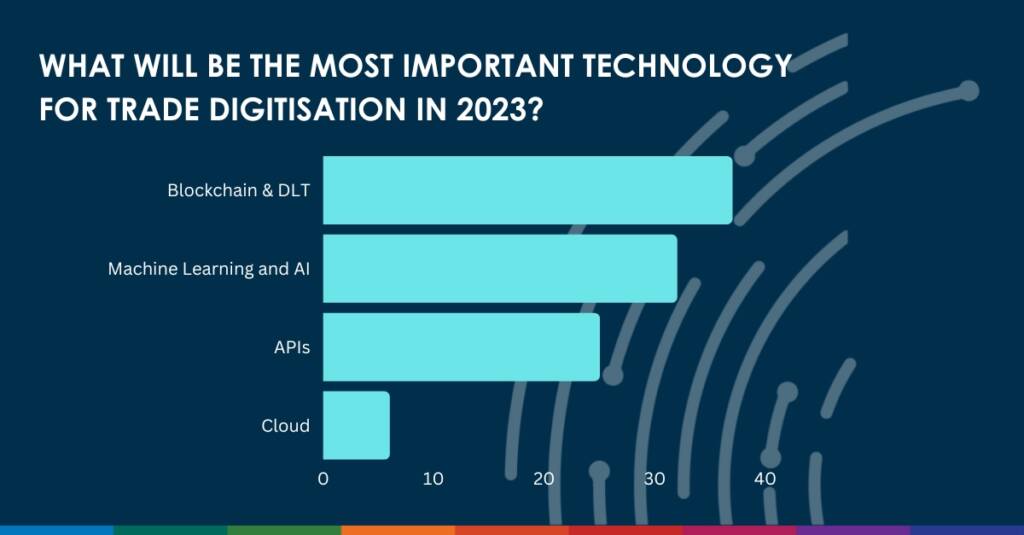

Finally, my favourite subject: trade digitisation. 2022 saw some notable bad news: the closing down of we.trade, Serai, and TradeLens due to a lack of scale and commercial adoption, leaving their backers unwilling to bankroll into the unpredictable future.

But set against this are some successes. Komgo, which has pursued a cautious approach to expansion to date, and served it well in the commodity trader community. Komgo pivoted toward the larger trade finance market by buying GTC, a multi-bank portal provider for corporates.

And let’s shoot down the idea that the failure of blockchain to immediately revolutionise the market and boil the ocean is somehow proof that trade digitisation won’t work.

Blockchain will always have a place as a tool and a technology, but it never had the power to overcome some of the challenges the industry always faced such as inertia, organisational change cycles, and the cost of change.

Digitisation is inevitable, but it is not always urgent and it will come from a multitude of small successes.

Make sure to join TFG on our journey in 2023 to see if these predictions come true! Follow our newsletter and LinkedIn to stay on top of breaking news and expert analysis.