Estimated reading time: 5 minutes

Inflationary pressures, monetary tightening, energy crisis and supply chain disruptions are jeopardising corporates’ cash flows.

But many governments decided to tackle the current situation by deploying some strong fiscal policies.

Will these measures be enough to contain a high rise in insolvencies at both global and local levels? Allianz Trade, an international trade credit insurance company, investigates in its latest report: ‘Corporate risk is back: Watch out for business insolvencies.’

Broad-based acceleration in global business insolvencies is anticipated

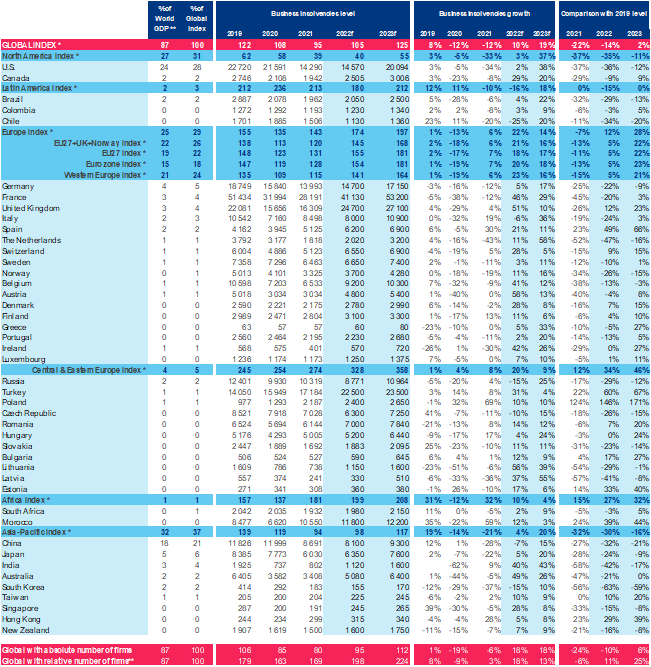

According to Allianz Trade, global business insolvencies should rise both in 2022 (+10%) and 2023 (+19%); two significant rebounds occurring after two years of decline, which may bring global insolvencies back above their pre-pandemic levels in 2023 (by +2%).

Maxime Lemerle, lead analyst for insolvency research at Allianz Trade, said, “The rebound in business insolvencies is already a reality for most countries, in particular for the top European markets (the UK, France, Spain, the Netherlands, Belgium and Switzerland), which explain two-thirds of the rise.

“At a global level, half of the countries we analyse have recorded double-digit increases in business insolvencies in the first half of 2022. However, the US, China, Germany, Italy, and Brazil are still registering prolonged low levels of insolvencies, but the trend should reverse next year”

Europe may be particularly impacted by the surge in insolvencies over the next two years: Allianz Trade expects important rises in France (+46% in 2022 ; +29% in 2023), the UK (+51% ; +10%), Germany (+5% ; +17%) and Italy (-6% ; +36%).

The region should exceed its pre-pandemic level of business insolvencies as soon as 2022 (by +5%). In Asia, China is expected to register +15% more insolvencies in 2023 on the back of low growth and limited impact from the monetary and fiscal easing.

In the US, Allianz Trade expects an increase of +38% in business insolvencies in 2023 as a result of tighter monetary and financial conditions.

Ano Kuhanathan, head of corporate research at Allianz Trade, “This normalisation in business insolvencies remains heterogeneous across sectors and size of firms.

“In Europe, we are seeing a rebound in insolvencies in slightly less than 60% of the industries, with a return to pre-pandemic levels most often in food/accommodation, manufacturing, and B2C services.”

Profitability shocks weighing heavily on corporates’ cash flows

How to explain this generalised surge in business insolvencies? Allianz Trade identifies three major shocks which may have a significant impact on corporates’ profitability.

The energy bill will remain the largest profitability shock, in particular for European countries.

At current levels, energy prices would wipe out the profits of most non-financial corporates as pricing power is diminishing amid slowing demand.

If firms can pass one-quarter of energy-price increases to customers, they can withstand a price increase of below +50% and +40% in Germany and France, respectively.

Looking at France more precisely, Allianz finds that, excluding micro-enterprises for which the price caps apply, at least €9 billion of losses are at stake for more than 7000 firms. This is in the 4 sectors for which wholesale electricity prices are currently above estimated breakeven price, namely paper, metals, machinery and equipment, and mining and quarrying.

This compares with €7 billion in Germany and 4000 firms at risk of losses from the rise in the energy bill, mainly in the metals and paper sectors.

Additionally, the interest rate shock is looming in the first half of 2023, along with the acceleration in wages. In Europe, this is likely to be equivalent to the Covid-19 profitability shock of -4pp.

As expected, high cash balances for corporates (still 43% above pre-Covid-19 levels in the US, +36% in the UK and +32% in the Eurozone) have provided a significant buffer against the monetary policy normalisation in 2022, but the worst is still to come.

Ana Boata, global head of economic research at Allianz Trade, said, “The wage bill is slightly higher for Europe’s industrial sectors compared to the US. Hence, an increase of 4-5% in 2023 could wipe out between -0.5pp to -1pp of margins on average.

“Overall, the rise in financing and wage costs in a context of a low economic growth puts construction, transportation, telecom, machinery and equipment, retail, household equipment, electronics, automotive, and textiles most at risk.”

Public support will be essential to avoid a massive insolvency wave

In order to avoid the highest annual increase since 2009, state support is likely to gain pace in Europe if the recession doubles to -2.4% from a stronger energy crisis.

Allianz Trade estimates that the current fiscal support, more targeted and focused on limiting the acceleration in severity rates, is reducing the rise in insolvencies by more than -10pp over 2022 and 2023 for all the largest European economies: -12pp in Germany (i.e. 2,600 firms), -13pp in France and Italy (i.e. 6,700 and 1,900 firms respectively), -15pp in the UK (4,300) and -24pp in Spain (2,100).

However, if the energy crisis worsens, intensifying the recession ahead, we would expect governments to increase the size of fiscal support measures as business insolvencies would rise by a further +8pp to +25% in 2023 in the EU – the highest annual increase since 2009.

To fully absorb the additional shock, fiscal support measures should increase to 5% of gross domestic product (GDP) on average.

However, these big fiscal leaps would be much more constrained amid restrictive monetary policies. To underline European solidarity, joint borrowing would allow all EU member states to formulate an adequate and aligned fiscal response to the energy crisis without putting debt sustainability at risk.