As we all look towards the year ahead and try and put the global recession of 2020 behind us, I wanted to outline The Hartford’s perspective for the year ahead. In respect to geopolitics we anticipate that the shift towards the regionalisation of power centers will continue, and potentially accelerate. Meanwhile, on the economic front, many industry experts expect emerging markets to witness a strong year.

Geopolitics – Regionalisation to accelerate

One of the key forces driving geopolitics in 2021 will likely stem from a change in US leadership as this could yield significant shifts on the foreign policy front. Specifically, it is anticipated that the year ahead, and thereafter, will be hallmarked by an increased US emphasis on multilateralism. This means less solo proclamations on the US’s intentions, fewer surprises and quick decisions, advanced telegraphing of major policy changes, and working with traditional allies to promote foreign policy goals, all while attempting to bridge divides with emerging partners. An emphasis on multilateralism, coupled with rising military and economic powers that feel the need to bolster their own defense capabilities in light of rising emerging security challenges, could ultimately lead to the regionalisation of power of centres, or least continue the evolution towards that end.

Political experts anticipate the US refocusing on traditional alliances, reposition troops in South Korea and Germany, and reaffirming its commitment to NATO. However, this reversion to a “robust” US engagement strategy is unlikely to result in a hardline approach towards China, at least not initially. Many believe that the US will not want a confrontational or contentious relationship with Beijing at the start of a new administration. This does not imply an outright reversal of the past administration’s policies with respect to China, as prior policies affecting tariffs and restrictions on investments and China’s tech sector are likely to stay. But it does mean a potentially less bellicose approach (at least publically), and instead one with more dialogue at the sub-executive level (there are indications that members of the new US cabinet may function as backdoor diplomats with China). The shift in tone alone could also be interpreted by some as the US opting to be “softer” on China than what was seen in recent years.

However, over time expect any “softer” US approach towards China to give way to a more aggressive posture. This is particularly true since China is largely a bipartisan issue in the US, with concerns ranging from security, to intellectual property, business, trade, investments, and labour standards. But while the US shifts from a hard line, to soft line, and back to a medium line approach with China, there will of course be other nations that choose to court Chinese engagement and proximity to Beijing. These include Pakistan, Iran, and Venezuela. Then there are countries that might not be allies or partners of China, but will continue to seek areas of cooperation, including the European Union, Turkey, Russia, and some nations in Africa.

An initial soft approach towards China in the US (which gives way to an eventual harder line), coupled with more willingness in Europe to work with China on select issues, could then mean that sections of Asia including Vietnam, India, Taiwan, Australia, and to a lesser extent Philippines and Japan, question the world’s commitment to “containing” Beijing, given that China is a preeminent geopolitical and security concern for these nations. As a consequence, these countries may be incentivised to deepen their regional cooperation, while concurrently bolstering their own defence capabilities. Amongst these, India and Australia are best positioned to present a credible military deterrence (given their existing capabilities), whereas Japan could continue down the path of revising its constitutional commitment to pacifism as the nation strives to build robust military offensive capabilities down the road. What this framework represents, in short, is a regionalisation of power structures as countries build their own capabilities, recognising that the world’s “approach” towards China is not binary.

Further examples of this regionalisation could be seen in the MENA region. Turkey has recently shifted its foreign policy seeking closer defense ties with Russia, despite Ankara being a member of NATO. This is partly driven by Turkey’s desire for strategic dominance in the region, which would otherwise come at the expense of Saudi Arabia. Both nations are US allies, but ties with each could well slide in the coming years. This in turn could embolden Turkey and Saudi Arabia to further bolster their own military capacity as they seek to be the power centres of the region. The bottom line is that in each region, the potential for power centres to emerge could accelerate in the coming year.

A big year for emerging markets

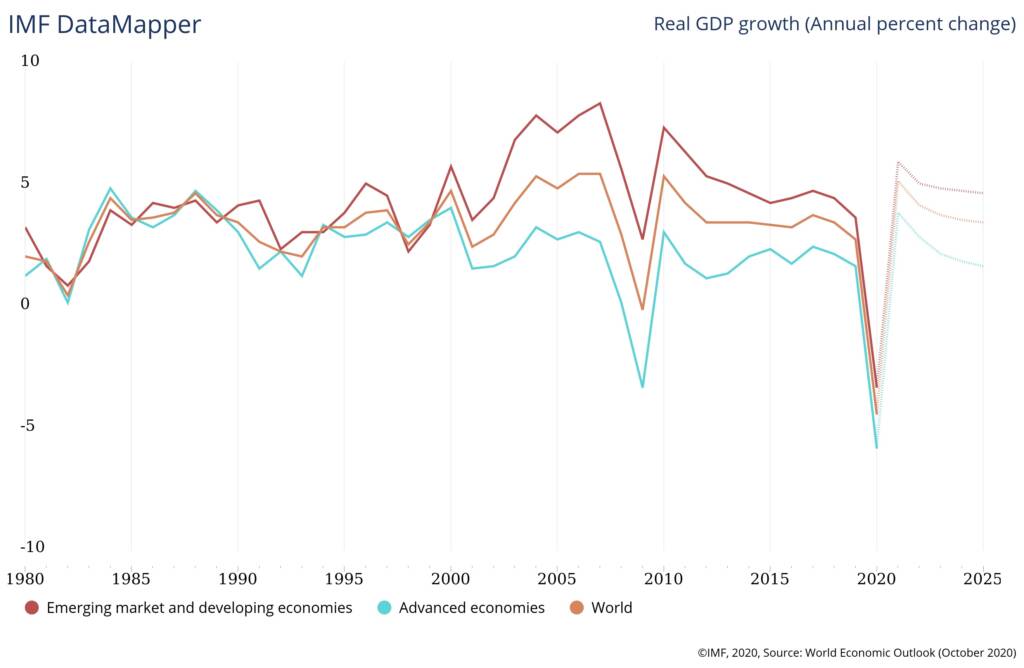

On the economic front, economic advisers no longer anticipate a V-Shaped economic recovery in the first part of 2021 and have a slightly more sanguine outlook than others. Of course, experts hope to be wrong, and although growth could pick up in the second half of the year resulting in strong annualised data due to base effects, we are not assuming it to be a given. But we could see a division between large emerging markets and the developed world. There are a few reasons for this:

First, in the developed world, the era of COVID-19 shutdowns will not necessarily cease at the start of this year, especially outside the US, due to possible delays in vaccine distribution and rising case levels. Second, shutdown related headwinds place even more pressure on policy support, which gives rise to policy misstep related risks. If countries are slow to approve fiscal stimulus, or the distribution of it, it could present an additional drag on growth. Third, policy missteps could also manifest in the form of asset bubbles – ongoing monetary stimulus has forced investors into risk assets, which have already inflated prices. This in turn could result in increased asset price volatility when/if prices come down and the bubbles burst. Fourth, when/if economic growth begins, fiscal stimulus support may be eased and we could start to see a wave of bankruptcies for entities that no longer have fiscal support. Accordingly, it is possible that the economic recovery remains choppy with a few fits and starts, which could take us all the way through 2021.

In the emerging markets, by comparison, it seems that shutdowns are less of an issue going forward. There is not time to go into all the numbers here, but generally the rate of death per 100,000 in many emerging markets is significantly lower than the developed world. This, amongst other factors, leads to less support for future shutdowns in these markets, and in turn implies that emerging markets could see an economic recovery sooner than other areas.

The differing economic outlooks could also result in differing policy responses. If the developed world fails to see a V-shape recovery materialise, or even some derivation of it, then we can anticipate US fiscal and monetary policy to remain accommodative for longer. We already know that the Fed will be on hold and keep rates at 0 percent for the next two or three years, per their comments in September. However, there is plenty they can do on the quantitative easing front, and could potentially continue or even ramp up purchases and security maturities over the next year. This could be particularly true as Treasury security supply increases given the rise in aggregate US debt from the 2020 stimulus packages. This in turn could suppress yields, at least in the front end (we could see steeper yield curves). Higher government spending, loose fiscal and monetary policy, low front end yields, and increased central bank balance sheet expansion could naturally be dollar negative, providing support to select emerging currencies and assets.

In emerging markets, especially those where/if the recovery takes hold sooner, fiscal spending may be curtailed sooner. Meanwhile, we are already seeing indications and hearing about the potential for inflation to pick up amongst these nations. Part of this may be attributed to supply dislocations, coupled with demand surging faster than anticipated, coupled with rising commodity prices. In response, it’s possible that some emerging market central banks start to tighten rates in 2021, adding upward pressure on their yields while strengthening their local currencies. These trends, coupled with a weaker dollar, could result in increased capital flow to emerging markets as investors seek yield, thereby strengthening emerging market currencies and assets.

Essentially, emerging markets could be poised to outperform in 2021, particularly those that are large, have diverse sources contributing towards growth and revenue, and have favorable debt metrics. In fact, our team has a set of models that create scores for countries on a host of perils, and our macroeconomic scores for select emerging markets are showing the largest numerical improvements when using 2021 economic forecasts. This indicates the potential for macroeconomic stability in these names. The risk to this though is if there is a bursting of asset prices in the developed world, for the reasons noted above. Inevitably, this would affect emerging markets too.

With that said, many expect, and hope, that investors do not paint all emerging markets with the same brush. The larger, diversified, and fiscally strong emerging markets with ample funding sources will likely witness greater capital flow and thus asset appreciation, even in cases where they have high nominal debt levels (i.e. Brazil). However, smaller markets that have their economies concentrated in one or two sectors, and are highly indebted, may risk having investors pass them over. The latter group of nations could see their refinancing costs increase, and further expose them to sovereign headwinds. Accordingly, we anticipate investors to likely be more discerning of actual fundamentals, at least more so than what we saw in the summer of 2020 when just about every asset class in every emerging market saw demand.

Increasing indebtedness is a growing issue, which could continue into 2021, and we expect investors to recognise it as such, thereby investing mainly in the stronger emerging markets that exhibit strong fundamentals. This then means that we could see a division between emerging markets too, with some significantly outperforming others. In other words, while we are positive on emerging markets, fundamentals matter, and some will potentially perform better than the rest.