Trade Finance Global helps structure finance for trading companies; increasing their trade lines and helping them grow quicker through stock and trade finance, without relying on tied up working capital in the business. TFG recently helped finance a frozen fish company – here’s how…

TFG have recently worked in new sectors and assisted with financing structures not typically seen in the industry.

One of the more interesting areas was frozen fish. The lender TFG worked with attempted to adapt a facility that is usually used for agricultural products, to fit the financing of hake, sole and prawns amongst other frozen foodstuffs.

Most supply originated from Asia and was bought into the U.K. Product was then sold out to supermarkets and small shops. The company previously had a term loan, which they were paying interest on for the fully drawn term. Therefore, even at points where the facility was not being utilised – the company still faced charges. It also lacked scalability, as it was a block facility and did not look at the creditworthiness of the end debtors or security of the underlying stock.

How did it work?

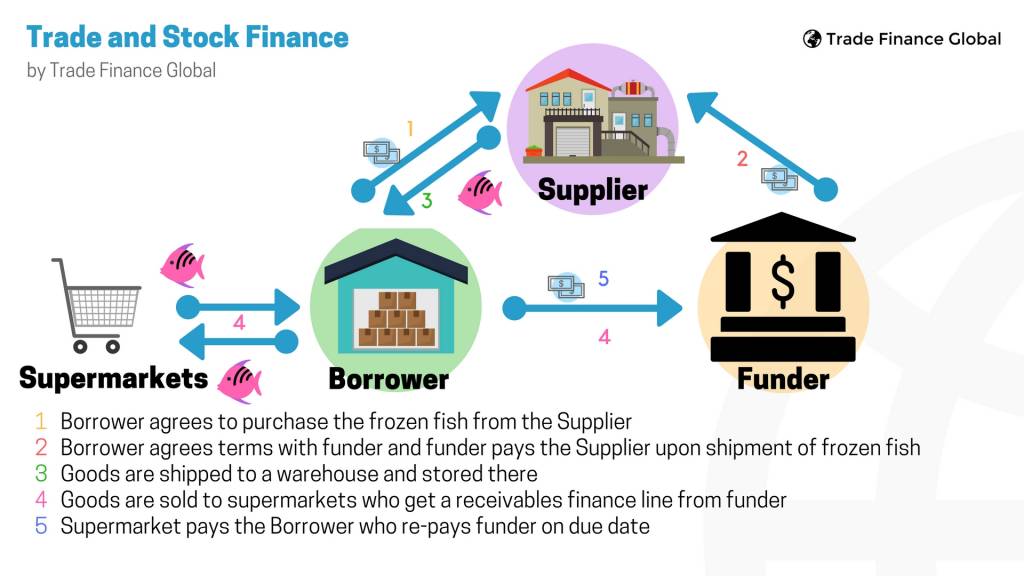

1 Borrower agrees to purchase the frozen fish from the Supplier

2 Borrower agrees terms with funder and funder pays the Supplier upon shipment of frozen fish

3 Goods are shipped to a warehouse and stored there

4 Goods are sold to supermarkets who get a receivables finance line from funder

5 Supermarket pays the Borrower who re-pays funder on due date

TFG worked with the company to provide a trade and stock finance facility. This allowed the company to build up stocks of product with a corresponding invoice finance facility, that allowed security and focus to look at the strength of the end customers. This allowed the company to deal with the historic issues that they faced with long payment terms.

The frozen stocking facility was structured by all parties to allow scalable and measured growth. If you’re importing food, check out TFG’s food finance guide here, or see our other case studies here.