Technology-focused freight forwarding and customs brokerage firm Flexport is launching a new trade finance solution. This solution will serve to help companies overcome the capital constraints resulting from the US-China trade wars

Flexport’s unique visibility into client shipments down to the SKU level through its digital platform provides them with a unique perspective on risk relative to banks offering financing. This insight into the client’s supply chain and business health allows them to provide flexible and customized terms. This degree of customization is ideal for clients but often not possible due to a lack of transparent data.

The solution is designed to help firms with bridging the cash flow barrier and free up liquidity needs to help them grow moving forward. “When I speak to our customers, one of their biggest obstacles to growth is a lack of working capital,” vice president of Flexport Capital Dan Glazer says, “They’re growing like crazy, but they don’t have the liquid cash to invest in new products, fulfill orders, pay suppliers, move their freight and cover customs all at the same time”. Trade finance programs such as this will help with these types of liquidity concerns.

Trade finance is a huge driver of economic development and helps maintain the flow of credit in supply chains. Estimates indicate that 80-90% of global trade relies on trade and supply chain finance, globally estimated at around $10 trillion annually. Despite this size and importance, a trade finance gap, the difference between funding needed and the amount actually supplied, is sitting at $1.5 trillion. The Flexport solution will help to mitigate this overall funding gap while simultaneously helping clients who have experienced particular difficulties following the US-China tariffs.

Impact of US-China Tariffs

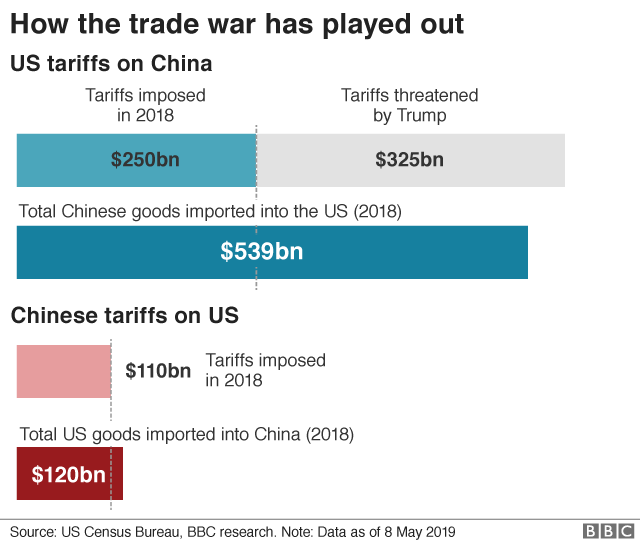

Glazer notes that “In the past year or so, the US-China tariffs have made this working capital constraint even worse”. More than 60% of Flexport’s shipper clients have been affected by the tariff increases. This is an unsurprising figure given that an estimated $360 billion worth of goods has been affected by the trade war with the USA’s largest trading partner. For firms already strapped for cash, this added burden may be too much for them to bear alone.

The situation affecting US businesses is leading to an inflection point in the industry. If companies are unable to manage their finances in a sustainable and long-term manner, their businesses will stagnate, bringing the economy down with them. Flexport is seeking to prevent this from happening. “By helping companies through smart financial instruments designed for the global trade process, businesses will be able to better steer through the chaos and find new ways to thrive and innovate,” the VP said of their new program.

TFG breaks trade finance into five main categories: trade credit, cash advances, receivables discounting, term loans, and leasing and asset-backed finance. According to the Flexport website, the program will work with clients to find solutions that fits their individualized business needs. The program also quotes a simple application process with approval in as little as a few days and no long term commitment as main drivers for adoption.