Estimated reading time: 4 minutes

The Organisation for Economic Co-operation and Development (OECD) recently published its Economic Outlook Interim Report, which paints a complex picture of global trade in the next few months.

The biannual report described decreased expectations of global GDP growth and rising volatility; policy uncertainty, geopolitical risk, trade barriers, and fragmentation unsurprisingly emerged as the main threats to trade in 2025 and beyond.

Perhaps the most consequential finding of the report is a revision of past predictions of global GDP growth, which would have seen it slightly rise to 3.3% from 2024’s 3.2% and hold steady in 2026. Due to increased uncertainty and rising trade barriers, growth is instead now projected to slow to 3.1% in 2025 and 3% in the following year.

This is driven by a significant slowing in US growth, projected to decrease by a full percentage point from its current level in 2026, and similar slowing growth in G20 countries. Developing countries will be the ones driving growth, with India, Indonesia, and Türkiye all rapidly increasing the size of their economies. Slowing growth may help decrease inflation globally, which remains above the targets set by central banks in many countries.

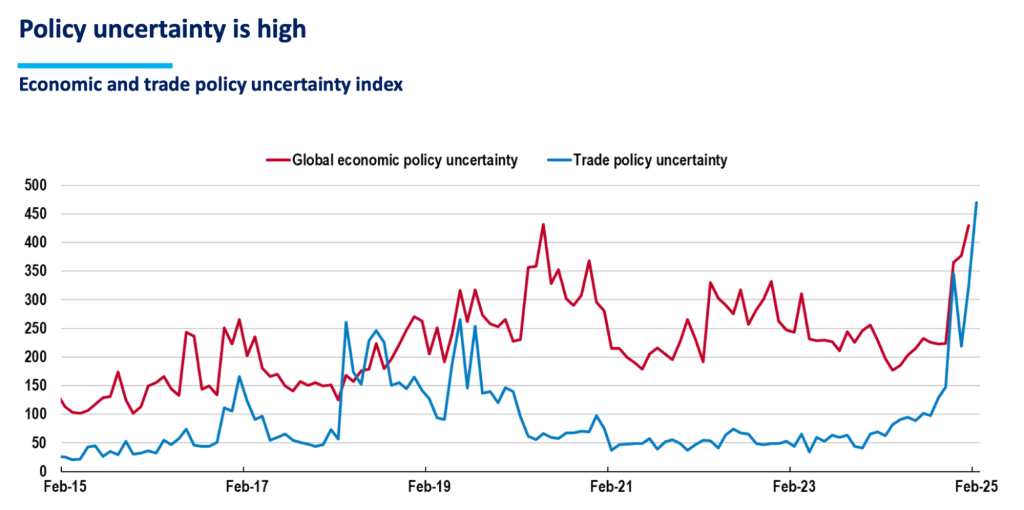

While uncertainty has been increasing worldwide, with consumer confidence hitting 2-year lows in much of the Americas, trade policy uncertainty has increased exponentially in recent months, the report found. This is likely related to President Trump’s tariff plans, which threaten to impose heavy duties on the US’s main trading partners in an effort to boost domestic producers and make trade fairer.

After a series of false starts, in which tariffs against Mexico and Canada were quickly levied and just as quickly lifted, the Trump administration has promised a sweeping tariff regime to go into effect on 2 April, nicknamed “liberation day”. Mexico and Canada were most affected by the rise in uncertainty; these two countries, as well as the US and Brazil, experienced slowing growth in the past months, mainly driven by the services sector shrinking.

Increased tariffs aren’t just affecting uncertainty. The OECD predicts that tariffs were they to go ahead, will be “a drag on global activity” and “add to trade costs, raising the price of covered imported final goods for consumers and intermediate inputs for businesses”. This effect will be amplified in regions with highly international, integrated supply chains, as the North American market is, potentially multiplying the effect of tariffs and driving unprecedented supply chain transformation.

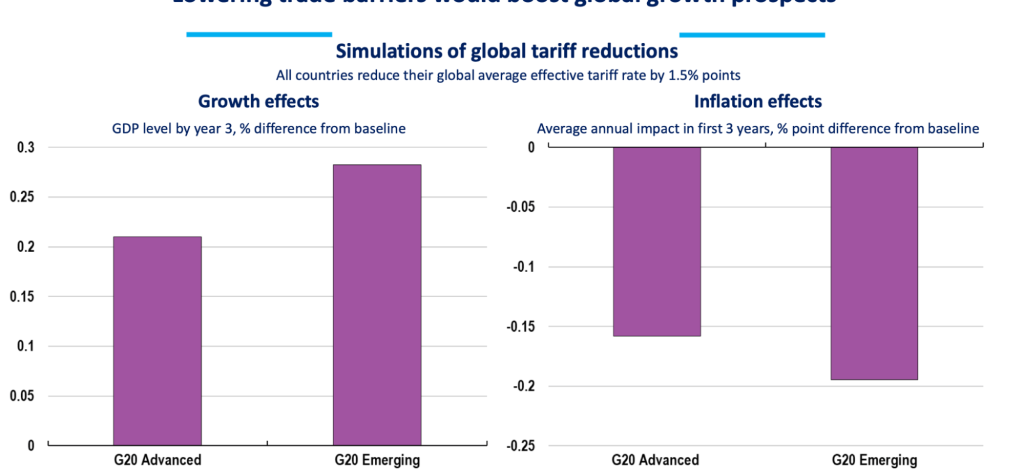

On the flip side, the OECD report sees potential for sustained growth if tariffs were removed and technology harnessed to boost productivity. An optimistic prediction of high AI adoption with robotics integration is projected to add over 1.4% to annual labour productivity over 10 years, while a more modest prediction of high integration with adjustment frictions is still expected to add over 0.6%. The report also highlights the importance of encouraging competitiveness in domestic economies, a measure which has consistently gotten better over the past 6 years; the UK has maintained its position as the most competition-friendly of the countries surveyed.

While the risk of tariffs and a retaliatory regime that might give way to an all-out trade war could be destructive, international cooperation could open the door to rising growth. Diversification, and strengthening supply chains will be a useful stopgap for firms affected by the tariffs and should be encouraged by national policies. However, a sustained effort to reduce fragmentation and multilaterally lower tariffs is the only thing that will bring the global economy back to sustained growth. Geopolitical risk, driven by conflicts in Europe and the Middle East and their effect on trade routes and energy prices, contributes to an undercurrent of volatility and uncertainty; developments in those conflicts or other simmering global conflicts could further contribute to rising or lowering consumer confidence and uncertainty.

The report paints a sobering but potentially optimistic picture for the months ahead. While fragmentation and tariffs are driving uncertainty and slowing growth, technology and cooperation can have a mitigating effect and contribute to higher productivity.

The first takeaway from the report, then, is that once again, trade and tariffs dominate global economic developments; trade barriers and geopolitical risk can have destructive effects worldwide, but will also be the key to promoting growth. Unlike the global disruption brought on by the pandemic, which seemed like a sweeping, uncontrollable force, or last year’s geopolitical volatility that was hard to contain or predict, 2025’s global challenges are entirely within the international community’s control – as is fixing them.