A recent study from Finastra and East & Partners indicated a widening gap between corporate expectations and the services offered by their banking partners. Whether it’s down to trust, inadequate solutions, or the lack of maturity of banking software in trade and SCF, this could well be why corporates are looking to alternative financiers for agile working capital solutions.

It is predicted that global trade banks, could save in excess of US$2.5 billion by adopting an “integrated digital solution that incorporates intelligent automation, collaborative digitization and future technology solutions”, and increase their revenues by approximately 10%, yet we’re still operating in a hybrid world of paper-based trade, part digitized operations.

TFG’s Ross McKenzie spoke to Singapore based Mike Walker, Head of Working Capital Finance, Finastra, discussing the relationship between banks and corporates, and a reality check on the current state of technological innovations and digitization to open up opportunities in trade and SCF.

Supply chain finance in Asia Pacific – do corporates trust their banks?

Ross McKenzie (RM): Let’s start with the corporate customer. Can you give us an APAC view on what, in your opinion, the current pain points are regarding receivables and SCF programmes offered by banks, as well as other trade finance related requirements – do corporates trust their banks in delivering solutions?

Mike Walker (MW): The countries in this region make up a significant portion of the world’s emerging economies, and we are seeing these countries and their businesses becoming more crucial to global supply chains. This trend will continue to grow, as evidenced by the prediction that India and Vietnam will be the 7th and 11th largest exporters globally by 2026.

The challenge many companies here and across the globe face is getting access to finance; particularly for SMEs and emerging economies where a lack of historical data and collateral leads to an inability to KYC, which contributes to high pricing that acts as a barrier to entry. Even for Approved Payables programs that rely on the creditworthiness of a large buyer, it is a challenge to provide “deep tier financing” as there is limited visibility of suppliers and provenance of goods further down the chain.

As well as faster turnaround times and lower pricing on existing solutions, corporates are looking for financing earlier in the lifecycle when the Purchase Order is raised. As supply chain financing is a relatively new business compared to traditional trade finance, these are often supported through different teams and solutions in the bank. Depending on the nature of the transaction and maturity of a counterparty relationship, a corporate will be using both traditional trade and supply chain finance products from their bank. For a corporate to get a single view across their entire financial supply chain in this scenario is difficult without managing data offline or delivering bespoke integration, which has a long time to market and requires on-going maintenance or extension.

Regarding whether banks are trusted by their corporates, amid the rise of non-bank financial services and platforms the ace that banks hold is trust and processing experience. They have been supporting international trade and the associated instruments for hundreds of years, they have longstanding relationships with corporate clients and other institutions, and the market is well regulated and standardized with respect to how business is conducted across borders. Non-bank platforms are becoming more prevalent in APAC, where we see the likes of Tencent’s We.Chain platform and Alibaba offering financing for small businesses, however these platforms and fintechs are also collaborating with banks as they see the value those institutions bring.

Fintech-fintech collaboration

RM: What’s the current relationship between Cognizant and Finastra – and what solutions are you, as a fintech-fintech collaborator offering to banks?

MW: Cognizant are a longstanding partner of Finastra’s, and of Misys’s prior to that. They have been a partner in Trade & Supply Chain Finance since 2013, working with us to deliver a number of successful projects globally in that time and we have now expanded from a traditional vendor – system integrator relationship to a partnership focused on collaboration and innovation.

Today we are leveraging Cognizant’s expertise in hosting and managing technology infrastructure, as well as business process outsourcing, to support our clients in new ways. Small and medium-sized banks, in particular, are reliant on their existing internal IT teams to stay current with technology and solutions, while system implementations traditionally require a large upfront expenditure followed by on-going maintenance and upgrade costs.

Our offering with Cognizant is a turnkey solution that involves them deploying and managing Finastra’s market-leading trade and supply chain finance capability on behalf of the bank; managing implementation, infrastructure and upgrades to reduce dependency on internal IT teams. Where banks are looking to grow their volumes it allows capacity to increase elastically over time, achieve economies of scale on infrastructure and environments, and even outsource transaction processing completely if required.

Cognizant have also used their business expertise and platform approach to build complimentary functionality and applications, that are pre-integrated with our Fusion Trade Innovation and Fusion Corporate Channels solutions.

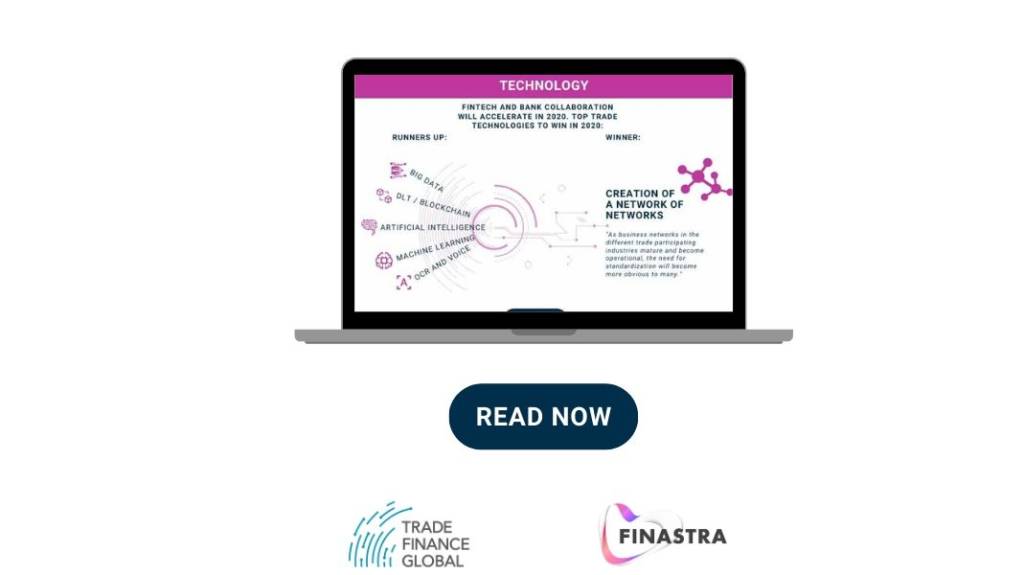

Upon conducting our 2020 technology predictions for the decade ahead, TFG concluded that automation, big data and artificial intelligence were amongst the winners for most adopted bank technologies.

Blockchain for trade finance

RM: In your recent whitepaper, you mentioned that 50% of commercial banks in the APAC region view blockchain as an effective tool in providing the supply chain finance solutions needed. Why are banks harnessing these technologies?

MW: If we look at the current state of international trade and the associated financing, it has not changed for hundreds of years. The majority of transactions and processes are still overly reliant on physical documents and manual processes. The same information is duplicated across multiple documents and stakeholder groups, with a paradigm based on the linear transfer of liability that relies on physical documents being moved between locations. Financing is ultimately provided based on documentary evidence of an underlying transaction or shipment. The transportation and processing of these documents, along with the increasing compliance and AML requirements that need adhering to, add to the time, cost and risk of doing business. This creates an elitist system of world trade with barriers to entry for those who need access to finance the most; SMEs and businesses in emerging markets.

When we compare the current norm for international trade to the characteristics of distributed ledger technologies, such as real-time collaboration, shared liability, and visibility of an immutable golden source of data, it is clear to see why trade and working capital finance are such a focus. This technology has the potential to redefine how we do business and ultimately remove barriers to entry; unlocking $1.1tn of additional trade in the near future.

However, there are technological, regulatory and cultural challenges that need to be addressed. Interoperability is needed, not just between the different networks that exist by product, sector and country, but with current processes and standards as well.

Want to know more? TFG conducted a comprehensive study on the various initiatives currently looking at blockchain and DLT to digitise trade.

Cloud for trade finance – is the future open?

RM: Let’s now talk about digital transformation. Banks dealing with legacy solutions and architecture face tremendous challenges around deployment and stability to maintain their current operations whilst streamlining at the same time. You also mention in your whitepaper that transformation or upgrade should consider the use of cloud-based deployments and open platforms. Why so?

MW: Cloud has several benefits when compared to traditional on-premise deployments. Banks are increasingly required to manage, analyze, and make decisions based on exponentially increasing amounts of data. By being able to manage capacity dynamically and quickly without the need to sink cost into your own infrastructure, organizations can be more flexible. This is particularly important where transaction volumes are initially low or are cyclical in nature. Economies of scale can be achieved due to shared environments and infrastructure, and through cloud-native, multitenant architectures and microservices it is possible for several organizations to use a single instance of software yet still maintain data and access segregation. This reduces the cost of ownership and lowers barriers to entry for those services. Last but certainly not least, from a security perspective cloud providers are certified by standards bodies and regulators in multiple regions worldwide and take the emphasis away from individual organizations to stay current.

Demand for cloud solutions is accelerating but the regulatory and cultural environment in some countries and regions lags this demand currently, therefore it’s likely we will exist in a hybrid world of on-premise, private and public cloud solutions for some years to come. With the number of fintechs, networks and initiatives in the market accelerating, banks typically face a long lead time in offering new services and products to their clients. They are required to source the appropriate solution before on-boarding, integrating and maintaining that relationship.

Open platforms such as our own FusionFabric.cloud take the emphasis away from organizations to source, on-board and maintain individual partners and solutions, allowing them to collaborate more easily with fintech partners and be faster to market with new products and services. By harnessing open APIs banks can standardize integration to their core systems but retain flexibility on the solution implemented, de-risking the scenario that a chosen provider does not scale or is not successful.

Platforms such as FusionFabric.cloud connect multiple data sources and ecosystem players, providing unrivalled potential when it comes to customer experience. By connecting to existing solutions they allow innovation to take place without impacting the underlying application, incubating consumers from underlying application changes and supporting faster speed to market for new products.

Podcast: APAC Trade and Supply Chain Finance in 2020 – Market Commentary

The digital island effect

RM: Standardisation also remains a key challenge (and requirement) for banks to adopt some of these technologies. We’ve seen the advent of digital islands, or digital silos created as a result of numerous emerging technologies and networks, and we need interoperable technologies built on common standards. How can banks help accelerate the process around encouraging the adoption of universal standards and interoperable technologies?

MW: Let’s not forget that digitization and electronic trade finance have been around for decades. However non-interoperable rulebooks and bespoke integration to back-office solutions, coupled with some jurisdictions still requiring physical documents or not recognizing electronic originals, has meant widescale adoption has not been achieved.

In terms of driving adoption, banks and large corporates are where the gravity for any initiative exists. In my experience, around 90% of trade finance is supported by just 10% of the world’s banks and these institutions can drive their partners to adopt new solutions, while large corporates can do the same by supporting their supply chain counterparties to adopt the new processes. Increased demand and adoption of new technologies and ways of doing business by banks and corporates will force regulators to accelerate their efforts, to ensure that international trade remains safe and sustainable for its participants.

Collaboration between banks, governments and industry bodies on standards and regulations is becoming more commonplace as all parties recognize the need for a mutually agreed framework; this is evidenced by the ICC taking over the Universal Trade Network (now the Digital Standards Initiative) and working with the Singaporean government and other large banks and corporates on TradeTrust.