The first estimates for the factoring industry worldwide in 2020 have been announced today by FCI Secretary-General Peter Mulroy.

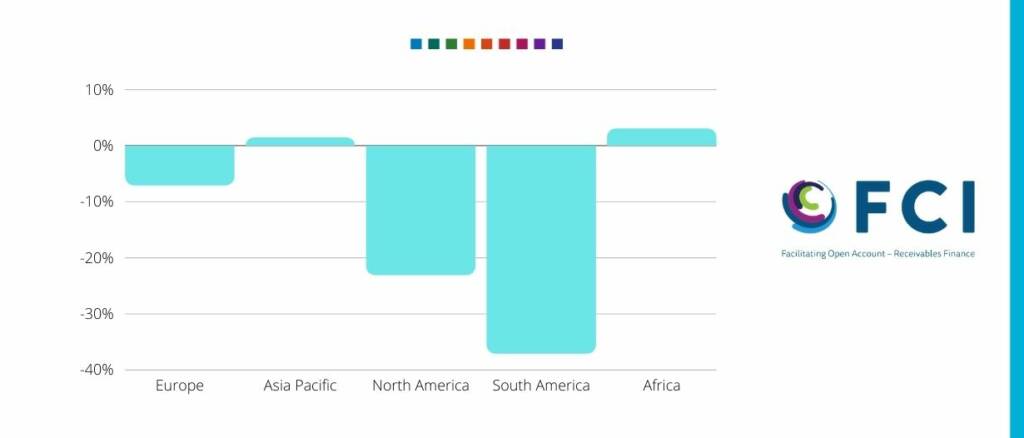

Factoring declines were recorded in most regions except Asia-Pacific and Africa.

The global figure gives a significant indication that the industry had a very challenging year, in line with the havoc that the 2020 pandemic created globally, all countries were impacted differently based on their own specific measures and response to this crisis.

Some reached the lowest factoring volumes in the six years reported, while others managed to cope better to the environment.

We entered 2020 with the residue from the trade war, major geopolitical issues, and the finalisation of Brexit.

However, the most significant event, COVID-19, was just unknowingly right around the corner, and the biggest threat to world trade.

Fast-forward to the year end, and compared with the previous year’s 2,917 billion euros, the 2020 estimated volume of 2,724 billion euros represents a decline of approximately 6.6%. International factoring volume also declined by 4%.

Europe, the largest contributor, representing around 68% of the total with 1,842 billion euros, recorded an overall decline of close to 7%.

From a factoring volume perspective, top five players include France (-8%), Germany (-0.2%), United Kingdom (-17%), Italy (-11%) and Spain (-2%) which makes up 70% of the market.

The vast majority of the countries reported declines, as can be seen in the report, but there are a few positive and noteworthy exceptions such as the Netherlands (+1.4%), Romania (+3.5%), and Hungary (+3.2%).

Turkey, another significant player in Europe showed a significant decline, from 22 Billion in 2019 to 16.5 billion in 2020, representing a -25%.

Asia-Pacific represents around 26% of the global volume with 697 billion euros, an increase of 1.4% over 2019’s 687 billion euros.

In 2020, over 521 billion euros related to Greater China (Mainland China +7%, Hong Kong -5%, and Taiwan -12%).

Possible explanation of China’s growth could be due to the increase in exports in the H2 2020, and also due to the rebound expected after the previous year of decline.

Japan showed a growth rate of 3.5%, reaching 51 billion euros, while on the opposite side, with the lowest value in the last six years, Singapore reported a decline of around 27% with 29 billion euros and India -30% with 3.5 billion euros.

The Americas together is in third position, representing a 5% share of the total world factoring volume, with an overall figure of 150 billion euros, having reported a decline of around 30%, certainly the hardest hit region globally.

South and Central America, which has a 3% share of the total world factoring volume, at 84 billion euros experienced a staggering decline of 37%.

The top three players present themselves as follows: Chile (-20%), Brazil (-60%), Mexico (-43%) while Peru, another important factoring market showed only a decline of 2%.

North America, which has a 2% share of the total world factoring volume, with just less than 67 billion euros, continued its decline trend reported in the last years, with -23% from 2019.

The North America region was hit hard by retail bankruptcies in the H1 2020, which impacted the P&L of many members there, but also in part affected volume for the remainder of the year.

Africa, which has grown nicely over the past few years, witnessed a slight growth in volume in 2020, representing a +3% increase.

The total market adds up to a total of 25 billion euros, indicating only slight growth, accounting for less than 1% of world factoring volume.

Certainly, the decline was driven by the massive reduction in GDP experienced in the first and second quarters of 2020.

However, as FCI reports its figures in euros, considering the eurozone countries account for over half of global volume, there were some major swings in currency valuations during the year, which in some cases drastically impacted the translated figures.

You can see that most major currencies depreciated against the euros in 2020, including the US dollar (close to -10%), the Brazilian Real (-42%), the Mexican Peso (-15%), the South African Rand (-14%), Turkish Lira (-36%), and the Japanese Yen (-4%), to name a few.

So the declines experienced globally, but especially in the Americas, have to be taken into consideration in light of this significant depreciation in world currencies.

FCI also reports the figures in US dollars, which understandably shows a much better performance, with world growth up by +2.6%.

The FCI Global Factoring Statistical Report presents on an annual basis the key factoring data around the world.

It covers domestic and cross-border factoring volume collected from over 350 members in 94 countries.

The full final statistical report is expected to be released by end May 2021 and will also be made available on the FCI website.